Cholesterol-reducing statins like Pfizer’s (NYSE:PFE) Lipitor may be the best selling prescription drug class in history, but for one kind of cholesterol disease, statins are just a pharmacological drop in the bucket.

Homozygous familial hypercholesterolemia (HoFH), though an ultrarare genetic disease at only 1 in 1,000,000 births, makes the liver completely incapable of metabolizing cholesterol. Lipids build up in the blood at levels so high that the blood is actually cream colored, and in order to survive, patients need to physically filter cholesterol out of the blood by a process similar to dialysis, or else get a liver transplant.

Only recently have two prescription drugs been approved to treat HoFH, but neither of them are grad slams, as they say. The first to be approved was Aegerion’s (NASDAQ:AEGR) Juxtapid in December 2012. It works by blocking a protein called MTP, which prevents very low density lipoproteins (VLDLs) from being secreted by the liver. Though the blocking mechanism is slightly different from run-of-the-mill statins, this is the same medical mechanism as Lipitor, in that it blocks cholesterol from being synthesized by interfering with liver function.

Juxtapid was approved after data on only 23 patients indicated a 50% median drop in LDL. 23 may sound like a small number but when the patient base is 1 in 1,000,000, it’s about 8% of the entire US HoFH population. Juxtapid sells decently, having totaled $155.2M in sales since its commercial launch, or roughly $89M a year so far.

The main problem with Juxtapid though is the side effect profile. Not all HoFH patients can even tolerate it (29 patients were enrolled in the trial and only 23 tolerated the drug at all) and for those that can, according to the FDA:

Juxtapid carries a Boxed Warning regarding a serious risk of liver toxicity because it is associated with liver enzyme abnormalities and accumulation of fat in the liver, which could potentially lead to progressive liver disease with chronic use. Juxtapid also reduces the absorption of fat-soluble nutrients and interacts with several other medications.

From an investment perspective, the financial numbers are important to take note of. Juxtapid was incredibly expensive to develop. To give a rough idea of how expensive, Aegerion had accumulated losses of $193M by the time Juxtapid was approved. When it finally was, the stock eventually rose from $20 to a high of $97.83 in October 2013. But sales have not been enough to keep the company net positive yet, and the stock has since crashed down to pre-approval levels. The drug is also ludicrously expensive at $300,000 a year. It would have to be if it cost hundreds of millions to develop and there are only around 300 people in the country that even have the disease.

The second drug approved for HoFH is Sanofi’s (NYSE:SNY) and Isis’ (NASDAQ:ISIS) Kynamro. If one can even call Juxtapid a sort-of success, maybe, Kynamro is so far a failure. Approved just one month after Juxtapid, Kynamro works similarly, except it blocks a different protein crucial for cholesterol synthesis in the liver. It was approved based on a trial of 51 patients with an average LDL-C reduction of 25% over 26 weeks of treatment. The placebo arm of the trial, however, saw a reduction of 21%. So really not much of an improvement over sugar pills, if any.

Couple that with the same scary-sounding FDA warning of serious side effects and the fact that Juxtapid had better trial results, and you can see why sales were so abysmal that they were not even publicly reported by either Sanofi or Isis. (Sugar pills at least don’t have any side effects, and they work almost as well according to the data. They also don’t cost $176,000 a year like Kynamro.)

Clearly then, the HoFH population is still in serious need of a drug that works well and does not have any serious side effects, and with any luck does not cost $176,000 – $300,000 a year. Enter Capstone Therapeutics (OTCMKTS:CAPS) and its lead HoFH candidate AEM-28. AEM-28 stands for Apolipoprotein-E Mimetic 28. Apolipoprotein-E, or apo-E is the protein that malfunctions in the livers of HoFH patients, which makes them unable to metabolize cholesterol. AEM-28 is a simple chain of 28 amino acids that act as a mimetic of apo-E, meaning it mimics its function, though is not the same molecule. It basically completes the missing link in the livers of HoFH patients, enabling them to actually metabolize cholesterol.

Think of it as insulin for diabetics, except AEM-28 metabolizes fat instead of sugar. Diabetics can’t produce their own insulin to metabolize sugar, so they inject an analog, and it works well enough. Same here with AEM-28 and fat.

The crucial difference between AEM-28 and either Juxtapid or Kynamro is that AEM-28 does not interfere with or block liver function. It simply enables it. Instead of blocking cholesterol from being produced, it enables cholesterol to be metabolized. And since it is a mimetic of a naturally occurring protein only 28 amino acids long, it is cheap to produce and manufacture, and there are no known systemic side effects. Capstone estimates that a registrational trial will cost around $10M.

A phase 1/2 study reported positive safety and efficacy data just last month: Specifically a 56% drop in VLDL versus placebo, and a 55% drop in triglycerides over placebo within 12 hours of treatment.

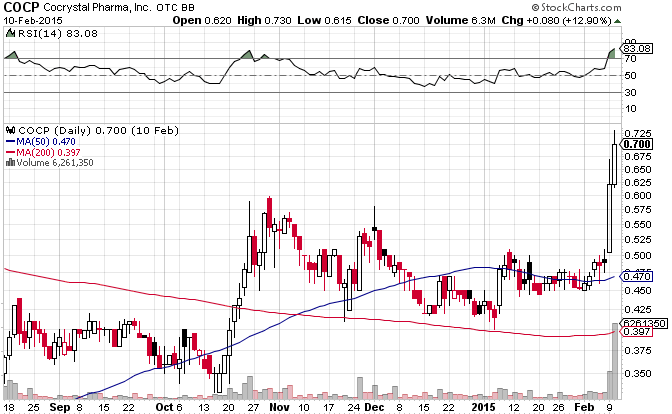

The next step is a phase 2/3 registrational trial, but first Capstone needs the money to get it started. It currently has $3M on its balance sheet but will need to raise more, or get a partner, to go to the next step.

If AEM-28 can do better than Juxtapid for HoFH, with little to no systemic side effects and at a fraction of the cost, then gains could be similar to Aegerion from trough to peak, except sustainable. From there, the big question is can AEM-28 also be applied to the heterozygous form of the disease as well, which affects 1:500 instead of 1:1,000,000?

Answering these questions will take time and money, but so far, so good for Capstone, and encouraging news for HoFH sufferers in particular.

Market Exclusive Is a financial portal geared to engaging discussion on current financial topics. Market Exclusive is not an investment advisor. Please read our full disclaimer at http://marketexclusive.com/about-us/disclaimer/