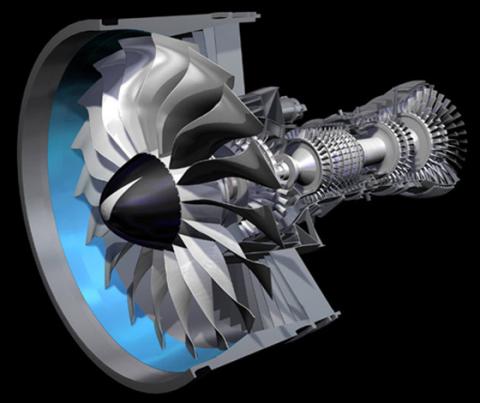

The Pratt & Whitney new GTF jet engine that cost $10 billion to develop is failing in its attempt to challenge General Electric Company (NYSE:GE) dominance. The fact that the engine has only attracted one buyer since it was launched, to power a narrow body Airbus SE plane, spells trouble for parent company United Technologies Corporation (NYSE:UTX).

GTF Engine Manufacturing Hurdles

Weak demand for the engine is already arousing concerns as to whether United Technologies will ever recoup its investment let alone scuttle General Electric’s dominance. The geared turbofan has been gripped with manufacturing hurdles, delivery delays as well as technical glitches even on meeting performance specifications.

Pratt’s delivery delays have forced a number airlines such as IndiGo to ground planes a position that other airlines don’t want to find themselves in, thus the reluctance in placing orders. Durability issues with regards to the GTF engines is another concern that continues to affect orders as Pratt fell short of its delivery goals last year.

Pratt & Whitney is currently working on fixes for durability issues affecting carbon seal and combustor that it plans to launch this year. Until the new fixes come into being, airlines may have to contend with extended periods in which some of their airplanes remain out of service. Over the past month, alone about 46% of A320neo jets powered by GTF were out of service compared to just 9% powered by General Electric’s engines.

GE Aviation $11.7 Million Contract

Separately, General Electric’s unit, GE Aviation, has secured an $11.7 million contract for the sourcing of aircraft parts at its aerospace manufacturing operations in Vandalia. Per the five year agreement with the Department of Defense, the company is to source parts for producing alternating engines for F/A-18 aircraft for the U.S Navy.

GE Aviation currently has an industrial backlog worth $150 billion for electric power generators and related systems used in military and civilian aircraft. The segment generated revenues of $6.5 billion after grappling with higher service revenues in the second quarter.

General Electric was up by 0.45% in Thursday’s trading session to end the day at $24.60 a share.