Most investors shy away from options, mostly from fear of the unknown. That’s a shame. Options allow for limited-risk speculation with tremendous leverage for buyers if you understand risk management while also offering outstanding returns if things remain fairly stable for sellers. Something if not for everyone, then at least for a lot more people than are currently using them now.

There are two basic classes of options. There are calls, which allow the holder to buy something at a fixed price for a specified amount of time, and puts, which allow selling at a fixed price for a specified time. Puts are particularly useful for investors wanting to bet against stocks without incurring the potentially unlimited losses involved with straight-up short selling, as well as for investors who want to protect gains in a stock while maintaining the possibility of additional upside.

For those who think options trading is reckless, consider that options are really nothing more than one form of insurance. Insurance is basically a put option on an asset, allowing you to sell it back to the insurance company at an agreed upon price (the strike price in options parlance) within a certain timeframe.

As we just noted, a put option is simply an insurance policy against a stock going lower. Similarly, a call can be viewed as insurance against a stock going higher—either to protect a short stock position against unlimited losses or to avoid missing out on gains. It’s somewhat ironic that Warren Buffett has spoken about derivatives, of which options are a subset since they derive their value from an underlying asset, as tools of financial mass destruction. Buffet’s core business is insurance, which itself is just a kind of derivative.

Derivatives are simply instruments whose payoffs are derived from the value of something else. When you buy homeowners’ insurance, you collect if your home’s value is damaged—the payoff increases as the underlying asset loses value. In other words, a put option.

An important point of clarification is the distinction between selling calls and buying puts. Since both trades tend to make money when the underlying stock falls, many investors new to the area confuse the two or think of them as being equivalent, but they are not. Selling calls involves taking in a fixed premium up front—the best that can happen with this trade on its own is the stock remaining at or below the exercise price. You don’t make any more from selling a call with a strike price of 50 from the stock going down to 30 than from it staying at 50. Buying a put struck at 50, conversely, would show a complete loss with the stock holding at 50 but almost surely a very large profit with the stock falling from 50 to 30.

This difference illustrates why the strategy of covered-call writing can be an important income-generation tool, especially in a low-rate but volatile market environment.

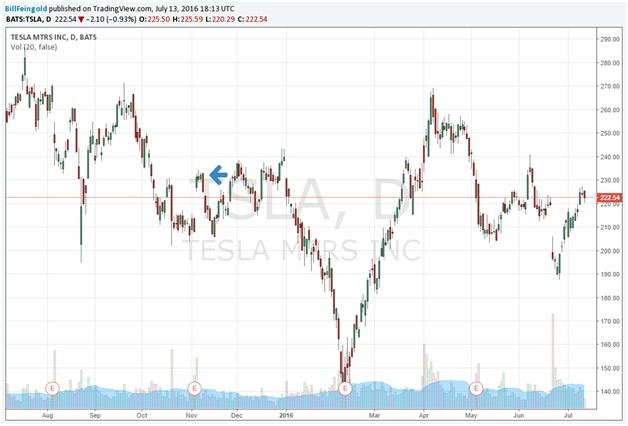

The chart of Tesla Motors Inc. (NASDAQ: TSLA) below shows what was a good time to sell a two-month call option against a stock holding.

While option prices typically fall right after a report, they often do not fall enough to reflect the lower near-term expected volatility. In the case of Tesla, the stock subsequently traded lower following the November 2015 earnings report, then back above the strike price, and ultimately lower again, which means you keep your premium. Buying a longer-dated put option would have ended up being profitable because of the sharp decline in early 2016, but again, that is a very different trade, betting on a precipitous fall instead of relative calm, and far riskier. Closing the position would have to be timed much more exactly.

Selling a call expiring in early January 2016—two months after the November earnings and a month before the February report—would have made a great deal of sense with much less risk. (The circled E’s at the bottom of the chart indicate earnings releases).