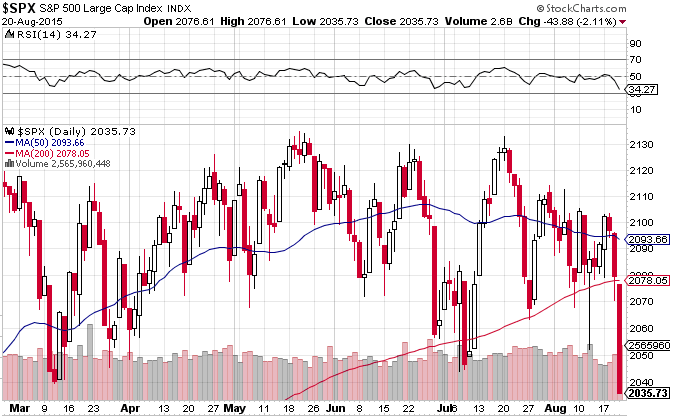

Last week’s correction has injected an element of risk off sentiment into markets, as investors attempt to reduce their exposure to any further decline. However, as a side-effect of the sell-off, there are a number of opportunities to pick up strong fundamentals at a discount. Here are five biotechs that we believe are undervalued at current prices.

Synergy Pharmaceuticals, Inc. (NASDAQ:SGYP)

Back in June, Synergy reported the results of a phase 3 trial of its lead candidate Plecanatide. The treatment is targeted at sufferers of constipation and irritable bowel syndrome, and is a synthetic version of a peptide (a type of amino acid that forms bonds in the body) called uroguanylin. Uroguanylin is partly responsible for the amount of water that lines the gastrointestinal tract, so by introducing a synthesized version Synergy believes it can increase water flow, and normalize bowel movement. Phase 3 data illustrated efficacy, and the company hit highs of just shy of $10 in July. However, the company pushed back its approval filing from Q4 this year to Q1 next year, and this looks to have weighed on its share price a little. This said, the fundamentals remain sound, and with about $160 million cash and cash equivalents Synergy looks financially on point. Key drivers will be the two approval filings, one set for Q1 next year (as we have already mentioned) and one set for December 2016.

Oramed Pharmaceuticals Inc. (NASDAQ:ORMP)

Next up is Oramed. Oramed hit the mainstream radar back in July when it announced the dosing of its first patient with an orally administered insulin pill. In doing so, the company proved itself as being one step ahead of Novo Nordisk A/S (NYSE:NVO), which is also developing its own version of the treatment. Since the announcement, however, Oramed stock has traded pretty flat – and is currently selling at a 75% discount on 2014 highs. While it is probably going to be 2017 before the company can get its pill into phase 3 (assuming efficacy is demonstrated in phase 2), we expect this one to gain strength between now and then. The real value in Oramed is its market potential, with best estimates putting the global insulin market at around $50 billion. The company expects to complete its ongoing phase 2 in October this year, so we will be looking for the meeting of its efficacy primary endpoint as an upside driver before the year is out.

Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX)

Third on the list is Lexicon. The company rocketed into August on the announcement that its lead candidate telotristat etiprate had met its primary endpoint in a phase 3. The treatment is a combination therapy designed to work alongside current standard of care for people with carcinoid syndrome. Since the news, however, a downgrade to neutral by JP Morgan alongside a Q2 loss has discounted some of the positive momentum. The treatment has orphan and fast track, and is targeting H2 2016 as its time to market (assuming accelerated review). Lexicon’s current market cap is a little over $1.2 billion, and if it can gain approval on the recent results, it could be going after a market worth around $700 million based on price point expectations. A $300 million raise last year should see the company through to revenue generation, with the next upside driver an NDA submission before the end of January 2016.

Xenoport Inc. (NASDAQ:XNPT)

Xenoport has one treatment already generating revenues and one promising lead candidate in the pipeline. The former is a restless leg indication that generated a little over $8 million during Q2 2015 and that the company forecasts will bring in a total of $43 million before the year is out. The second is a psoriasis indication, currently undergoing phase 2. The company is currently trading around 45% from highs with a market cap of a little over $430 million – about 10 times forecast 2015 revs. The release to watch going forward on this one is the top line from the ongoing phase 2 – expected before the end of September. Interim was promising, and if we see the trial meet its primary endpoint Xenoport could be on for a quick upside revaluation. The psoriasis market will be worth $7.4 billion within five years, and we have seen comparable therapies bring in over $1 billion annually recently.

Omeros Corporation (NASDAQ:OMER)

Finally we’ve got Omeros. Having spent most of 2015 slowly ranging downwards, Omeros stock pretty much doubled in price on the release of some positive top line data from its phase 2 thrombotic microangiopathies candidate, OMS721, this month. The gains turned out to be nothing more than a spike, however, and we are currently trading pretty much bang on prerelease levels. This one is a little riskier than some of the others on the list, as the company only has about 10 months of operational capital available to it based on current burn rate – but it generates (albeit lackluster) revs from a treatment launched in April and has just hit markets with a second indication in Europe. OMS721 is the one to watch here though. Completion is slated for December this year, and we have already seen what promising results can do to its market cap.