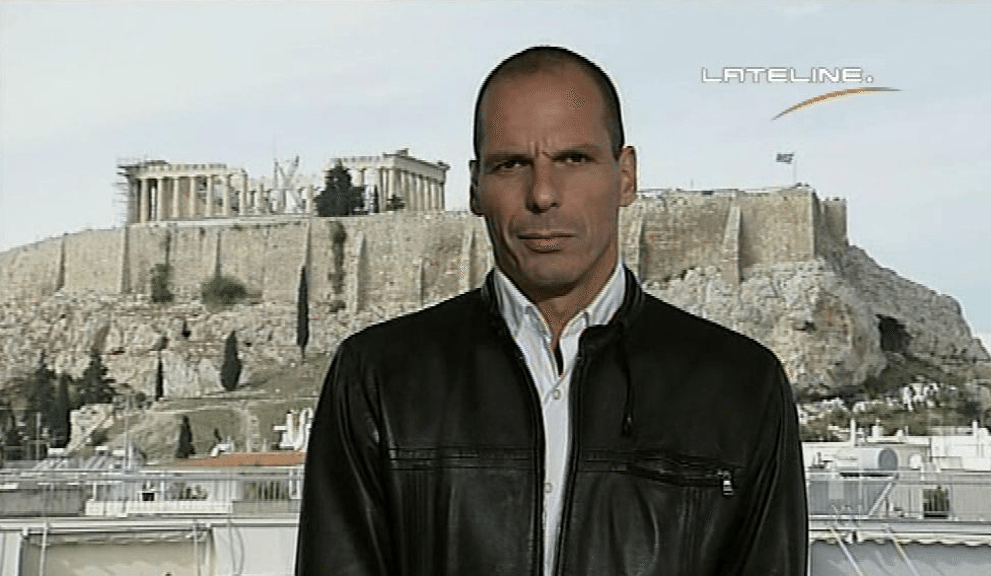

Greece’s scrappy Finance Minister Dr. Yanis Varoufakis had an interesting message for the German people in an interview with German television on February 5th. While being interviewed by Tagesschau, he was asked a simple question. “What does Greece have to offer its European partners?”

Varoufakis answered simply. “We do have one thing going for us. We are not corrupt. Not yet.”

Varoufakis’ angle on the current standoff between Greece and its creditors seems to be simply this: We’re new, we have no governmental experience, we’re not the ones who got Greece into this mess, so give us until the end of May to work out a deal and I’m sure we can work something out.

Back in 2012, before Varoufakis became a household name in financial circles, he was spreading the gospel of Greek Tragedy, namely that the current Greek recession was not simply a recession but a catastrophe.

“I do not use the word ‘crisis’ for a very simple reason. Greece has had a catastrophe. An implosion. A humanitarian crisis if you will.” His considered opinion according to earlier interviews is that the Eurozone will not survive the exit of one of its member states, and therefore must not go in that direction.

Varoufakis views the so-called Greek crisis not as one centered on Greece per se, but as a European crisis in which Greece is the canary in the coal mine.

“Imagine if we were in South Dakota in 1931, and we were talking about the South Dakota crisis. How sensible would that be? It wouldn’t be. There was a financial crisis in the United States of America, in all the Western world. This is crisis of the Eurozone. The reason you are talking to me is that Greece is the canary in the mine. It’s very weak. That’s why it dies first. But it’s not responsible for the methane in the mine that has caused it.”

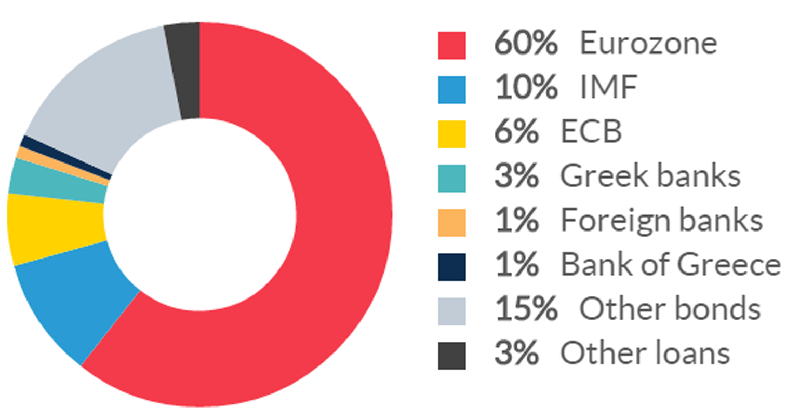

Varoufakis’ ultimate plan has always been to default within the Eurozone, and in order to cushion any one holder of Greek debt against heavy losses, unify the European banking system so there are no longer any Greek banks or Spanish banks, only Eurozone-wide Eurobanks. This would bring the Eurozone one step closer to a political union that former Fed Chairman Alan Greenspan said would be necessary if the Euro is to survive as a single currency.

A banking union in Europe would effectively mean that Greece’s losses would be diluted by spreading them throughout the Eurozone’s financial system. In other words, it will be another form of bailout, paid for by European citizens through bank losses throughout the continent.

However this catastrophe as termed by the newly minted Greek Finance Minister is resolved, somebody will be taking hundreds of billions in losses, somewhere. The question is, will those losses result in a breakup of the single currency, or will they be diluted into the oceanic European banking system through a banking union?

And if a banking union does happen, will that lead to an ultimate political union with the Eurozone being governed by a single, mammoth central government? Headed by whom? And how?