Tesla Motors Inc (NASDAQ:TSLA) intends to build an electric car factory in China, with the aim to tap the largest auto market in the world and reap rewards. Since China has the largest global auto sales market, the Californian electric car manufacturer wants to gain a strong foothold there.

Click Here For Market Exclusive News & Updates

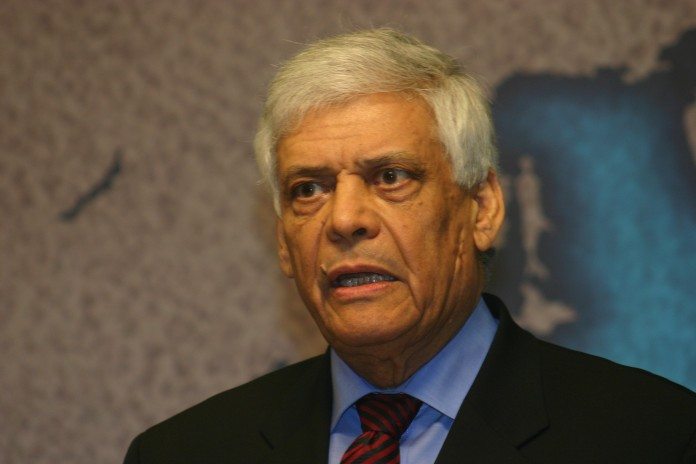

Elon Musk, CEO Tesla, made the announcement a couple of days ahead of his participation in the technology forum to be held in Hong Kong. He was updating media about his perspective on Tesla’s role in Greater China’s auto market. However, the CEO did not reveal the specifics associated with the business and said that the performance of his company was reasonably well in the Mainland China although there have been few hiccups earlier.

Musk said that Tesla wants to invest in a local partner and a location in China for building a car manufacturing plant by the middle of 2016. The key strategy will be to get a waiver on high import duties that are charged by the local governments for all the foreign automakers who intend to do business in China. The company will also try to gain access to the various local incentives that are available for EVs.

Electric cars more in demand in China

Electric vehicles are in high demand in China so Tesla is keen to open its manufacturing unit in the country. However, even Musk admitted that the company would have to overcome many challenges before it becomes a reality.

Tesla Stats

At present, there are 15 stores in seven metro cities, over 1600 destination chargers and 340 Superchargers of Tesla in Greater China. Hong Kong is the city with the highest intensity of rapid changing stations of Tesla with 42 Superchargers. The city also has 75 destination chargers. Last year Tesla sold 2,221 Model S in Hong Kong, almost 80% of the electric vehicle sales made locally and 4.39% of the total global shipment from Tesla.