The debate around Syriza’s victory today is centering around the end of so-called “austerity”. The assumption seems to be that Syriza will end this policy as promised, and Greece’s national budget will no longer be “austere”. Logically, then, this means that the budget will be expanded, i.e., Greek government spending will increase because Syriza says so.

The question is how will that be possible? Greece has no money, and the European Central Bank (ECB) will not give it any money on Alexis Tsipras’s – Syriza’s leader’s – terms. While Syriza may have won – possibly even enough for an outright ruling majority without any coalition partners, the European Central Bank still holds the printing press.

The will of the people cannot overcome reality, no matter how united that will is. An appropriate analogy might be a new CEO voted in to lead a bankrupt company on promises that he will give every company employee a raise. How, exactly? Well, what he can do is default on the company’s current debt, and then print his own “money” and give it out to his employees. How much would that new money be worth though? Chances are, not much.

Defaulting on current debt and handing out new money to appease voters would be the equivalent of a Grexit. No more Euros, the Greeks would begin printing their own money on the off chance that it will buy something without hyperinflating within weeks or days. The other option is to stay in the Euro, which would mean either toeing the line with the ECB in order to keep Greek debt from falling to zero. This would spell the end of Syriza’s election promises.

The other option, which seems to be that of Syriza’s probable candidate for Finance Minster Yanis Varoufakis, is to default on all bonds but stay in the Euro. In that case, “austerity” would become real bona fide austerity, because nobody would buy Greek bonds any longer, and the Greek government would have to operate on tax revenues alone. The budget would have to be slashed by much more than it has been since “austerity” began.

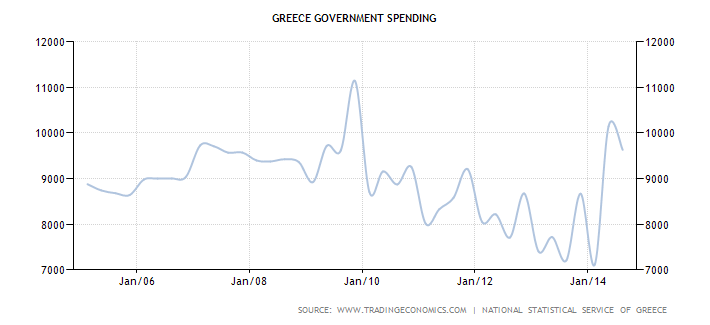

The chart above plots Greek government spending from 2005 until the present. While there is a downtrend beginning in 2010 from the time austerity began, it is only slight. From peak to trough, it decreased €11137.7M to €7116.6 per quarter, a maximum decrease of 36%. If Greece defaults but stays in the Euro, it will have to be cut by much more, because without access to bond markets, budget deficits will not only be undesirable – they will be impossible, as no one will lend any money to finance them.

Greece, Syriza especially, is between a rock and a hard place. If they go through with their plan to end “austerity”, the ECB will cut them off. At that point, they will either have to print drachmas and risk hyperinflation, or else stay in the Euro and rely solely on tax revenue to finance themselves.

Those are the options. There aren’t any others.