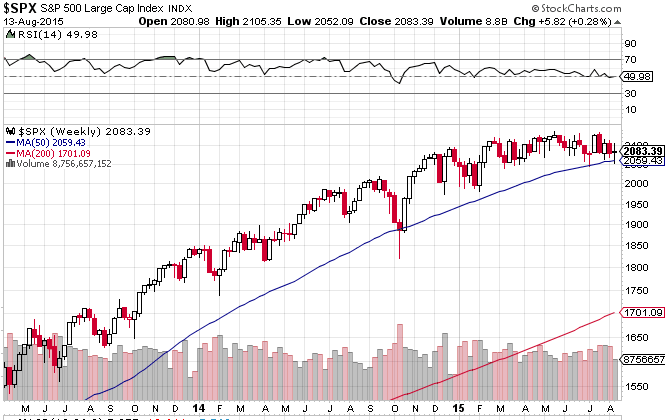

If you want to see a chart that looks a lot like tiptoeing on the edge of a cliff, take a look at the weekly chart of the S&P 500 (NYSEARCA:SPY).

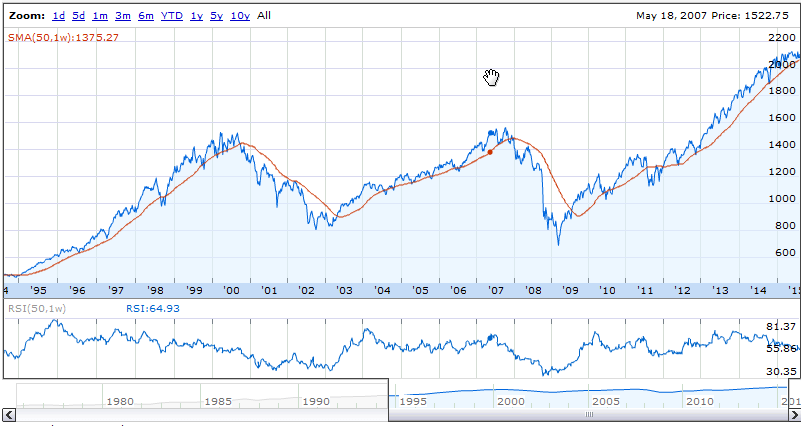

How important is the 50 DMA? Here’s a look at a longer term chart of the S&P to gain a wider perspective on the 50 DMA and its correlation with bear markets.

Since bear market bottom in March 2009, the 50 DMA has been tested 6 times, counting the 2011 break as one, and the weekly tests are becoming more frequent now. Only time will tell if this is the top for the current cycle, but it’s looking more likely by the day.

After yesterday’s largest turnaround by percentage in stocks for three years, equities fell sharply in the final hour of trading on high volume, signaling a probable lower open tomorrow.

Meanwhile, mixed signals are everywhere as the Atlanta Fed has forecast Q3 GDP growth at just 0.7%, as weekly unemployment claims continue to rival the 2000 trough. Then again, perhaps the signals are not so mixed, as that unemployment trough came one month after the 2000 NASDAQ (Nasdaqgm:QQQ) top was already in.