What does 2017 hold for Amgen, Inc. (NASDAQ:AMGN) and can this pharmaceutical stock lend color to your equity portfolio? Here’s a look at what makes Amgen attractive and what’s not-so attractive about the stock.

What’s Impressive About Amgen?

The stock has ample room to rally in 2017. Amgen’s shares performed fairly well in 2016 considering that they dropped 10% compared to more than 27% decline in the Biomed/Genetics industry, according to a Zacks metric. However, the fact that Amgen shares dipped in 2016 suggest that they have ample room to rally this year and beyond if the company’s pipeline and other corporate updates turn out to be upbeat.

Cost-efficiency drive

Amgen is in the process of restructuring that would enable the company to whittle down some costs and generate savings that can be reinvested for growth and returned to shareholders in the forms of dividend and stock buyback.

As part of its restructuring initiative that is expected to yield up to $1.5 billion in annual savings by 2018, Amgen said it lowered its gross costs by $700 million in 2015, and the company was targeting $400 million in additional savings in 2016.

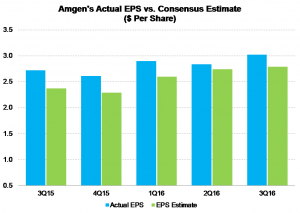

Amgen’s cost-cutting should not only yield savings, but also uplift the bottom line, leading to upside earnings surprises.

The chart below shows Amgen’s EPS (earnings per share) for the last five quarters against the consensus estimate.

Industry consolidation

The healthcare sector is consolidating as major drug companies acquire smaller and promising rivals to expand their product portfolio and seize larger market share. Amgen is among drug companies pairing internal with acquisitions to drive growth and such maneuvers are also adding to industry consolidation.

Amgen’s acquisition of Onyx in 2013 and Micromet in 2012 helped strengthen the company’s position in oncology market.

What’s Worrying About Amgen?

Pipeline disappointments. Amgen has pipeline data to report in the coming quarters and the quality of those reports will affect the direction of the stock. Disappointing clinical results from late-stage studies could have far-reaching adverse implications on Amgen shares.

Amgen is also locked in patent conflict with Pfizer Inc. (NYSE:PFE) and Sanofi SA (ADR) (NYSE:SNY), who are seeking to invalidate its European Union patent relating to PCSK9s. A setback in the patent war would adversely affect the stock.

The impact of biosimilars on key products

Biosimilars pose a significant threat to Amgen’s key products, putting the company’s future topline growth at risk. Amgen’s key drugs Neupogen and Neulasta have both lost their patent protection in the US and are beginning to feel the heat of biosimilar competition. Zarxio is Sandoz’s biosimilar version of Amgen’s Neupogen and Apotex is on the verge of introducing biosimilar versions of both Amgen’s Neupogen and Neulasta.

Drug pricing pressure

Healthcare reforms around the world are focusing on cost curtailment and this is having adverse impact on sales and profits of many drug companies not just Amgen. The pricing pressure means that pharmaceuticals have to offer steep discounts in some quarters before they can qualify for reimbursement coverage.