It wasn’t a pretty day for gold bugs. The four year old gold bear has seen many days like this before. Gold (NYSEARCA:GLD) barely down but gold stocks plunging. Is the bounce over, and will the bear resume its course yet again?

There is no definitive answer at this point, but consider that days like this happened quite often during even the fiercest parts of the last gold bull market as well. The bounce out of the October 2008 bottom exhibited plunges in the Gold Bugs Index (^HUI) very similar to what we saw today, on very minor down days for the metal itself. Even the final big run from July to September 2011 saw days where gold miners dropped 4%.

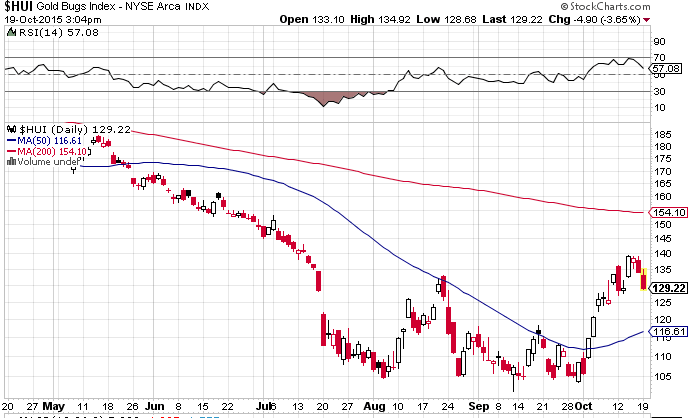

If the bear is intact, look for a break in the HUI to below 115. That is the most recent support zone that should stay solid if we are in a new bull market. There may be a brief break at that level just to clear sentiment and throw technical traders off who put all their apples in the support/resistance cart, but if the break is marginal and quickly reversed, we can continue higher from here to around 150 before the next resistance zone is tested.

Days like this being quite familiar to gold traders in the last four years, we should see bearish sentiment increase rather quickly and the 14 day RSI drop near 50 on the assumption the bear has resumed. This should give some running room for the next leg up by the end of this week or early next.

Keep in mind that the 115 level on the HUI index is also now the same as the upturning 50 day moving average. A new bull market should stay above that line in the sand, whereas a bear market really should have it turn back down again so the 50 cannot move above the 200. That type of move would be the ultimate confirmation of a new bull market, and we have a while to go before we get near that point.

The most important thing to watch on a daily level for now is what kind of move the HUI makes on the next up day for gold. Gold stocks need to be up big when the next up day hits. Otherwise, this could just be another bull trap.