Is there a chance that the Federal Open Market Committee will declare an interest rate hike and raise the target federal funds rate by 25 basis points today, September 21st? Yes, but it’s pretty small. Here are 5 reasons why there will be no interest rate hike by the Federal Reserve today.

First, there was the 11-strong “tweetstorm” by Larry Summers, who was actually the favorite to become the next Federal Reserve Chair after Ben Bernanke, but pulled out of the race at the last minute to give then-Vice Chair Yellen the job. In Summers’ series of 11 tweets, he gives vociferous reasons why the Fed must not raise rates now, ranging from lack of tools if macroeconomic conditions worsen, to strengthening the dollar in a time of heavy protectionist measures.

Whether he is or is not, Summers is perceived as nominally more hawkish on monetary policy than Yellen, though that isn’t saying much. If Summers is being so insistent about not raising rates, then a fortiori Yellen, who is probably more dovish than Summers, will not want to raise rates now either.

Second, there will probably be no interest rate hike today because the inflation rate is still pretty low. Price inflation hasn’t picked up significantly yet, and even though the core inflation rate is slightly above the Fed’s 2% mark, it will take more than that to get them to raise rates in a time when nominal GDP growth is still sluggish. When the core inflation rate hits 3% or higher, then the Fed may consider a rate hike, but not yet.

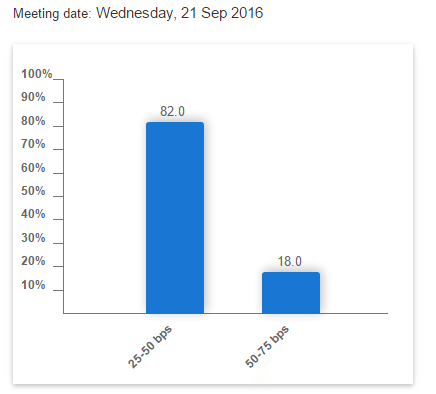

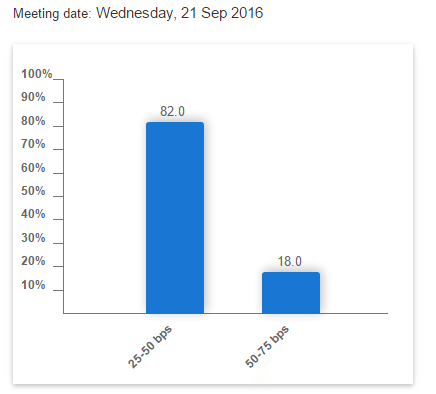

Third, there will probably be no interest rate hike because the Fed does not want to rattle markets. It would get yelled at and blamed for instability. Nevermind that the Fed is the crux of pretty much all economic instability and the boom/bust business cycle itself in the first place by constantly fiddling with the money supply, but it would be obvious and apparent if the Fed raised rates and suddenly the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) tanked. Why would it tank? Because the Fed futures market is heavily predicting no rate hike, by 82% to 18%.

The significance of the Fed futures market is not its predictive nature per se, as if market predictions as to what a group of people will do are necessarily accurate. It is to say that the Fed generally follows the market rather than leading it, so if markets are not expecting a rate hike, and clearly they are not, then Yellen is not likely to give it any unwanted surprises.

Fourth, gold and the corresponding SPDR Gold Trust (ETF) (NYSEARCA:GLD) is up nearly a full percent today, so perhaps somebody knows something. Leaks have been known to happen and have become more frequent.

Fifth, MarketWatch published a piece by David Marsh yesterday, September 20th, depicting central banks generally as on a gold buying spree since 2008. This is true, and though not exactly news, is evidence that central banks, including the Fed, are in the mood to let economies run hot before they raise rates. While there was one rate hike, that was only a rate hike for the sake of principle, to prove that it could be done without triggering the end of the world. It was done, and the Earth is still in orbit around the sun.

But two interest rate hikes? Not until the core inflation rate reaches at least 3%. Otherwise there might be an earthquake and the planet may swing out of orbit.