Karyopharm Therapeutics Inc (NASDAQ:KPTI) is set to report an overview of the topline data from its lead multiple myeloma trial on September 6, and markets are rallying in advance of good news. An upgrade from Jeffries has sparked speculation that the company will put out something positive, and Karyopharm is set to open Wednesdays’ US session at a 36% premium to its Tuesday open. They say sell the fact, but if the data does indeed prove to be positive, there’s plenty of further upside potential to be had on announcement day and beyond. Here’s what to look out for when the numbers hit.

The drug in focus called Selinexor, and it’s an oral administration oncology drug targeting the above mentioned MM in patients that have already undergone heavy standard of care (SOC) treatment. It’s under investigation in a host of other cancers, but the data set to report next week is specifically related to MM, a phase IIb, and positive results would serve as a leading indicator of succesfull campaigns in the other oncology indications.

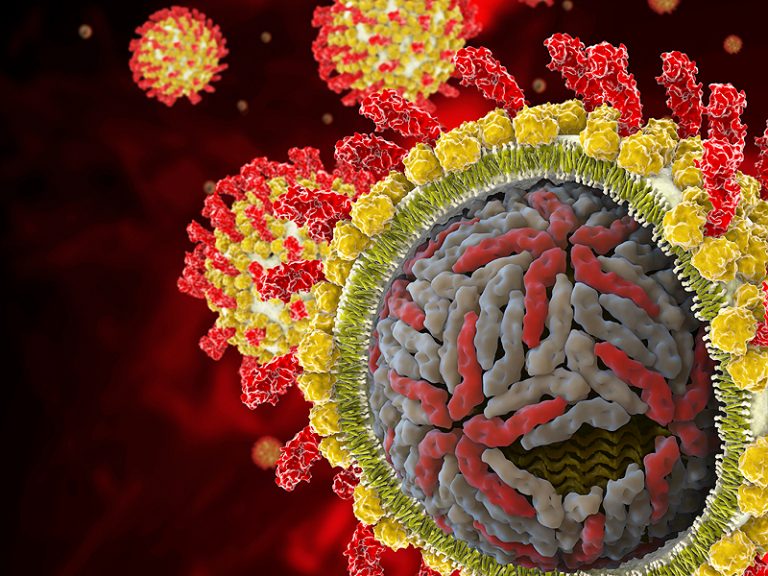

So how does it work? The science behind this one is pretty elegant. Healthy cells have what are called tumor suppressor genes (TSG) built into their nuclei. These genes serve as a sort of restraint on inappropriate cell growth – they stop cells from becoming cancerous and proliferating uncontrollably. In cancerous cells, something called a nuclear export, specifically exportin 1 (XPO1), transports TSG outside of the cell, rendering it useless. Without the restraining effect of the TSG, cells grow and replicate uncontrollably, and become cancerous. Selinexor is an XP01 inhibitor. It inhibits the exportin, meaning the TSG remains inside the nuclei of the cell, and in turn, stops the cell from growing uncontrollably.

How has it performed to date? In July, the company announced data from a phase Ib trial in patients with advanced refractory bone or soft tissue sarcoma. The numbers looked good. Out of a total of 52 patients, 30, or 58%, showed a best response of stable disease (SD), with 17, or 33%, experiencing durable SD. Durable SD here is defined by a response greater than or equal to four months. Further, thirteen, or 30%, of 43 patients with quantifiable tumor measurements showed a reduction in target lesion size from baseline. Across a few secondary endpoints, including increased nuclear accumulation of tumor suppressor proteins, decreased cell proliferation, and increased tumor cell apoptosis after treatment, the drug also registered a hit, further backing up the efficacy hypothesis. Safety and tolerability proved no issue at the scheduled dosing – twice per week, three weeks on, one week off.

So what are we looking for in the upcoming data?

The trial is investigating efficacy of Selinexor in combination with an already approved steroid medication called dexamethasone. Dexamethasone is an established SOC, and patients will be dosed twice weekly each week in four-week cycles, with 80mg of Selinexor and 20mg of Dexamethasone. The primary endpoint is overall response rate (ORR) across a 5-7-month time frame.

It’s open label, meaning there’s no placebo arm, so the topline figure we are looking at is ORR. If there was a control arm we’d compare active ORR to control ORR, but there isn’t, so the single figure will be the headline. It’s all about response. With these patients many other treatments have failed, so the response isn’t going to have to be that great in terms of scale to be indicative of supporting a pivotal.

We’d like to see some mirroring of the soft tissue sarcoma data, with a response in anywhere between 20-50% of patients, but with this being a very late stage MM trial, chances are the company will count an endpoint hit at the low end of this range – perhaps even lower.

What comes after the data?

The company is set to hold a conference call before market open on data day, so we should get a decent insight into the data on that call. We’ll be listening in and we’ll bring readers an interpretation shortly after it takes place. At this point the company has said it will announce its forward strategy for the drug in this indication. If we were to hazard at a projection, we expect a pivotal initiation during the first or second quarter of next year.

Remember to join us on September 6 for our interpretation of the conference call and an assessment of what’s next!