Gold (NYSEARCA:GLD) continued to drift lazily higher today without attracting too much attention to itself. It is still uncertain if a new bull market in precious metals has begun yet, but either way, it is useful to take a step back and consider a broader historical perspective to see what we may have in store this time around.

As far as gold goes though, all business cycles before 1971 would not have had an effect on the gold price no matter how extreme simply because gold and the dollar were pegged back then at either $21 per ounce or $35 per ounce after President Franklin Roosevelt’s 1933 gold confiscation and devaluation. That being the case, inflation’s effect on the gold price would have to be analyzed after 1971 when President Richard Nixon finally delinked the dollar from gold, introducing pure fiat money.

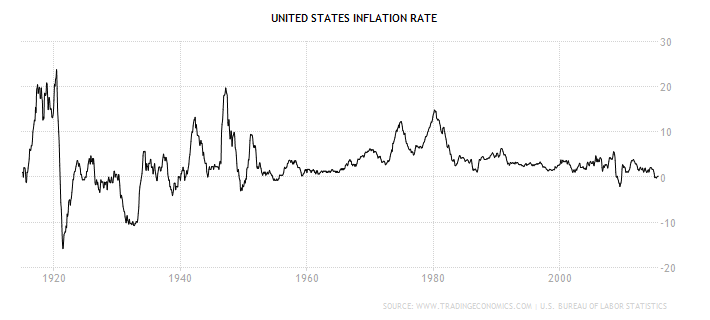

It just so happens that gold’s peak on January 21, 1980 at $850 an ounce (over 5 times where it was just two years before) coincided with the highest post 1971 inflation rate print ever. What this shows is that when inflation becomes patently obvious, gold goes parabolic in a true sense. The bad news for gold bulls back then was that then-Fed Chair Paul Volcker was pushing interest rates even higher than the inflation rate in an attempt to calm the CPI and save the dollar.

While that approach did save the dollar, it destroyed the gold bull market.

This time around, there is no possible way to raise interest rates significantly if inflation pulls above 5%. The debt is too large, and saving the dollar that way will destroy the bond market. Sadly, inflation will destroy the bond market on its own anyway, putting US Treasuries in a conundrum.

Gold prices may have bottomed, and they may have not yet. But what is certain is that if and when inflation inches above 5%, there will be virtually no way to save the dollar this time without linking it directly to a commodity. The Fed cannot even hike rates a measly 25 basis points let alone to nearly 20% as Volcker did. Volcker-era interest rates are an impossibility, a non-starter. If ever the CPI climbs at a rate of 5% or higher annually, we may even see a repeat of the 1980 parabolic move in gold, but this time with no way to bring it back down.

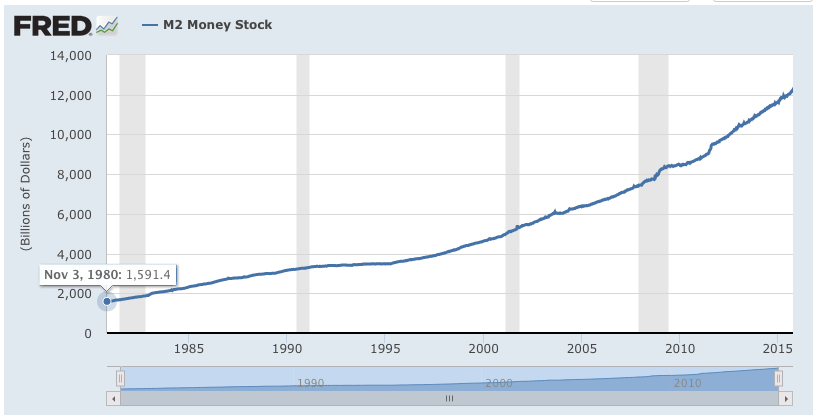

The result would be a fundamental revaluation of gold in dollar terms and the relinking of paper to metal. At what price exactly? Well, in 1980, the money supply totalled $1.6 trillion (see below), and gold maxed out at $850 an ounce.

Disclosure: The author was long precious metals at the time of writing.