When PhaseRx Inc (NASDAQ:PZRX) made its debut on the NASDAQ back in May this year, the company traded for a little over $5 a share. Having peaked at $5.64 at the end of its IPO month, PhaseRX has declined across the subsequent four months to current levels of a little over $2.40 a share – a close to 60% decline across the period.

Serving as a backdrop to this decline, the rare disease market is growing at an unprecedented rate. FDA initiatives such as Orphan Drug Designation have incentivized development in the space, and speculative capital is being pumped into target indications that have no treatment, or that have relied on the same treatment for decades.

PhaseRX is a young company in the sector, but a couple of key factors help it to stand out from the crowd. It’s a risky exposure – this end of the biotechnology sector is notorious for failure – however, there are some entities in the space that are undervalued, and we believe PhaseRX might be one such entity. Here is why.

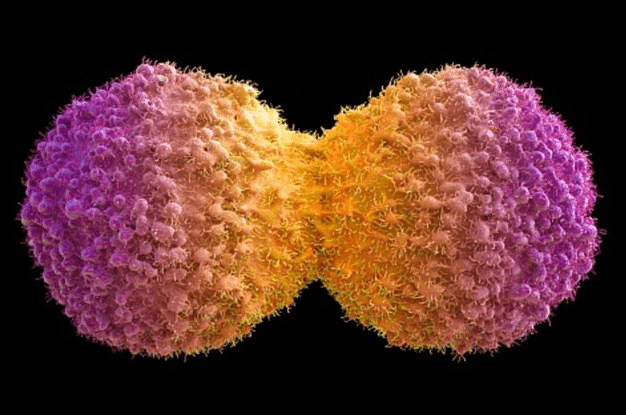

The company has developed a technology that it calls intracellular enzyme replacement therapy (i-ERT). With this technology, it is targeting a category of diseases, which are caused by the body’s inability to produce certain enzymes that would normally be produced in the liver. It is a very specific set of diseases, all caused by a genetic mutation past found from one or both of the patient in question’s parents.

In traditional enzyme replacement therapy (ERT), the patient is hooked up to an intravenous drip, and the enzyme is introduced systematically. This works in some cases, but in a large number of conditions, it is ineffective. Why? Because in these conditions the enzyme needs to be created intracellularly. Systematic introduction of an enzyme doesn’t allow for intracellular access, rendering traditional ERT useless.

PhaseRX’s iERT system uses a lipid nanoparticle to protect a particular type of mRNA (more on this shortly), and uses a polymer to direct these nanoparticles to the liver. Once at the liver, the latter organ takes up the nanoparticles, and the mRNA is delivered into hepatocytes (just another word for liver cells).

The company just outlined its lead candidate and target, which will be a condition called ornithine transcarbamylase (OTC) deficiency, and which PhaseRX is targeting using a drug called PRX-OTC. Having already outlined the technology, and the delivery method, the mechanism of action (MOA) explanation is relatively simple. Essentially, the company is using its delivery mechanism and technology to introduce mRNA that will code for functioning versions of the enzyme that is deficient in the disease in question. In this instance, the disease is OTC deficiency, and the enzyme is OTC. To put it simply, PRX-OTC takes OTC producing mRNA to the liver, the liver cells take it in, and start producing the enzyme.

It is important to mention here that it is very early days for this treatment. The company has a proof concept that derives from a mouse model, but essentially that’s all the proof it has for now. It hopes to push forward with an investigational new drug INT registration mid-2017, however, which should allow for the movement of the assets from preclinical status into the clinic and human trials.

There is also a second asset under investigation, a drug called PRX-ASL, for the treatment of Argininosuccinate Lyase Deficiency (ASLD). Again, this one delivers the mRNA for the enzyme in question, this time Argininosuccinate Lyase, to the hepatocytes, which in turn start to produce the enzyme.

Both target indications have very few treatment options available right now, and those that are available are palliative as opposed to curative. In other words, PhaseRX is targeting a potentially large and lucrative market despite the relative rarity of the diseases that underpin it’s pipeline.

That said, there is also a potentially larger (and more near-term) catalyst on the horizon.

The target indications are interesting long-term; but to u,s right now, of equal if not greater interest, is the technology itself. PhaseRX has proof of concept that it’s technology can deliver mRNA into hepatocytes. This means the technology can be used to improve the accuracy and – in turn – the efficacy of pretty much the full scope of current ERT therapies. This is a $4 billion space, and it’s growing fast.

That’s not all, however. The company is actively seeking out licensing opportunities, which would see (presumably) big Pharma organizations in-license the rights to its technology, and build their own development programs based on the iERT platform. The application for this is huge. Gene editing, ERT, oncology, infectious disease – essentially, anything that currently uses viral vector delivery could be improved using this sort of lipid nanoparticle delivery.

Sanofi SA (ADR) (NYSE:SNY) is pumping billions into the space by way of its Genzyme subsidiary. Regeneron Pharmaceuticals Inc (NASDAQ:REGN), Amgen, Inc. (NASDAQ:AMGN) and Roche Holding Ltd. (ADR) (OTCMKTS:RHHBY) all have viral vector programs under way. If PhaseRX demonstrates the efficacy of its technology in the clinic, even very basic data would likely be enough to entice one or more of these big names in to a collaboration deal.

So that is the story and the potential, what about the risks?

Well, as mentioned, the primary risk on this one is rooted in the nature of the junior biotech space, and the relative youth of the company’s pipeline. Yes, it’s technology may have picked up proof of concept in mouse models, as might have its lead candidates, but it is not always easy to transfer science from small rodents to humans. The fact that traditional ERT is already an established space somewhat mitigates this risk, but it’s worth keeping in mind. Additionally, capital is a consideration. PhaseRX will need to raise funds in order to capitalize the clinical trials through which it intends to carry its lead candidates, and these funds will be dilutive to shareholders. Of course, the assumption on the bullish side is that the value added by the trials that get funded will mitigate, or ideally completely negate, the dilutive impact. But again, due diligence requires investors be aware of these risks heading in to any allocation. As a best case scenario, PhaseRX will be able to pick up some upfront capital from a big Pharma on the back of a collaboration deal. This would serve to reduce the degree to which capital needs to be raised, and in turn, the degree to which an investor is diluted.

All said, we like this one. The company is not without its risks, as we’ve just discussed, but it has multiple shots on goal with both its in-house asset development programs, and the potential for the licensing of its core technology. A solid kicker is a great asset in biotech, and in its proprietary tech, PhaseRX has exactly that.