Friday was a bit of a scary day for the permabulls, but we are most likely not entering a new bear market. The decline may have gotten the permabears a little too overexcited.

The NASDAQ Composite (INDEXNASDAQ:.IXIC) was down Friday by more than 2.5% for its biggest single day drop since the surprising Brexit vote that caused global market turmoil for a whole two days. Call it an overly simplistic leap of logic, but if Brexit could only spur a market decline of 2 days, the signs are that money is ready and waiting to overwhelm any selling pressure that may build up.

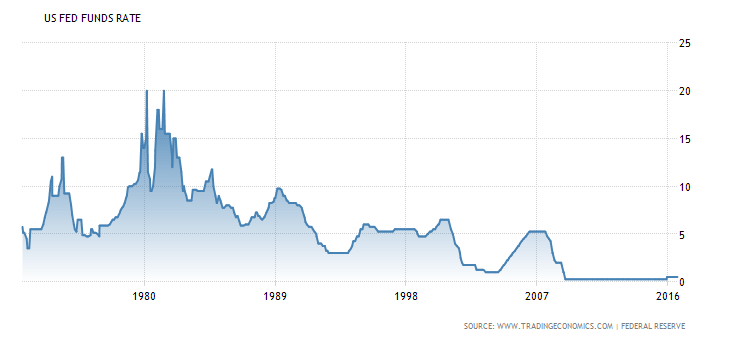

The catalyst for this particular decline looks to be the debate over whether the Federal Reserve will decide to raise the effective Federal Funds Rate by another 25 basis points or leave it as is come their September 20-21 meeting. There have been some offhanded hints by dovish Fed officials that a hike is likely. Historically this is all a meaningless question because 25 basis points is historically nothing. To see why, here’s a long term chart.

Judging by this chart, the recent 25 basis point hike that the Fed embarked on just at the turn of 2016 is barely noticeable. Another 25 basis point hike would be equally unnoticeable in the grand scheme of things. The lack of any long term effect of the much more far-reaching Brexit vote, at least in terms of the magnitude of surprise dished out to markets in a single flash point, does signal that even if a rate hike is totally unexpected by markets, the effect of one wouldn’t have any long term effect on the upward trend for stocks.

While the act of increasing the Federal Funds rate following the September 20-21 Federal Open Market Committee (FOMC) meeting could negatively impact stock prices for a day or two, any surprise is likely to fade into distant memory within a very short time because we are now headed into a seasonally favorable time for more new Fed hot money to enter the system. As we head into the fall and winter months, spending tends to increase and more loans are made by banks. This generally tends to increase the supply of money in the banking system which in turn increases the price of capital, AKA stocks.

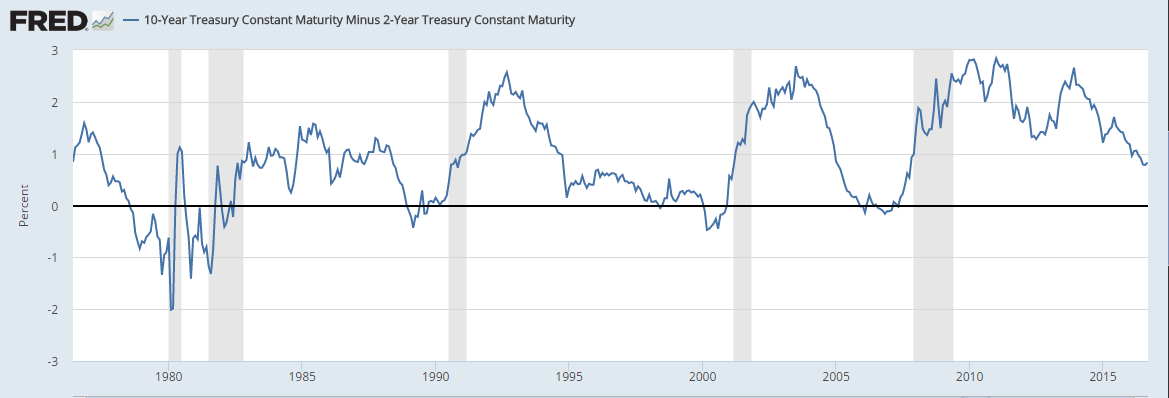

The very purpose of increasing interest rates on the short end of the curve is to discourage bank loans so as to slow down money creation and thereby slow an overheating economy. However, as the spread between long term and short term rates remains far above zero – meaning banks can still borrow short and lend long, make money on the spread and create money on the loan, the money supply will keep growing and that money will keep flowing into stocks and will also continue to fuel more consumer spending. As you’ll see from the chart below, the yield curve is still far into positive territory, so there is probably no recession at the door nor any stock market crash.

Notice also that there were recessions and bear markets in 1990, 2000, and 2008 when the curve was below zero. We are not anywhere near that level right now.

We are left then with two likely possibilities. Either the Fed does not hike interest rates next week and stocks pop higher, or the Fed does hike interest rates next week and the S&P 500 (INDEXSP:.INX) falls for a day or two providing nothing more than an additional buying opportunity.

In order to bring the yield curve into negative, the Fed would have to raise the Fed Funds rate by other 100 basis points next week. There is no chance of that happening. The bull market will most likely continue raging onward.