Market Exclusive Weekly Biotech Report including:

- Sarepta Therapeutics (NASDAQ:SRPT)

- Collegium Pharmaceutical inc. (NASDAQ:COLL)

- Acadia Pharmaceuticals Inc. (NASDAQ:ACAD)

- Kempharm Inc (NASDAQ:KMPH)

The Past Week

Monday April 25, 2016 – Friday April 29, 2016

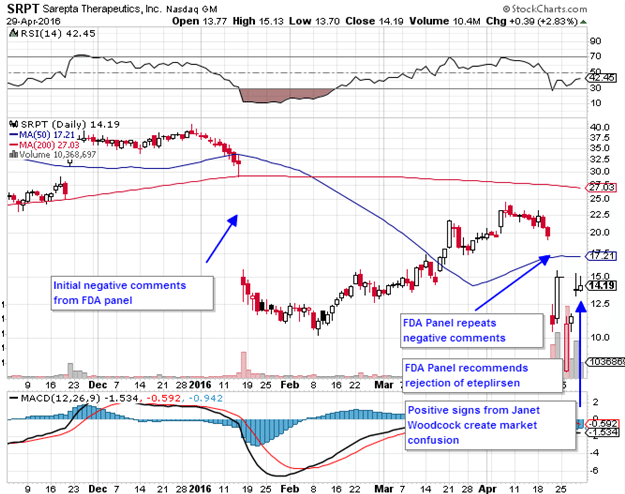

Last week was an historic one for biotech, particularly the drug approval process, FDA power plays and hierarchy and the battle between human mercy and rigid government bureaucracy. This all played out with Sarepta Therapeutics (NASDAQ:SRPT) on April 25th.

Sarepta Therapeutics

Movie buffs may remember the popular Mel Gibson action flick Payback. The plot is about one criminal named Porter who had the paltry sum of $70,000 stolen from him by the local mafia called “The Outfit”. Against all odds, Porter cleverly mows down target after target in the Outfit, eventually getting high enough that he threatens the existence of the entire operation. Towards the end when Porter is really reaching the higher-ups in the Outfit, he demands to know the name of the man in charge of the whole operation so he can demand his money directly from him.

He’s told that in order to get his $70,000, the decision would have to be made by a committee. Then Porter says a key line. “One man.” He says. “You go high enough you always come to one man. Who?”

It’s the same with most hierarchical structures. Committees are committees, panels are panels, but at the top you always come to one person. In the case of the FDA, it’s one woman. There is one woman who ultimately has the final say in what drugs people are allowed to take and what drugs they are not. It is not up to the patients, nor the developers, nor anyone else. It’s up to one bureaucrat named Janet Woodcock.

The question is, come May 26 when the decision must be made, what will Woodcock decide? We previously stated that a negative vote would almost assuredly doom eteplirsen’s chances of approval, but after what happened last week, the chances of approval for eteplirsen, at least insofar as accelerated approval is concerned, are not as doomed as we once thought.

Those who want an in depth analysis of exactly what went on at the FDA panel meeting should read Adam Feuerstein’s firsthand account. He sat there for hours listening to 52 speeches and watching for any clues from any of the big players. Essentially it comes down to whether Woodcock fears delaying approval until more evidence of efficacy is gathered. Whether or not Sarepta gets approval for eteplirsen on May 26, the Phase III trial will continue. The issue being, if the trial is successful and eteplirsen does prove effective, that means years will have been lost during which the thousand plus patients suffering from the Duchenne variant that eteplirsen is designed to treat will have deteriorated or worse, died outright.

The confirmatory phase 3 study is enrolling 160 patients and is scheduled to complete only in January 2019, and that’s if enrollment goes as planned. That’s almost 3 years away, and if the drug is actually effective, it will be on her conscience alone for having delayed it as the ultimate decision maker in this case. We previously estimated the market for eteplirsen at about 1,560 people, meaning around 1,400 people will have been prevented from taking a drug that may have been able to save their lives, or at least extend their years.

The worst that can happen if the drug is ineffective but approved now is that these people will have wasted some money trying something they thought might help. What the FDA panel really fears though is not denying an effective medicine, but staining its own reputation by approving an ineffective one. It makes them look like rubber stampers.

What is going on is truly a battle of government bureaucracy against human compassion. The FDA panel was asked to answer 7 questions, and panelists actually asked whether to take patients into account when making their decision. The very question may seem crazy – who else are you going to take in to account when determining whether a boy with a terminal illness can be allowed to take a drug that may or may not help him?

Woodcock made this clear in one of her statements. Says Woodcock, in what can only be called a fit of realism and compassion:

But most of these consequences [of not approving a drug that works] are borne by patients who traditionally have little say in how the standards [of approval] are implemented.

True, the consequences of the decisions of an FDA panel are borne by patients who have no say in the outcome of the approval process. Woodcock advised the panel to take patient considerations into account. In advising this, she is essentially saying that normally, a panel would not take patient considerations into account.

One panelist, a Dr. Chiadikaobi Onyike, had asked the following question as Feuerstein transcribes it:

To what extent are we to incorporate into this question the testimony of the families, the boys and their families? From my reading of the question, it seems narrowly worded towards the actual statistical results so I want some clarification on that point.

Onyike was asking straight out if he was expected to act as a statistician/bureaucrat or whether to bring in the dynamic human factor, to actually listen to testimony and let it affect decisions. The fact that he can ask the question reveals the bifurcation of the typical FDA panelist between their compassionate and scientific personas. They are separate, and will only be united with explicit permission from the woman on top.

Most revealing though in terms of what ultimately will happen is the fact that Woodcock actually took pictures together with the suffering boys and their families at the panel. If she did not have any inclination to approve this drug, those pictures would border on teasing, given that she is the one woman who has the power to allow these kids to take eteplirsen, with or without FDA panel support.

While the panelists were answering scientific questions to the best of their scientific ability and voted eteplirsen down, when it comes to the one woman on top, taking pictures with the people whose lives she literally holds in the palm of her hand, it shows she is leaning away from the inconclusive data and towards basic human mercy.

It now looks like eteplirsen will be granted conditional approval come May 26 at Woodcock’s discretoin. The question for investors now is, what will that mean for the stock?

Market Reaction and Trading Strategy

Sarepta was trading at around $20 before the bad news began to trickle in even prior to the panel vote on the 25th of April. It is now at $14.20. Before the original bad news came in January, the stock had a high of $42. Approval this month will likely see shares skyrocket. All time highs are at $55.61. Approval could see shares move to $60 or higher. After that though, it becomes not a question of compassion, but of economics. And the economics don’t look too promising.

The market is so small that Sarepta will have to set a very steep price for eteplirsen as we noted previously, and companies are not going to want to cover that for a drug with no proven efficacy. It will be a big battle with insurance companies that Sarepta may not win. Assuming the drug is approved, when the euphoria dies down and investors start wondering how the money is going to come in, Sarepta shares could begin to fall back down. It may take months, but that’s what looks the most likely outcome in the event of accelerated approval.

Aggressive traders may want to go long here or buy call options if only for the approval jump. The options prices on Sarepta are extremely out of whack with near term options expiring in June more expensive than long dated calls expiring in 2018. This makes absolutely no sense and cannot last. A few out of the money 2018 calls should pay handsomely if Woodcock approves eteplirsen on May 26. Our suggestion though is to sell them shortly after approval.

Collegium Pharmaceutical inc.

Collegium has been coiling in a tight trading range since the beginning of April. The 200 day moving average is essentially flat, which usually means price will spring in one direction or the other relatively soon. What happens with the stock from here depends on how well Xtampza is accepted by the pain market and how quickly.

The good news is that Xtampza looks to be the most advanced abuse deterrent opioid now on the market. There are now only three other opioids with an abuse deterrent label that will compete with Xtampza. One is OxyContin OP, marketed by Purdue. According to the warning label on OxyContin OP, administration of the active ingredients by injection may result in necrosis, infection and increased risk of heart disease. Further, the warning label states:

Instruct patients to swallow OXYCONTIN tablets whole; crushing, chewing, or dissolving OXYCONTIN tablets can cause rapid release and absorption of a potentially fatal dose of oxycodone.

That sentence pretty much defeats the purpose of abuse resistance. This is also the case with Hysingla, another extended release opioid marketed by Purdue. Neither of them have Xtampza’s abuse deterrent property that is resistant to crushing, chewing, and dissolving. Xtampza’s other competitor is Embeda, marketed by Pfizer Inc. (NYSE:PFE) Embeda is able to be sprinkled on food, but is still not resistant to crushing like Xtampza is. From the Embeda warning label:

Do not cut, break, chew, crush, dissolve, snort or inject EMBEDA because this may cause you to overdose and die. If you cannot swallow EMBEDA capsules sprinkle the pellets inside the capsule on applesauce and swallow immediately without chewing. See the detailed Instructions for Use. You should not receive EMBEDA through a nasogastric tube or gastric tube.

Embeda was reintroduced into the US market in February after being recalled in 2011. In 2011 it only had annual sales of $70 million. What makes Embeda and OxyContin OP technically abuse deterrent is that they contain separate ingredients that counteract the effects of the drug. This is equivalent to stepping on the break and the gas pedal at the same time, and is not particularly efficient for the purposes of drug delivery.

Xtampza, as of right now at least, is clearly superior to any of its competitors and the quicker it saturates the market before a true abuse resistant opioid competes with it, the better. Annual sales are expected to peak at $700 million. Collegium has 8 months this year to make as many connections and sales as it can to get the landscape used to Xtampza.

Collegium’s quarterly burn rate is slightly less than $10 million. Spending will rise in order to bring the drug to market, but Collegium already has a dedicated sales staff and is ready to move ahead here. As we wrote previously, Collegium is focusing on the niche geriatrics market targeting the 1.4 million patients in skilled nursing homes, 35% of whom have chronic pain. OxyContin sees 50,000 prescriptions filled per month in long term care, or $300M a year and Collegium is looking to take a good portion of that market.

If Xtampza can reach its target of $700M in sales in the next 5 years, Collegium’s market cap could move from the $450M now to the low billions by the end of the decade. Price to revenues can get as high as 10 to 1 in young biotechs, which gives an upper target of $7B market cap, or a gain from current levels of about 1,450%. That’s if all goes perfectly, which it probably won’t, but triple digit gains are nothing to sneeze at either.

As for risks, there really doesn’t seem to be much downside in the short term. Collegium is a young company marketing its first drug, and investors will probably give it the benefit of the doubt at least until the end of this year, at which point they’ll have to show some numbers. If for whatever reason Xtampza fails in the marketplace though, we’re looking at a 25-50% downside by the middle of next year. Given the current state of the abuse resistant opioid market though, this does not seem very likely. If you’re a physician looking for a true abuse deterrence for a patient you suspect may be an addict, you’ll turn to Xtampza. If you’re a geriatric specialist looking for a medication you can use in a feeding tube or for patients who cannot swallow, Xtampza is the best choice.

Collegium is a long term buy, but we’ll know a lot more when we see pricing and initial sales numbers next quarter. So while it is a buy, it is not a buy and ignore. It’s a buy and monitor.

The Week Ahead

Monday May 2, 2016 – Friday May 6, 2016

Acadia Pharmaceuticals inc.

On April 29, the FDA approved Nuplazid, a drug developed by Acadia Pharmaceuticals Inc. (NASDAQ:ACAD) targeting psychosis and hallucinations in patients with Parkinson’s disease. The market will have a chance to react this week at the open, but we don’t expect major movements given that approval had been expected and priced in. An advisory panel voted in favor of its approval at the end of March.

The Science

The drug is an inverse agonist of serotonin receptors. In Parkinson’s disease, degeneration of the neurons that produce dopamine results in the common symptoms associated with the condition – motor control impairment, shaking, etc. The most used drug to counter these symptoms is L-DOPA, but this drug has serious side effects. One is psychosis. The psychosis comes about as a result of a build up or overexpression of serotonin. Normally, dopamine levels would balance this out through a negative feedback loop, but because the neurons aren’t producing dopamine at normal levels, and the L-DOPA doesn’t stimulate enough dopamine production to counter the overexpression of serotonin, there is no balance.

Nuplazid is an inverse agonist of serotonin receptors. That is, it has the opposite effect of an agonist – in this instance, to bind to serotonin receptors and inhibit their ability to produce serotonin. This, in turn, targets a balance, and hopefully offers some level of treatment.

The Data

The data on which the NDA is based came from a phase III, for which integrated data was released in June last year. The trial met its primary endpoint of a highly significant reduction in psychosis versus placebo, its secondary endpoint of motoric tolerability, and also showed benefit in areas such as sleep hours, mindfulness and caregiver burden. Tolerability didn’t look to be an issue, and this forms the basis of the panel’s recommendation.

Having said this, the trial only showed a marginal advance over placebo, which may affect market absorption somewhat. The current standard of care is generic antipsychotics, and with the drug’s expected high price as a branded compound, it could see a bit of trouble in the sales department given that while effective, it is not overwhelmingly so.

The Market

As with nearly all Parkinson’s treatments, and development candidates, the psychosis sub sector is a huge market. Estimates suggest a little over 40% of Parkinson’s patients suffer from some level of psychosis, and all of these would potentially be suitable candidates for Acadia’s drug. We don’t yet know a price point, but with up to 1 million Parkinson’s sufferers in the US at present, and 60,000 new cases each year, the price tag wouldn’t have to be too high to command a multibillion dollar market potential.

Finances

Acadia is a development stage biotech company, and as such, has all the financial risk associated with a company in this position attached to it. Its current market capitalization sits at $3.65 billion, and it generates little to no revenues. Quarterly net losses come in at between $39 million and $46 million across the last four quarters. Cash on hand was a little over $102 million at last count – December 31, 2015.

The cash position will likely see the company through to late stage development of its pipeline, and also fund the commercialization of Nuplazid if the FDA approves the drug, so a finance raise shouldn’t be required near term (assuming Nuplazid gets off to a decent start). Longer term however, the company will likely need to raise some cash if it is to commercialize the remainder of its development pipeline.

Trading Strategy

Just as with the majority of the biotech space, Acadia suffered throughout the latter half of 2015 and early 2016. The last four weeks have seen the company stage a recovery, however, likely on the back of expectations of a Nuplazid approval. Acadia stock sits at circa $33 a share at present, but shares probably won’t move too violently given that approval has been expected since late march on the positive panel review. This one is a wait and watch, and buy only on any major unexplained dips. Long term, the movement of the stock will depend on patient response to Nuplazid, which we won’t know about for at least 6 months or so.

KemPharm Inc.

On May 5, an advisory panel will convene, discuss and report its recommendations regarding KemPharm Inc (NASDAQ:KMPH) abuse deterrent opioid KP201/APAP.

The Science

This one is pretty straightforward. Kempharm has designed an abuse deterrent formulation of hydrocodone and acetaminophen – both of which are currently available standard of care pain management drugs. The company’s formulation, KP201/APAP, is a combination of the two, with a ligand attached to the compound. A ligand is a type of molecule that binds to the drug, and in doing so, it stops the active compounds in both hydrocodone and acetaminophen from being released until the drug hits the GI tract, and the ligand delinks, creating active drug.

What does this mean? That the drug can’t be abused using the most common methods of opioid abuse – that is, crushed up, dissolved, intravenously administered, etc. Simple, but KemPharm hopes, effective. Additionally, the delayed onset delivery should reduce the time-limited exposure to hydrocodone, which should in turn make it very difficult to overdose.

Data

The trial on which the NDA was based was called KP201.AO1, and was a double blind designed to compare the abuse deterrent properties of KP201/APAP with a drug called Norco – more commonly known by its brand name Vicodin. The drug performed well across its target endpoints, demonstrating a lower exposure to hydrocodone for two dose levels (8 and 12 tablet doses) and bioequivalence at a 4 tablet dose regimen. 34% of patients demonstrated a 20% reduction in Cmax – essentially, a baseline measure of the patient’s exposure to hydrocodone – when compared to norco, and the two drugs demonstrated pretty similar safety profiles.

All said, the data looks positive, and safety and tolerability shouldn’t really be an issue as the two active compounds are currently widely available in the same indication KemPharm is targeting with its investigational KP201/APAP. Of course, there may be some elements of the data that have unforeseen implications, and these will become apparent as the panel deliberates.

Market

The market potential for this sort of drug is very big. A recent study conducted by Frost and Sullivan concluded that there is a $10 billion market potential for any drug that reaches commercialization and can be marketed as a safe alternative to the currently available opioid pain management drugs. Total opioid pain management market revenues came in at a little over $50 billion during 2013, and this is expected to expand to $60 billion by the end of 2018.

Of course, the real potential may vastly outweigh the predicted $10 billion – at a glance, it looks conservative. Opioid abuse costs the US government and other entities in excess of $55 billion annually, and any drug that is seen as potentially being able to cut these costs would likely get external support. This could bolster any marketing efforts, and in turn, increase potential opioid pain management market penetration.

The drug will not directly compete with Xtampza because Xtampza is designed for daily round-the-clock pain management and KP201/APAP only for short term management. There may be some overlap, but it probably will not be all that significant.

Finances

KemPharm doesn’t have any drugs approved and generates zero revenues as things stand. It has a current market capitalization of a little over $240 million, and chalked up a full year 2015 net loss of $54.6 million. Cash and cash equivalents at last count (December 31, 2015) came in at $32.3 million, and we can reasonably expect the company’s operational costs to increase if KP201/APAP gets an agency nod and KemPharm carries the drug through to commercialization, and in turn, has to bear the costs of its marketing efforts. Of course, if the launch is successful, the company should start generating revenues before 2017 kicks off. Between then and now, however, there’s every chance the company will require a finance raise. As always, this has the potential to dilute any holdings.

Trading Strategy

If KemPharm gets a recommendation for this candidate, there is plenty of potential upside. Using the conservative market potential of $10 billion as a guide, the company will be chasing revenues at a fifty times multiple to its current market valuation, and so we can expect plenty of capital attraction on a green light from the agency.

Upside potential probably comes in at anywhere between 70%-120% with a clean approval – that is, one with no label warnings (or at least, none that would hamper its potential sales). With this in mind, upside potential if the panel offers up a positive review is probably in the 50% arena.

Downside is probably not quite as steep, as the company has a pretty robust secondary pipeline – probably circa 20%-30% if the panel says no.

Written by Rafi Farber, Samuel Rae, and other Market Exclusive contributors. At the time of writing, Farber owned shares of COLL.