It’s rare for a developing biotech to trade in a pattern that resembles a more established pharma company with much higher liquidity. When it happens it is reason to investigate.

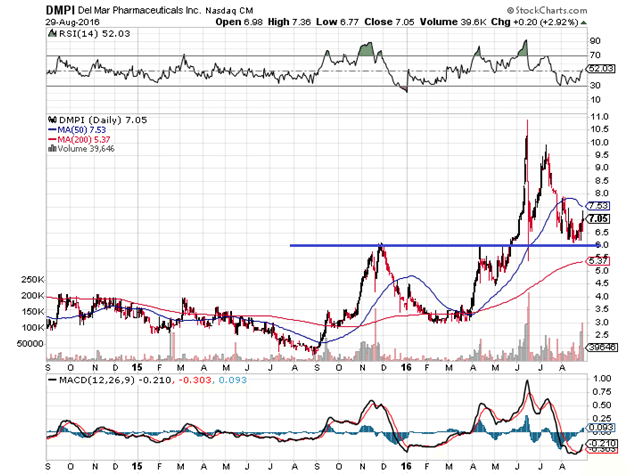

Since last year, almost to the day, trial stage biotech DelMar Pharmaceuticals Inc (NASDAQ:DMPI) has been trading in a classic bullish pattern of advances, consolidations, and retracements halted by key moving averages. Typically, small biotechs of this sort tend to trade in wild gyrations with obvious volume spikes based on data releases that often fade to pre-breakout levels. A more fluid trend like the one below is relatively rare.

For almost exactly one year now, DelMar has been trading in a three-steps-forward, two-steps-back formation complete with trend line support and resistance (see the blue line) aided by the 50 and 200 day moving averages, with very few extreme volume spikes that took the stock completely out of range, and consistent bounces off oversold RSI measures. This is basic technical analysis 101 of bull trends, patterns that generally do not appear with companies like DelMar due to liquidity constraints. The question is, Why is DelMar trading this way, and does its stock really warrant the pattern shown here?

On the one-year anniversary of Delmar’s current run, Market Exclusive has decided to take a deeper look into the company to provide possible answers to these questions. What we found is that, while the risks are considerable, the upward trend may still continue, notwithstanding the 300% run that began last year.

Inside DelMar

DelMar’s flagship drug candidate is called VAL-083, or dianhydrogalactitol. It is a chemotherapy discovered in the 1970’s with early stage clinical development in the 1980’s but never fully developed to commercialization. There is clinical data going back to 1984 for example on 20 patients with medulloblastoma treated with VAL-083 resulting in a stable disease rate of 40%, tumor regression rate of 10%, and a 4-year no progression rate of 20%. Of course these trials were too small to prove anything conclusive, but the data was good enough for DelMar to resurrect the drug for larger clinical trials, especially given that the safety database from earlier trials included over 1,000 patients.

The company is now trialing VAL-083 for glioblastoma brain cancer, seeking to take advantage of and widen a specific market bottleneck for that indication. A Phase II trial has already been completed and has shown median overall survival of 8.35 months over the average 2 to 5 months for other salvage therapies by historical literature. While it is true that the Food and Drug Administration typically has problems with historically controlled studies over the more preferred placebo control, DelMar has already conducted an end of Phase II meeting with the agency, and the FDA has already agreed that the company can leverage historical clinical and non-clinical data to support its New Drug Application. The leniency here is mostly due to the rarity and severity of glioblastoma.

The market bottleneck with glioblastioma in particular has to do with the fact that the standard of care has not changed in decades. Temodar (temozolomide) is the first line chemotherapy for this disease after surgical resection, but its results are highly unsatisfactory. It’s not easy to introduce a new drug after so many decades, but VAL-083 has one more advantage in trying to widen the bottleneck. Its mechanism of action is relatively well understood.

The importance of understanding the mechanism of action is critical when it comes to clinical trials because it allows a company to tailor its patient-base with a fine-toothed comb. VAL-083 is known to bypass a DNA repair enzyme called MGMT that renders the first-line therapy temozolomide ineffective after a short period of time. VAL-083 operates independently of this enzyme, which allows DelMar to screen its patients specifically for high expression of MGMT. Selecting patients with high expression of that enzyme is expected to further differentiate VAL-083 from standard-of-care.

Consider the following hypothetical. If, for example, DelMar did not know about the MGMT factor and patients with low or even zero MGMT expression were admitted for a pivotal trial, temozolomide would theoretically work decently on a control group, differentiating it much less from VAL-083. Admitting only patients with high MGMT will allow the FDA to see what is anticipated to be a stark difference between temozolomide patients versus VAL-083 patients, with the goal of showing a wide gap between the two therapies and making approval that much more likely.

From a market perspective, this is also quite helpful as it narrows down the patient base and increases the chances that the drug will work for its specific group, encouraging oncologists to prescribe it on an MGMT test.

Separating Two Knotted Strings

In terms of mechanism of action, the way the chemotherapy works is by causing cross links in the DNA structure, which when unraveled during DNA replication, cause both strands to break at the cross-link point. Think of pulling apart two delicate strings that are knotted at a particular point. The strings will separate until the point of the knot and then break.

The nature of glioblastoma cells is that they aren’t good at recognizing the knot or the resulting break for repair, one of the reasons the cancer is so abnormal and aggressive. The lack of repair causes the cancer cells to get stock, and eventually undergo apoptosis and die. Healthy cells on the other hand recognize the breaks and repair themselves, which explains why the side effect profile of VAL-083 is comparatively low according to the most recent data of the Phase II trial just completed.

Combination Possibilities

But there are other advantages to understanding the mechanism of action here. DelMar’s data so far provides evidence that glioblastoma cells get stuck in a particular phase of cell division when exposed to VAL-083, called the S-phase. There are other chemotherapies that are only active when cells reach this particular phase, which opens up the possibility of a combination therapy in any upcoming pivotal Phase III trial with these particular drugs.

The point here is not that the company will necessarily choose this path. It may not, or it may choose to use this kind of combination as one of the active arms in a future trial. The point is that DelMal, due to its deep understanding of its own candidate, has opened many options for itself as to how to ideally optimize a pivotal trial that would end up bringing this drug to market. Not only that, but it could even make finding a potential partner easier if DelMar can convince a partner that its own drug will be strengthened in this way. That is, if DelMar chooses to go the partnering route, which is not certain at this point. It may want to go it alone.

All of this together makes the chances of a successful Phase III much higher than a company that knows its drug works in some vague way, but is otherwise flying blind.

Don’t Forget the Risks

That being said, it is important not to forget that glioblastoma is a notoriously difficult disease to trial and treat. Though it is a $1 billion market, it is a rare disease, with only 15,000 people in the US suffering from it. Even fewer will exhibit high amounts of MGMT the company is looking for, and even some of those that do cannot be tested because they are not candidates for surgery. This will be no cake walk here, but some of the advantages discussed above do help explain why the company is trading the way it is.

The biggest risk near term does not stem from VAL-083 failing outright, though that would certainly devastate the company. That is a longer term issue. The biggest risk at this stage of development is a halt in any upcoming pivotal trial, and unexplained screening halts or outright trial suspensions have been known to happen to other companies trialing glioblastoma in particular. If there are any bureaucratic roadblocks to a pivotal trial due to safety concerns or anything else, we are looking at a 60% downside or more.

Financially, the company has enough funds to run through the end of next year, with $10 million more in cash available from the exercise of warrants. By that time, a pivotal trial will probably be well underway.

Conclusion

Cutting the $1 billion market estimate by 80% taking into account that not all glioblastoma sufferers are the target patient population here, a $200 million annual revenue from VAL-083 is a conservative guess upon approval. Given that potential and an average price to sales revenue of 4.37 for pharmaceutical firms as of January 2016, a market cap of $72 million is still quite undervalued. Given the uncertainties here and danger of a trial halt for whatever reasons, even if we cut that ratio to say 3:4, a market cap of $150 million is still double where we are now.

Whether or not VAL-083 succeeds or fails in the long term, DelMar can continue on its current trend if and only if it gets its pivotal Phase III off the ground and running in the short to medium term. If there are any holdups that linger unexpectedly, the downside could be 50% or more ultimately.

And if VAL-083 is approved and sells well? That’s a different calculation entirely, and Market Exclusive may cross that bridge when we get there.