Vantiv, Inc. (NYSE:VNTV) Files An 8-K Regulation FD DisclosureItem 7.01Regulation FD Disclosure.

Vantiv, Inc. (“Vantiv” or the “Company”) is furnishing this information in response to an article written by a subscription-based organization that claims Vantiv deceives merchants by marking up interchange fees. Vantiv rejects the conclusions and methodology asserted in the article. Vantiv does not mark up interchange fees; the Company properly discloses the calculation of its fees to merchants, and generally charges merchants less than the industry.

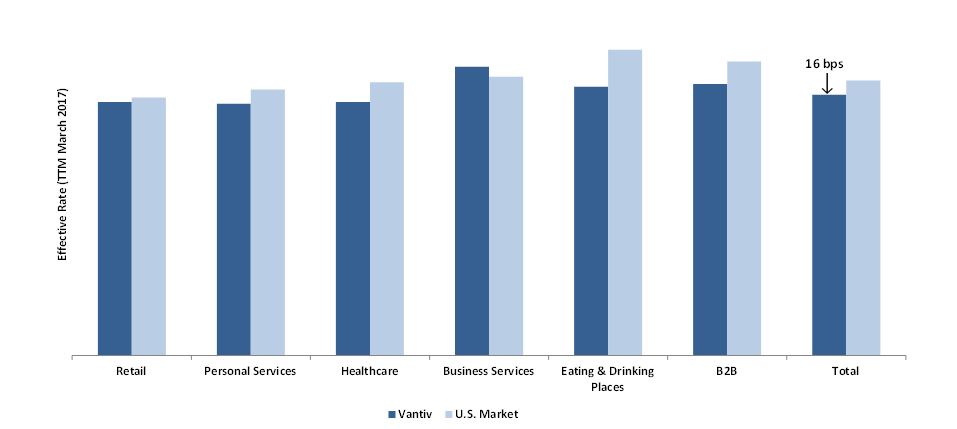

Third-Party Review of Vantiv and Industry Effective Rates

Vantiv’s average effective rate for small and medium sized business clients is lower than the U.S. payments industry average.

The Strawhecker Group, a respected independent payments research group with expertise in the payments industry, analyzed data to determine Vantiv small and medium sized business (SMB) clients’ average effective rate and compared them to the industry. Strawhecker’s analysis shows that our clients’ average effective rate is below the industry average across many of the Company’s largest verticals as well as in total.

The effective rate that a merchant pays is a critical measure of pricing. Because different processors charge different fees with different names and present them in different formats on a merchant’s billing statement, it is widely recognized that calculating a merchant’s effective rate is the only way to get a true apples-to-apples comparison of client pricing from one merchant acquirer to another. Calculated as the total of all charges and fees billed to a client divided by the client’s total sales volume in the billing period, the effective rate captures the client’s all-in cost of transaction processing. Effective rate includes all processor fees, all network fees and all third-party assessments.

The payment processing industry is highly competitive, with hundreds of acquirers and thousands of sales professionals. Merchants are regularly approached with a range of value propositions and effective rate pricing is often a key selection criteria.

Exhibit 1: Vantiv’s “Effective Rate” is Below U.S. Average by 16 Basis Points

Source: The Strawhecker Group

Note 1: Includes merchants with $500-$500K in annual volume

Note 2: The six merchant types shown above account for ~75% of all card accepting merchants in the U.S.

Vantiv’s Low Attrition Rates

As a result of our competitive pricing, Vantiv’s merchant attrition rates are below industry average, based on industry data published by The Strawhecker Group for 2016. Given the ease with which merchants can change payment processors, were Vantiv to be out of step with the industry as claimed in the article, we would likely experience high client attrition rates. In addition, contract termination fees are standard practice in the payment processing industry, as well as many others, and competitors are often willing to reimburse potential clients for termination fees if they agree to switch.

Background on Vantiv’s Risk-Based Pricing

We are able to profitably operate and develop leading products and services while offering competitive pricing by employing risk-based pricing. Vantiv’s pricing methodology is based on the concept of charging lower rates for low-risk transactions and higher rates for higher-risk transactions, such as “card not present” or international transactions.

We clearly delineate base processing fees from our risk-based per transaction costs and surcharges by separating them into separate sections within our client billing statements, including delineating Vantiv’s risk-based per transaction amounts in a “Surcharges Section” within client statements. The line items in the “Surcharge Section” of a client’s billing statement are comprised of a combination of surcharge fees charged by Vantiv as outlined in the merchant’s agreement and subsequent updates and a variety of third-party costs borne by Vantiv to process the transactions (including interchange and high-risk transaction downgrade fees assessed by the networks).

Vantiv’s Strong Reputation for Service Excellence

Finally, Vantiv prides itself on the high-quality of its operations, and its commitment to delivering superior value to our clients. Vantiv has consistently won industry awards for service excellence. These include:

|

Best Processor Judges Choice and Customer Choice 2017 CNP Awards; |

|

Best Processor Judges Choice and Customer Choice 2016 CNP Awards; |

|

Business Solutions Magazine's Best Channel Vendor 2016; |

|

Stevie National Bronze Front-line Customer Service Team 2015 and 2014; |

|

International Service Excellence Award 2014; |

|

National Customer Service Association Service Team of the Year 2014; and |

|

RSPA's RetailNow Gold Medallion Winner. |

The information furnished on this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, regardless of any general incorporation language in such filing.

About Vantiv, Inc. (NYSE:VNTV)

Vantiv, Inc. (Vantiv) is a holding company. The Company conducts its operations through its subsidiary, Vantiv Holding, LLC (Vantiv Holding). The Company is a payment processor, merchant acquirer and personal identification number (PIN) debit acquirer. The Company operates through two segments: Merchant Services and Financial Institution Services. The Company offers payment processing services that enable its clients to meet their payment processing needs through a single provider, including in omni-channel environments that span point-of-sale, e-commerce and mobile devices. Its value-added services include security solutions and fraud management, information solutions, and interchange management. It also provide critical payment services to financial institutions, such as card issuer processing, payment network processing, fraud protection, card production, prepaid program management, automated teller machine (ATM) driving, and network gateway and switching services.