Target Corporation (NYSE:TGT) has been improving its e-commerce operations as more and more people are now shopping online. The discount store plans to spend up to $7 billion to boost its online presence and on its physicals stores over the next three years. On Thursday, the company announced that it is consolidating its mobile apps to make shopping better and easier.

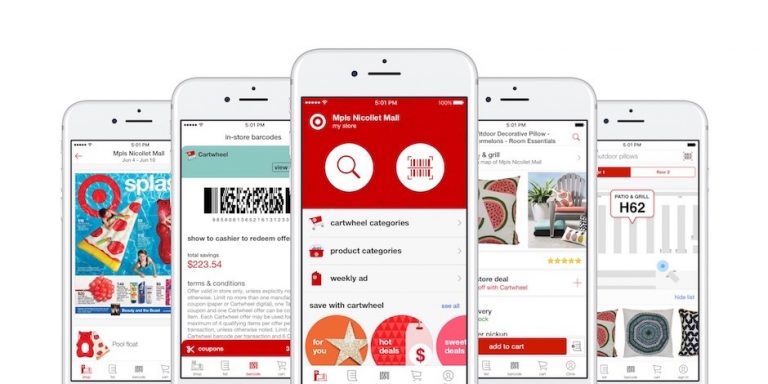

Target has been operating two separate apps since 2013, the main app for shopping and Cartwheel that offers coupons and discounts for shoppers in physical stores and online.

“We’ll soon begin inviting Cartwheel app users to switch over to the Target app. Our goal for the updated app is to make shopping Target even better. We want to put the best of Target in the palm of guests’ hands. Our job is to make it easy for guests, and we’ll stay focused on that every day,” the company said in a statement.

In addition, Target Corporation (NYSE:TGT) said that it is working “on new ways the app can save guests time and money. Soon, the app’s store map will show visitors their location as they shop and highlight Cartwheel deals nearby, the company said.

Further, Target said that it is planning to add mobile payment for Target REDcard holders, allowing them to “eventually score all their Cartwheel deals and get an additional 5% off everything they buy with their REDcard. All with a quick, easy scan of the app at checkout.”

For the fourth quarter of 2016, the retailer reported a 34% increase in comparable digital channel sales. The digital channel sales contributed 1.8 percentage points of comparable sales growth.

“Our fourth quarter results reflect the impact of rapidly-changing consumer behavior, which drove very strong digital growth but unexpected softness in our stores,” Target Chairman and CEO Brian Cornell said earlier this year.

“We will accelerate our investments in a smart network of physical and digital assets as well as our exclusive and differentiated assortment, including the launch of more than 12 new brands, representing more than $10 billion of our sales, over the next two years. While the transition to this new model will present headwinds to our sales and profit performance in the short term, we are confident that these changes will best-position Target for continued success over the long term,” Cornell added.

Shares of Target Corporation (NYSE:TGT) closed up 4.16% on Friday. The stock is down more than 21% so far this year. During the last 12 months, the company’s share price has dropped over 17%.