uniQure N.V. (NASDAQ:QURE) is an end of the week mover in the biotechnology space this week. The company just updated markets as to the progress of one of its lead development assets, a drug called AMT-061, along its pathway towards commercialization.

The situation is a pretty unusual one.

uniQure has been developing a drug called AMT-060 in a target indication of hemophilia and the drug had picked up breakthrough designation in the US as well as a comparable designation in Europe during its early stages of development. However, as per data reported last year, there were some signs that it might not be able to compete with another drug that is being developed in the space, a gene therapy asset that is at pretty much exactly the same stage of development as that of uniQure and is being developed by Spark Therapeutics Inc (NASDAQ:ONCE).

During 2017 to date, therefore, markets have been pretty subdued as relates to uniQure given that it looked as though, even if the company could get AMT-060 to market at the same time as Spark, it wouldn’t be able to compete with the latter based on available efficacy data.

That now looks as though it has all changed, however.

Late this week, uniQure announced that it is ditching AMT-060 in favor of an alternative hemophilia drug, the above-mentioned AMT-061. On a molecular level, the two drugs are pretty much exactly the same, with one exception – two nucleotide substitutions in the coding sequence for factor IX (FIX). In patients with hemophilia, FIX action is key to treatment and, with AMT-061, uniQure thinks that it can go after the same condition, with an almost exactly the same drug, but can dramatically improve on efficacy based on the just mentioned coding sequence alteration.

As per reports, the gene variant, called FIX-Padua, has shown an eight-to-nine-fold increase in FIX activity compared to wild-type FIX protein in preclinical testing.

Of course, in a normal situation, if a company was to drop its lead development asset in favor of an alternative version, however similar, said alternative would have to essentially restart its own pathway towards commercialization. In this instance, however, that’s not the case.

Alongside the company’s reporting of its switching out of its lead candidate, uniQure has also suggested that regulatory agencies in both the US and Europe are willing to accept the switch as part of the same development pathway and, just as importantly, that the program will maintain its breakthrough designation.

What this means, then, is that uniQure has set itself up for an intriguing battle with Spark near term. Both companies are poised to advance their respective assets into a pivotal trial and both companies are doing so under the guise of breakthrough designation.

Whereas once Spark was assumed to be the outright winner if the two assets were put head-to-head, the fact that uniQure’s drug is now (supposedly) dramatically improved over its previous iteration throws a spanner in the works from Spark’s perspective.

What also makes this situation interesting is the fact that uniQure has been able to nail down a pretty favorable trial protocol for the upcoming pivotal investigation. The trial in question will be open-label (meaning the company doesn’t have to compare its drug to a placebo arm) and will evaluate a single dose of AMT-061.

Patients are going to serve as their own baseline in the study, which means each will be evaluated at the start of the trial, then dosed, and then evaluated again once the trial draws to a close, and the primary endpoint of the investigation is a reduction in bleeds.

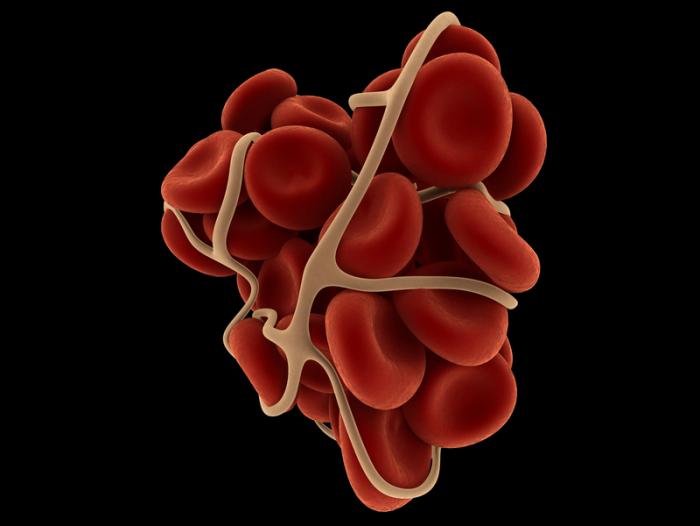

For those not familiar with hemophilia, it’s an inability to form blood clots correctly and is characterized by excessive bruising and bleeding on the back of small cuts and wounds etc. If uniQure can show that AMT-061 can help patients reduce bleeding from baseline in the upcoming pivotal investigation, the company could be on the fast track for a regulatory green light from both the FDA in the US and the EMA in Europe and, in turn, could grab a fairly decent portion of the available market share ahead of Spark and its own gene therapy asset.

Markets are trading up on the company on the back of the latest news, with uniQure closing out the session on Thursday for a 33% premium to its pre-announcement market capitalization.