Midway through the session on Monday, NeuroDerm Ltd. (NASDAQ:NDRM) announced that it is set to be taken over by Japanese Pharma giant Mitsubishi Tanabe Pharma Corporation. The company is an Israeli biotechnology that is working to develop treatments that – as its name suggests – target central nervous system (CNS) disorders.

Specifically, NeuroDerm has developed a device/drug combo that it calls its levodopa and carbidopa (LD/CD) product, which is differentiated across a pipeline full of different development stage assets. The lead product and the one that Mitsubishi is likely most eager to get it it’s hands-on is a drug called ND0612. As many reading will likely already have guessed from the levodopa reference above, NeuroDerm’s pipeline primary targets Parkinson’s disease and its lead asset falls in line with this indication type. ND0612 specifically is a novel liquid formulation of the above-mentioned LD/CD aimed to reduce motor complications in patients with advanced forms of the disease.

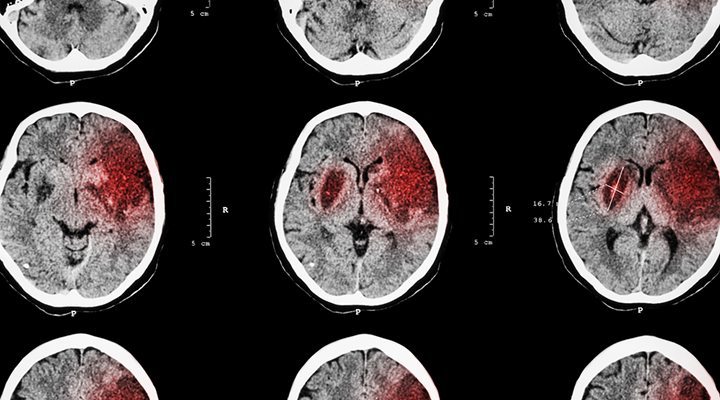

Parkinson’s is a highly prevalent disease across developed nations and – despite a range of treatment options being available to sufferers right now – there still remains a considerable unmet need across all stages of the disease. The treatments that are available generally bring with them very undesirable side effects and – in most cases – only last for a relatively short period of time from an efficacy perspective. With its ND0612 asset, NeuroDerm set out to show that the drug can overcome some of the shortfalls of the currently available formulations of levodopa (which, for those not familiar with this condition, is the standard of care treatment in the space) and has spent the last few years gathering data to support this hypothesis.

Markets got mid-stage trial results back in May from an investigation of the asset in the target population and – according to the numbers – the drug looks incredibly strong. The endpoint of the study was to reduce what is called ‘Off’ time, which is the period of time the standard of care treatment fails to improve the symptoms of the condition for the patient during the day. The results showed that the liquid combination of LD/CD was able to bring about a significant reduction of off-time in the target population, from 5.5 hours at baseline to just 2.7 hours at study end.

This is a billion-dollar market and one that any major drugmaker would love to get its hands on, so that Mitsubishi has made this move and is set to acquire NeuroDerm doesn’t come as any real surprise. Well, not the acquisition side of it, that is. That the company is being acquired by Japanese drugmaker is a bit of a surprise, with a number of big Pharma companies in the US having been reported to have had their sights set on NeuroDerm ever since the above-discussed data hit press.

Anyway, a Japanese drugmaker it is and it looks as though the deal has worked out pretty nicely for both companies.

Mitsubishi will pay $39 per share for NeuroDerm, which represents somewhere in the region of a 17% premium on the company’s pre-announcement share price. Based on this per-share price, total valuation comes in at around $1.1 billion. There might be some shareholders that feel this is something of a small undervaluation, given the market potential for not only ND0612 but also the company’s deeper pipeline and its portfolio of development assets (most of which are rooted in the same sort of treatment, but each of which targets a different subset of the Parkinson’s population).

With that said, however, a close to 20% premium overnight is not something to be scoffed at, especially considering that the acquisition means that Mitsubishi is taking on the entirety of the risk associated with carrying the asset in question through a pivotal trial and regulatory submissions in various regions. It also negates any dilution risk for NeuroDerm shareholders, which at the smaller end of the biotechnology space, is a major consideration for anybody thinking of picking up exposure to a development stage pipeline.

The deal is set to close during the fourth quarter this year, meaning there is still a fair amount of back and forth to conclude before anything is finalized. With that said, however, we don’t see any reason why the deal won’t go through (as mentioned, there doesn’t seem to be anything that would disgruntle the majority of shareholders of either company) and we expect NeuroDerm to hold its current share price (based on the overall valuation of the company) heading into deal close.