PhaseRx Inc. (NASDAQ:PZRX), a small $30M preclinical biotech Market Exclusive initiated coverage on back in September, just climbed 150% in a single day on news of an Orphan drug designation from the Food and Drug Administration (FDA) for its lead candidate targeting a rare genetic liver disease. In 99% of cases, this type of news wouldn’t cause such a spectacular move, especially for a preclinical company that hasn’t even reached human trials yet.

Orphan designation is of course great news for the company and its shareholders, but does it really justify such a move higher? Was this merely an emotional overreaction to good news that fed on itself, or is there something else going on here that is more fundamental?

A strong case can actually be made that something much more fundamental is going on with PhaseRx other than good news being blown out of proportion. It has to do with the nature of the disease class that PhaseRx is pursuing, how specifically it is pursuing it, and the nature of its preclinical data to date.

The Disease

The lead candidate for PhaseRx, PRX-OTC, targets a disease called ornithine transcarbamylase (OTC) deficiency, or OTCD. It sounds complicated, but it’s actually very simple. Normally, the liver uses the OTC enzyme to turn ammonia into urea, which is then excreted in the urine. Ammonia is a highly poisonous nitrogenous waste produced when protein is digested, and the liver turns it into the less poisonous urea.

OTCD patients are born without an ability to convert ammonia in urea due only to the simple lack of this enzyme caused by an error in the mRNA genetic code that produces it. Then why not simply add the enzyme? Because OTC only works within liver cells, or intracellularly. Flooding the body with the enzyme wouldn’t do anything useful because it has to get inside the cell. Children with the disease are lucky enough to get past birth and are restricted to a low protein diet while in constant danger of severe brain damage, coma, and death from high ammonia levels. Disease incidence is 1:56,500.

The technology that PhaseRx has at its disposal doesn’t exactly transport the enzyme itself into liver cells, but it does transport the genetic code for the enzyme into the cell. Once inside, the cell uses the mRNA code to produce the enzyme, and the disease is for all intents and purposes cured.

The Data

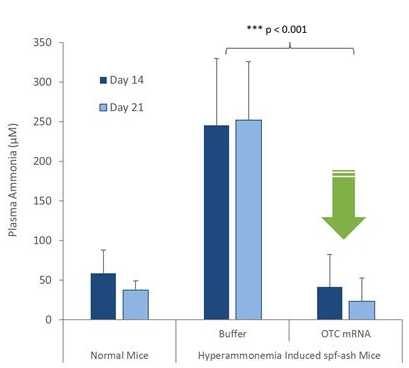

Granted, PhaseRx has no clinical data backing its lead candidate, which normally would make it a very speculative long shot. However this case is different for two reasons. One, the disease is perfectly understood. Two, the mechanism of action of PRX-OTC is perfectly understood as well. The data that PhaseRx does have is from a mouse model of the same exact genetic deficiency of the same exact enzyme. Introducing PRX-OTC into these mice did not merely improve symptoms in some of the mice. It completely eliminated the disease in 100% of the mice, yielding a 100% survival rate.

The data are below.

The Pathway

The nature of the disease and the mechanism of action of PRX-OTC yields a very unique clinical pathway for PhaseRx that does not apply to most companies, not even Big Pharma. How so? Essentially, it is extremely binary and very quick. Either PRX-OTC will work on all patients trialed very quickly, or it won’t work at all, and the company will know within days of starting clinical trials. There will be no long drawn out processes here. Either serum ammonia levels will be lowered to normal levels within days as they were for the mice, or they won’t.

PhaseRx is targeting ammonia levels as a clinical endpoint for its first clinical trial, which the company hopes will begin—and probably be completed—in 2018. It believes it can establish clinical proof of concept in as few as 20 patients.

The idea here is that once clinical trials begin, they will be fast, results binary and obvious, which could indeed lead to a quick approval based on an easily measurable endpoint. The reason that a simple Orphan designation may have led to such an enormous jump is that it may have just kickstarted this whole process.

The Market

There are two drugs currently on the market that treat OTCD. They are both ammonia absorbers that latch onto ammonia in the bloodstream. Both are marketed by Horizon Pharma PLC (NASDAQ:HZNP) and together logged sales of over $100M in 2015 (see page 93). One, Buphenyl, has generic competition and must be taken orally forty times a day, not exactly convenient, especially for children. The other, Ravicti, is an oral solution taken three times daily but costs $400,000 a year. Neither cure the disease, and eventually ammonia gets backed up in the blood anyway and a liver transplant is needed.

The market for PhaseRx goes beyond OTCD however, because if delivering one mRNA code into the liver works, it can work for any mRNA code for the same kinds of liver diseases. It’s just a matter of changing the code and keeping the same delivery mechanism. PhaseRx already has similarly good data from mouse models for another liver disease called ASL deficiency, with the same high ammonia symptoms, addressed by the same technology, just with a different mRNA code.

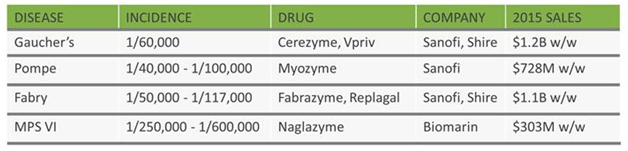

The company estimates the potential market addressable by its technology to be about $4 billion a year. Success with OTCD would open up that entire market. The table below, taken from PhaseRx, shows the current market for liver diseases addressable by standard enzyme replacement therapy addressed by Sanofi SA (ADR) (NYSE:SNY), Shire PLC (NASDAQ:SHPG), and Biomarin Pharmaceutical Inc. (NASDAQ:BMRN).

What about competition? There is no other company even pursuing any intracellular enzyme replacement therapy. PhaseRx has no competition for this class of drug candidates.

Putting The Jump Into Perspective

On the one hand, a 150% jump in a single day seems excessive. But seen from this perspective, it’s actually a plausible revaluation, considering that an Orphan designation starts this whole process, which could be complete relatively quickly given the nature of the disease and clinical pathway involved here.

From a technical perspective as well, the jump is not as excessive as it looks. Since its initial public offering, the stock has declined over 80%. Even with this jump, shares are still below half of where they were at IPO. So on the one hand, investors can see this as a huge upside revaluation. On the other hand, it can simply be seen as only a partial recovery following an oversold decline.

Now that PhaseRx has a way forward, things can begin to move quickly here. The market may have just shown that with yesterday’s huge move higher. And despite the sudden rise and accepting the possibility of profit-taking over the next few days, shares still look fundamentally undervalued given the potential here, the pathway, and the data to date.