GREAT SOUTHERN BANCORP, INC. (NASDAQ:GSBC) Files An 8-K Regulation FD DisclosureItem 7.01.Regulation FD Disclosure

GREAT SOUTHERN BANCORP, INC. (NASDAQ:GSBC) Files An 8-K Regulation FD Disclosure

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank.

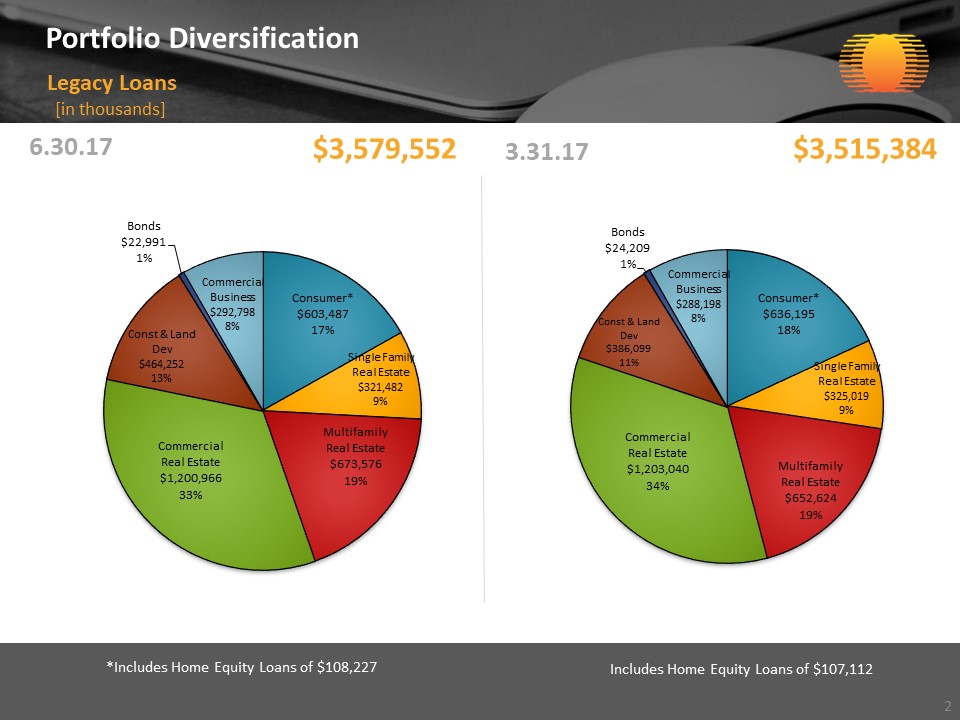

Portfolio DiversificationLegacy Loans6.30.17$3,579,552$3,515,3843.31.17*Includes Home Equity Loans of $108,227Includes Home Equity Loans of $107,1122[in thousands]

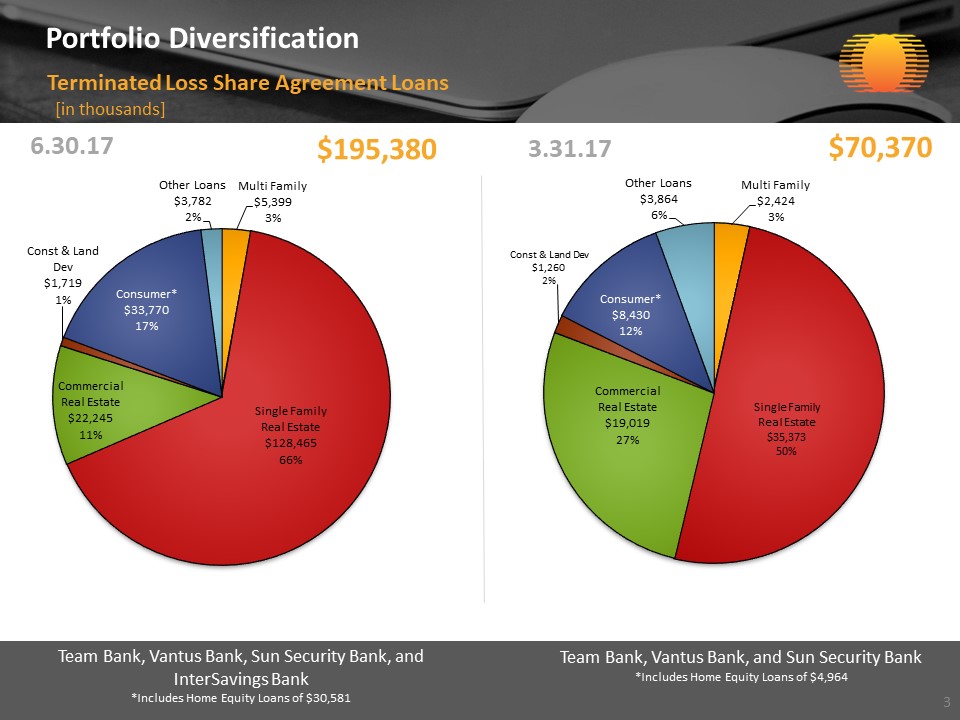

Portfolio DiversificationTerminated Loss Share Agreement Loans6.30.17$195,380$70,370 3.31.17Team Bank, Vantus Bank, Sun Security Bank, and InterSavings Bank*Includes Home Equity Loans of $30,581Team Bank, Vantus Bank, and Sun Security Bank*Includes Home Equity Loans of $4,9643[in thousands]

Portfolio DiversificationFDIC Assisted Acquired Loans6.30.17$71,860$74,9863.31.17Valley Bank*Includes Home Equity Loans of $647Valley Bank*Includes Home Equity Loans of $6134[in thousands]

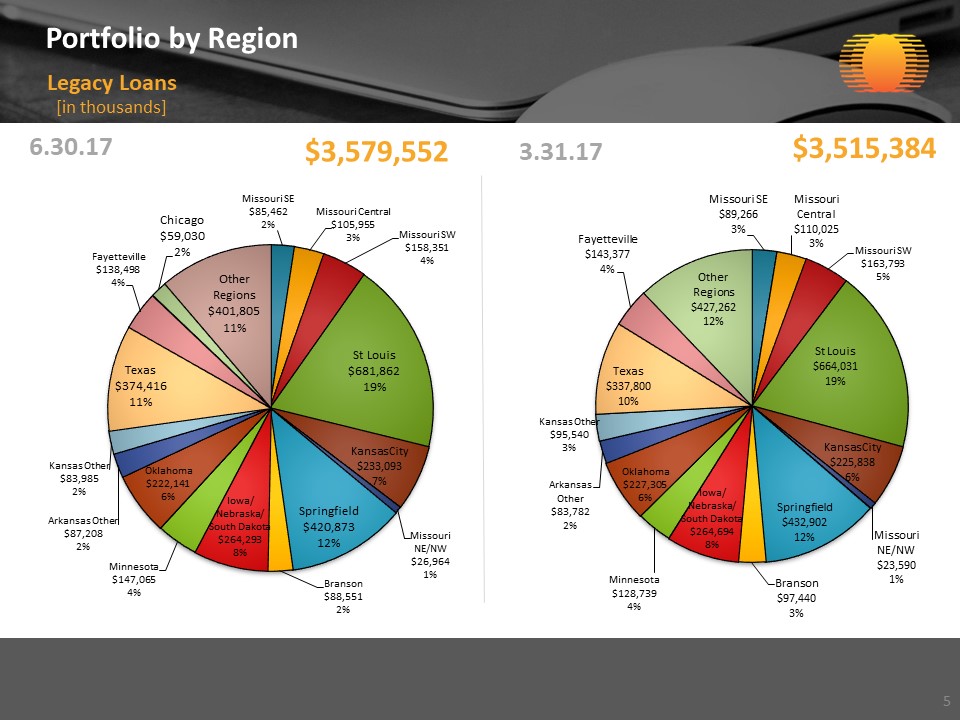

Portfolio by RegionLegacy Loans6.30.17$3,579,552$3,515,3843.31.175[in thousands]

Portfolio by RegionTerminated Loss Share Agreement Loans6.30.17$195,380$70,3703.31.176[in thousands]Team Bank, Vantus Bank, Sun Security Bank, and InterSavings BankTeam Bank, Vantus Bank, and Sun Security Bank

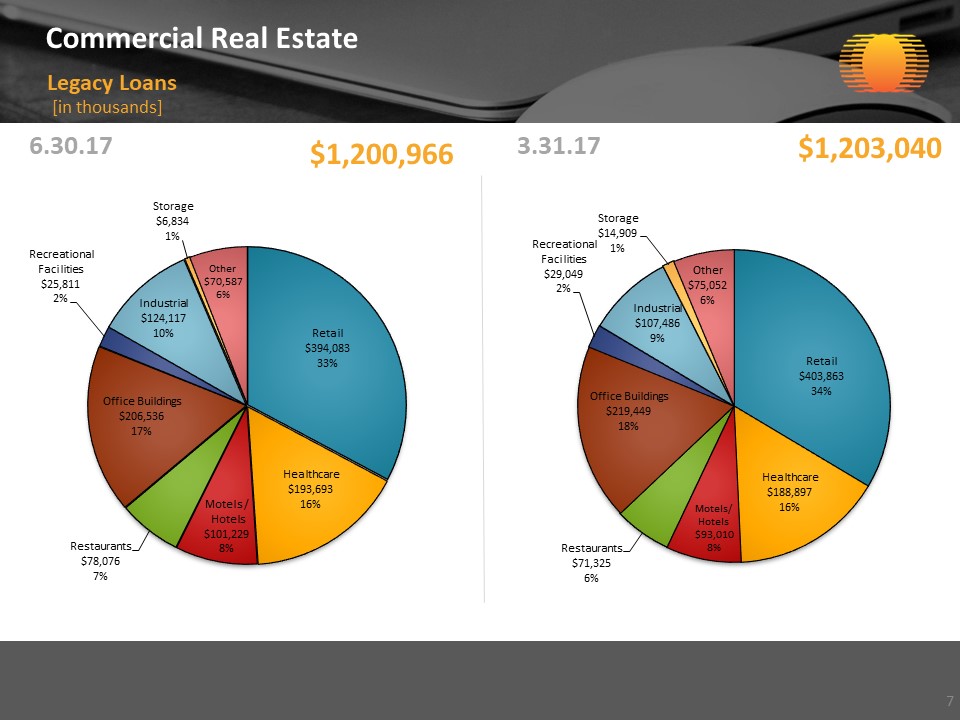

Commercial Real EstateLegacy Loans6.30.17$1,200,966$1,203,0403.31.177[in thousands]

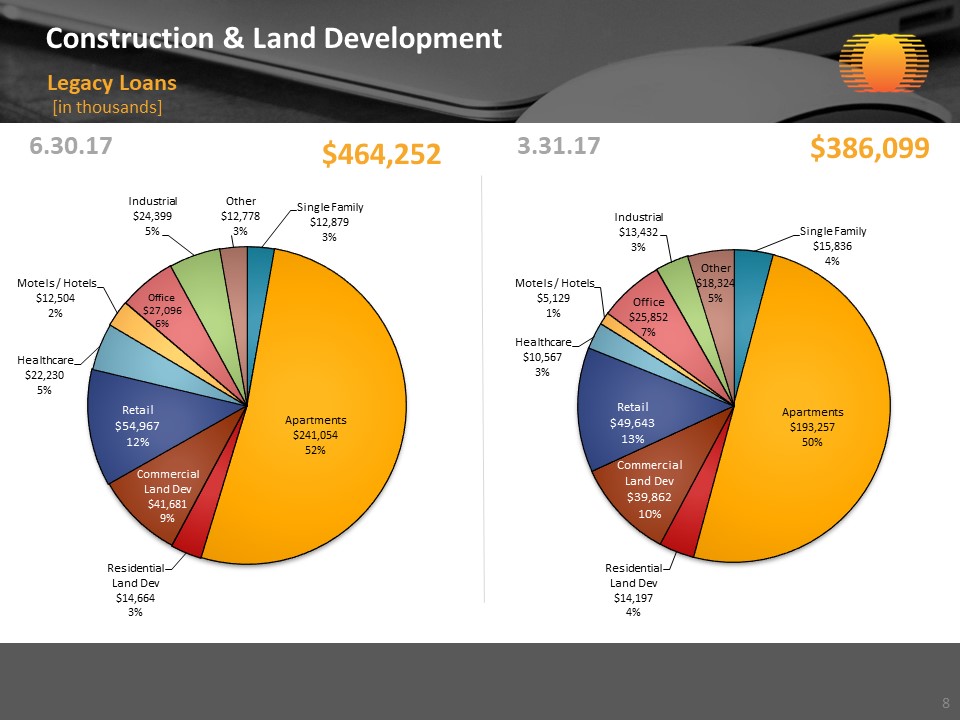

Construction & Land DevelopmentLegacy Loans6.30.17$464,252$386,0993.31.178[in thousands]

Multi Family Real Estate by RegionLegacy Loans6.30.17$673,576$652,6243.31.179[in thousands]Average credit size is $2,363,425Average credit size is $2,322,506

Multi Family Real Estate by LTVLegacy Loans6.30.17$673,576$652,6243.31.1710[in thousands]

Consumer Auto Loans by RegionLegacy Loans6.30.17$429,346$463,0223.31.1711[in thousands]71% of the Consumer PortfolioAvg. origination balance $16,300Avg. origination term 5 yearsExpected life 23 months Average Primary FICO–689New autos–4% Used autos–96% Indirect loans– 89%Direct loans–11%73% of the Consumer PortfolioAvg. origination balance $16,372Avg. origination term 5 yearsExpected life 24 monthsAverage Primary FICO–701New autos–5% Used autos–95% Indirect loans– 89%Direct loans–11%

NonPerforming by TypeLegacy Loans6.30.17$13,264$16,0743.31.1712[in thousands]*Includes Home Equity Loans of $333*Includes Home Equity Loans of $214

NonPerforming by RegionLegacy Loans6.30.17$13,264$16,0743.31.1713[in thousands]

About GREAT SOUTHERN BANCORP, INC. (NASDAQ:GSBC)

Great Southern Bancorp, Inc. is a bank holding company. The Company is a financial holding and parent company of Great Southern Bank (the Bank). Through the Bank and subsidiaries of the Bank, the Company offers insurance, travel, investment and related services. The Bank offers banking services through its approximately 108 banking centers located in southern and central Missouri; the Kansas City, Missouri area; the St. Louis, Missouri area; eastern Kansas; northwestern Arkansas; eastern Nebraska, the Minneapolis, Minnesota area, and eastern, western and central Iowa. The Bank’s consolidated net loans total over $3.34 billion and consolidated deposits total over $3.29 billion. The Company primarily makes long-term, fixed-rate residential real estate loans. The Company’s investment portfolio consists of the United States Government agencies, mortgage-backed securities, states and political subdivisions, and other securities.