On July 1, 2015, we learnt that Illinois-based biotech company Baxter International Inc. (NYSE:BAX) had finally spun out its pharmaceutical operations into the newly named and listed Baxalta Inc (NYSE:BXLT). On launch, the company has billed itself as a global biopharmaceutical company dedicated to delivering transformative therapies to patients with orphan diseases and undeserved conditions. Bringing forward with it a pretty strong portfolio of legacy treatments already marketed by Baxter, the company kicks off its life in the bioscience space as a $6 billion revenue generator with a robust pipeline of potential further revenue generators going forward. So, with this said, what is the new company all about, what does its pipeline look like, and is it a valid investment opportunity at this stage, or should we be waiting until it is slightly more established before getting in? Let’s take a look.

First of all, let’s look at the company’s current operations. Baxalta has achieved seven regulatory approvals to date, across a range of incidences but primarily focused on hemophilia – a condition in which patients’ blood does not clot properly and so they can suffer high levels of damage from small injuries. Of the company’s current annual revenues, approximately 50% of its total $6 billion generated comes from hemophilia treatments, while the remaining 50% derives from inhibitors and immunoglobulin treatments (weighted towards immunoglobulin). Similarly, 50% of this total revenue comes from the US, and about 35% comes from international established markets and the remaining 15% from international emerging markets. In its previous incarnation – Baxter Science – the company achieved 6% annual sales growth year over year between 2012 and 2015, and has become a self-proclaimed leader in the hemophilia space. Some of its leading marketing approvals have exceeded this growth, two examples being ADVATE and FEIBA, which recorded a compound annual growth rate of 9% and 10% respectively between 2012 and 2014.

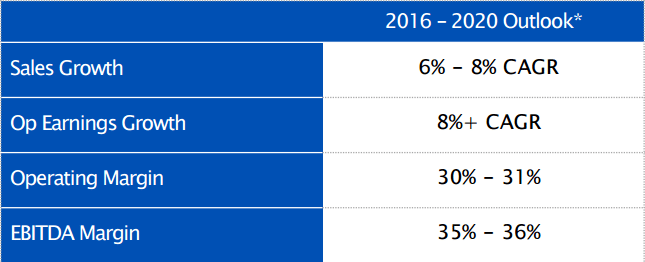

Going forward, and as illustrated by the table below, the company expects to match this growth across the board.

As you can see, between 2016 and 2020, Baxalta is targeting a sales growth of between 6% to 8% on a compound annual growth rate basis, and operating earnings growth of 8%, and operating margin of between 30% and 31%, and an EBITDA margin of just over 35%. An area in which the company is currently not generating that much activity revenue is oncology, but according to its most recent investor presentation (reported upon the announcements of the company’s listing), Baxalta expects to be generating between $500 million and $700 million revenues from the oncology space by 2020. Sticking with this last area, two of the company’s most promising candidates in the oncology space. The first is nal–IRI (MM-398), and IRI cytotoxic treatment targeting metastatic pancreatic cancer, with the company is developing in collaboration with Merrimack Pharmaceuticals (NASDAQ:MACK). The treatment is currently awaiting a response from an EU approval filing, having demonstrated an overall survival rate of 6.1 months in phase 3 trials, and a progression free survival of 3.1 months. The second is Pacritinib, currently being developed in partnership with CTI BioPharma (NASDAQ:CTIC). This treatment targets myelofibrosis – a type of blood cancer – and is scheduled to be filed for approval in the EU this year. Once again, this treatment is produced positive phase 3 results, showing a 35% spleen volume reduction (primary endpoint in the trial) at 24 weeks.

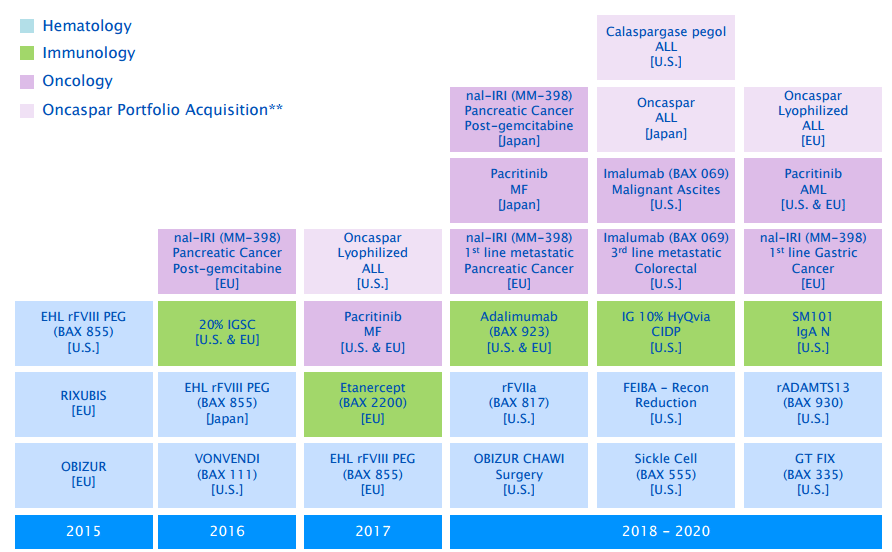

These aside, Baxalta has a pipeline of possibly 20 new products, which it expects or hopes to launch by 2020. From these 20 new products, the company hopes to generate 2.5 billion sales annually by 2020 deadline. The treatments and their timelines or illustrated in the below chart.

So what’s the takeaway here? Well, as with any biotech company, there are risks associated with an investment in Baxalta. However, the company offers a rare opportunity to get in at the very early stages of an already established biotech with a pipeline that is already generating revenues. Add to this the potential for extra $2.5 billion dollars revenues by 2020, and an extensive pipeline in development, and there could be some considerable upside from current market capitalization over the next five years.