There’s a lot of money to be made on election day volatility if you know how to play it. Let’s begin this guide with a few bullet points, getting down to the meat immediately. Then we will expand. See the bottom line for conservative traders on what to do before market close at the end of this article if you cannot trade futures.

- Stocks (NYSEARCA:SPY) will tank and gold (NYSEARCA:GLD) will skyrocket if Trump wins.

- Stocks will rise and gold will fall if Clinton wins, but the moves will not be as extreme as if Trump wins.

- The market is more priced for a Clinton win than a Trump win, especially after Comey’s second clearance of Clinton from charges.

- Regardless of who wins, longer term (by April or May), stocks are headed higher because the money supply is expanding.

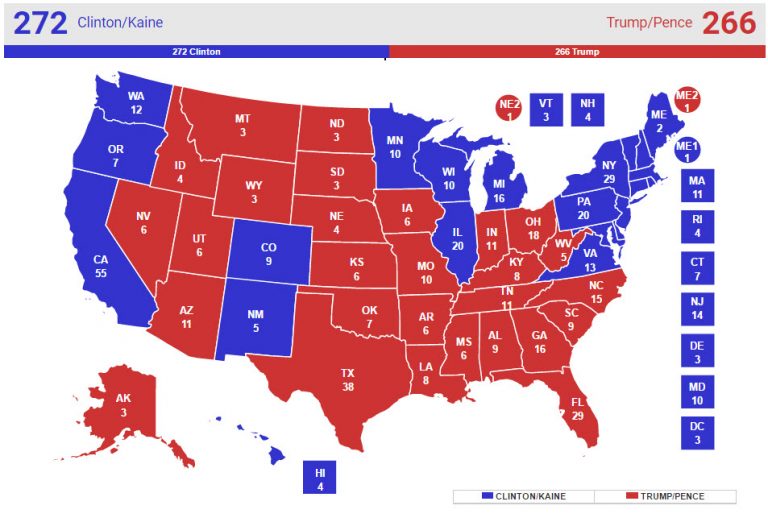

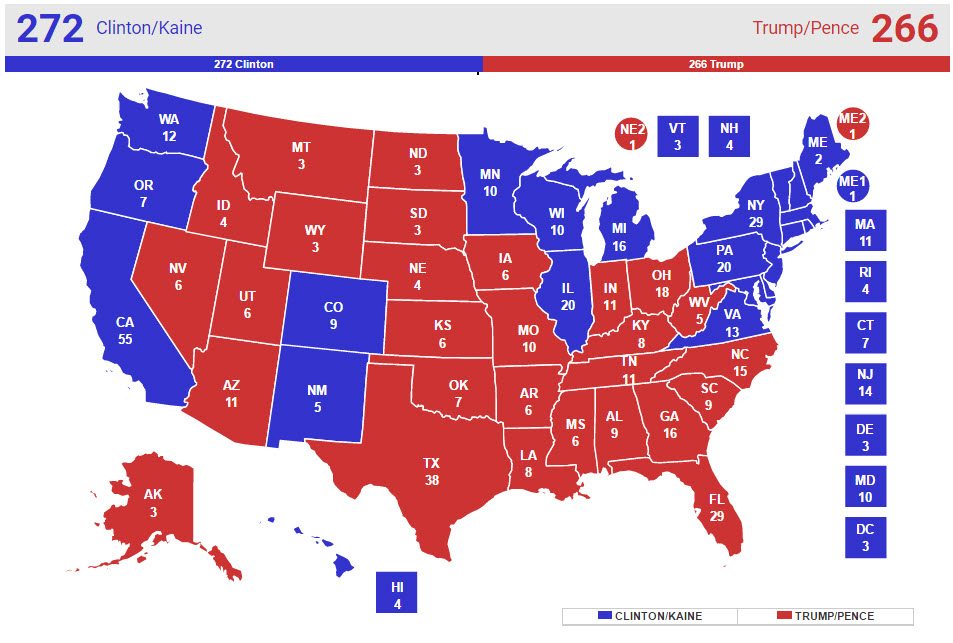

- Clinton’s biggest strength is that she only needs to win one to three swing states (depending on the state or states) to seal the deal.

- Clinton’s biggest weakness is that she is so widely hated, even by her staunchest supporters, that lukewarm supporters who distrust her may not show up to vote at all, effectively handing over swing states to Trump.

- Trump’s biggest strength is…the fact that Clinton is so broadly hated.

- Trump’s biggest weakness is that he can only afford to lose one or two small swing states at most. He must win all the others.

So how can we use this information to make profitable trades? The answer is we won’t be able to trade during market hours, because the earliest polls will only close after the markets close. But aggressive traders can make use of the futures markets to make money.

The earliest states that would indicate a likely Trump or Clinton win are Florida, North Carolina, Pennsylvania, Ohio, Michigan, and Maine. Trump absolutely needs Florida AND Ohio, and either North Carolina or Pennsylvania. Now here’s where it gets really complicated.

- If Trump wins Florida, North Carolina, Ohio, Michigan, AND Pennsylvania, all of which close by 8:00pm, then we’re looking at a likely Trump victory. Short positions can then be taken in SPY futures and larger positions in gold futures, because gold will eventually recover regardless of who wins. Be sure to check both CNN and Fox News for their calls on the winners in each state, as they represent different sides of the political spectrum. We can’t be sure who wins until both networks agree on who wins.

- If Trump loses either Florida OR Ohio OR Michigan, Clinton will likely win, and large long positions going out to April or May can be taken in stock futures immediately on the call, assuming all networks agree and it is clear. Large because even if Trump wins, stocks will eventually recover by April or May.

- If Trump wins Florida, Ohio, Pennsylvania AND Michigan but loses North Carolina, traders will have to wait a little longer until the next swing states are called.

- If Trump wins Florida, Ohio, Michigan and North Carolina but loses Pennsylvania, Clinton will still likely win and small positions can be taken in stock futures, to be added to later in the event Trump pulls off a surprise victory.

- Maine splits its electoral vote, so watch out for an X factor here.

Basically, Trump can only afford to lose one or at most two states in the east, but he absolutely must win Florida AND Ohio. If he loses either Florida OR Ohio it’s over and Clinton wins. If he wins both AND North Carolina the he can afford to lose Michigan, as the two are almost equal in electoral votes. He can theoretically afford to lose at most Pennsylvania AND Michigan, but then he absolutely MUST win North Carolina AND Nevada AND Colorado.

Now if Trump wins everything but Pennsylvania AND Michigan, that’s when we have to wait for the next polls to close at 9:00pm EST when Colorado closes. If Colorado goes Clinton in that case, it’s over and Clinton wins. If Trump wins Colorado, in this case we have to wait even longer for Nevada to close. Nevada will then determine the election.

In order to visualize this, here is the RealClearPolitics No-Tossup map.

Maine and Nebraska are X factors since they split their electoral votes. And in the unlikely event that a 269-269 tie does happen, prepare for civil unrest. In that event, stocks will tank hard and gold will skyrocket.

It is important to remember that polls showing narrow Clinton victories in swing states give Trump an advantage because it would mean that turnout has to be high. Clinton does not inspire enthusiasm among pretty much anyone, so there may be a lot of Clinton no shows. If voter turnout is reported to be low, Trump has the advantage.

Bottom Line for Conservative Traders

For those who cannot or will not trade futures or for whom this is too confusing, the safest play to execute today is to be long stocks or options on stock indices going out to April or May in small positions assuming a likely Clinton victory. In that event, if Clinton wins you can sell at a profit in a day or two, and if Trump wins, you can add to these positions on the fall assuming stocks will recover by April or May anyway.

Disclosure: A time of writing, the author was long gold and gold stocks.