Q: Can you please tell us about your company and the specific problem or challenge that you are addressing?

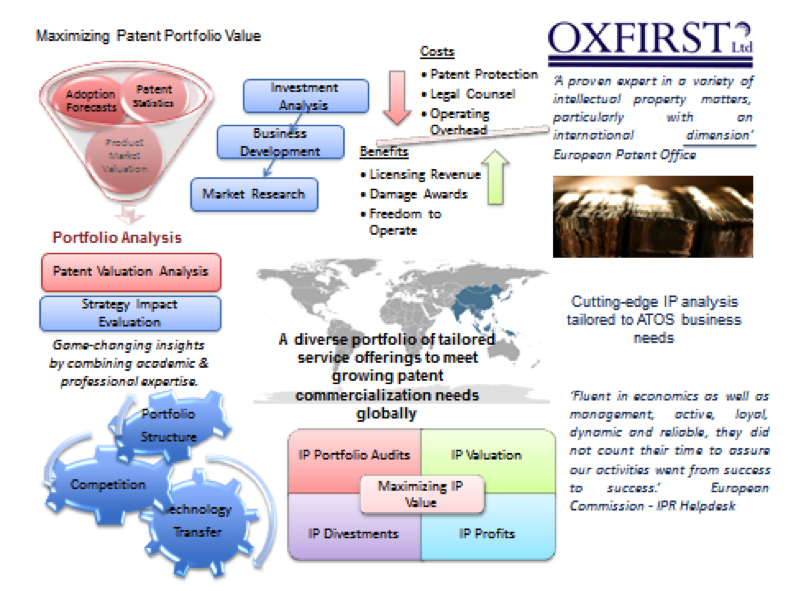

OxFirst (www.oxfirst.com) is an award-winning law and economics advisory firm founded in 2011 by Academics from Oxford University. We offer independent expert testimony on behalf of companies, governments and international organizations, produce authoritative studies for business and public policy formulation and conduct economic analysis in litigation and commercial disputes. Our aim is to integrate high quality economic analysis into the everyday practice of technology transfer, intellectual property commercialization, commercial litigation and public policy formulation in the high-tech area. As such we support intellectual property and competition strategy through sound economic analysis.

We were recently awarded as ‘Best IP Valuation Firm’ in the U.K. by Corporate Finance Magazine ‘Acquisition International.’ https://www.acq-intl.com/2018-oxfirst

We won this prize for helping high-tech scale ups assess the economic value of their IP portfolio and subsequently monetize it. This earned OxFirst also the recognition in the UK 2018 IP Excellence Awards. (https://www.businesswire.com/news/home/20180417006563/en/OxFirst-Awarded-Intellectual-Property-Valuation-Firm-UK)

Other than scale-ups, we work also with Fortune 500 firms, as well as national Governments throughout the world and assist with in-depth economic analysis that allows to formulate strategies and policies so to fully leverage creativity and innovation as an engine of growth. We believe that breaking away from conventional solutions is a vital asset in today’s knowledge driven economy. Our services are outside the box and tailored to the specific requirements of the people we work with.

Q: Can you please tell us a little about the market and the market opportunity?

OxFirst’s aim is to systematically establish the commercial element in commercial law. The global market for patent filing is growing consistently at 10%, but evidence shows that only a fairly small fraction of that IP can truly be linked to commercial activity!

This IP commercialization gap can to a large extent be explained by the fact that there are not enough economists in this area who can bridge the gap between IP law and economics. This gap means that many firms do not even know the value of their IP assets, let alone how to manage their IP assets for wealth generation. By consequence, much IP sits gathering the dust and IP departments are often perceived as a mere cost center.

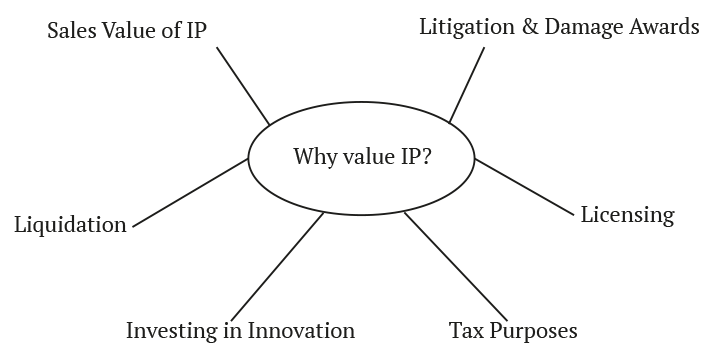

This is why it is so important to value intellectual property. An economic valuation of IP is core to turning an intellectual property right into an intellectual property asset. Without an adequate valuation of the intellectual property, it is really difficult, if not impossible, to manage IP as a commercial asset.

- Can you manage what you cannot measure?

- Can you trade if you don’t know the worth of your assets?

- How can you adequately communicate the value of all your firm’s assets, be they tangible or intangible to investors, if you have not valued them?

The valuation of intellectual property allows a firm to identify the commercial worth of its IP assets, it also helps understand where there are gaps in the portfolio and what steps can be undertaken to commercialize IP. Such commercial steps should not be misunderstood with launching action in case of infringement.

In fact, I think that the future of IP lies in taking it out of the Court room and into the Board room. IP based financial transactions need to occur in a free and open market environment and not be determined by Courts. The adequate valuation of IP is a crucial step to achieve this.

Intellectual Property has long viewed as the exclusive domain of the legal profession. Work was undertaken by lawyers for lawyers. The economic, business and management opportunities associated with intellectual property were more or less ignored.

Q: What geographic markets are you focusing on currently?

We focus on the intellectual property rich regions in Europe and in the United States.

Q: What are the key benefits and features of your work?

Quite simply; OxFirst (www.oxfirst.com) helps you turn intellectual property into a business opportunity. Our award winning advisory firm assures that firms, governments, international and supra- national government institutions leverage intellectual property for growth. We do that by offering high quality economic analysis on intellectual property. This enables IP commercialization and IP driven business strategy. Key to our work is sound economic analysis. This helps shed light on otherwise untapped business opportunities. A mere legal perspective on IP is not enough to unleash the untapped wealth of intangible assets.

For example, OxFirst acted as an IP valuation expert in a commercial transaction between a high-tech firm and a private equity company. The high-tech firm owned some fairly interesting intellectual property, but those had to be first identified. The valuation of the IP was crucial to identify interested trading partners, helped with price formation and was crucial to the commercial transaction.

As for Governments, our IP valuation led the Republic of Austria to formulating its First National IP Strategy since its first written mention over a thousand years ago! This work is driven by an eagerness to help the country leverages it’s IP as an economic opportunity rather than a negative right.

Q: Who are your competitors?

McKinsey & Company was founded in the 1930s with the idea to bring the concept of a law firm to the world of Management. The very term ‘Management Consultancy’ originated in the 1930s. But what the world was missing for a long time was ‘Management Consulting for IP.’ In 2011 OxFirst brought this concept to the world of commercial law.

So, just like McKinsey, the Boston Consulting Group or Accenture we offer high level economic analysis; however solely directed towards the strategic management of intellectual property assets. With such a highly-specialized expertise, there are hardly any firms that can truly compete with us.

Q: What advantage does your services offer in contrast to your competitors?

OxFirst is systematically looking at IP from an economic perspective. We are not a law firm and we are not a general top-management consultancy. We are a law and economics consultancy and it is this unique combination that gives us the competing edge in an era where knowledge and rights in knowledge assets will be the key driving force of wealth generation.

Q: What makes your services stand out?

OxFirst focuses on three specific areas of IP and competition law and policy. As such, we are highly experienced in the valuation of IP, the preparation of Expert Testimonials for licensing, litigation, damages analysis and IP driven investments. Other than that we focus on IP management and IP policy formulation for growth.

- The Valuation of Intellectual Property

One of its flagship projects allowed an early stage high-tech firm to raise over 10 Million US Dollars on the basis of its IP valuation. At another instance, the valuation of the IP undertaken by OxFirst formed a cornerstone of a patent acquisition, which gave the seller a significant boost to its cash reserves.

- Accredited Expert Testimonials for Commercial Disputes, Litigation and Licensing Negotiations

OxFirst has been multiple times involved as an economic expert in commercial disputes, litigation and licensing negotiations. Our economic analysis formed the cornerstone of price formation in licensing negotiations, have helped Courts identify the adequate value of a damage award and allowed also to assess the economic risk of litigation in mergers and acquisitions.

- Economic Analysis of intellectual property and competition policy formulation

Equally, we have had a substantial contribution to policy formulation. In the copyright space for example, OxFirst economic analysis contributed to the formulation of a New Directive on Collective Rights Management (http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014L0026&from=EN)

We did so, by showing that there was a significant gap between what collecting societies could be making from digital licensing revenues and what they are in fact generation from this segment. We estimated the 2012 market for digital music royalties in ten different E.U. countries at well over €18 billion. However, only €116 million were reported by corresponding Collective Rights Management Organizations in that same year. The findings of the study were also published in a well- regarded scientific journal. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2576672

Q: Tell us about your team?

What makes us unique is that all of us have worked in the IP space for decades and gained substantial experience in the ‘real world of Academia’, but also in practice. Very few can offer such depth of expertise and knowledge on IP and competition law and economics.

Q: How will you succeed in such a saturated market?

The market for IP assets commercialization is far from saturated. The current addressable market in the United States alone is the $12.6 billion that the patent licensing sector generates annually,[1] and the approximately $80 billion in annual private value of patent licensing in the U.S.[2] The U.S. Patent Office reports that 97% of all U.S. patents fail to generate any revenue due to the current system being difficult, expensive and time consuming. The IP valuation of OxFirst should increase the volume and value of patent licensing transactions in the US and overseas.

Q: Anything else that you would like to add?

Intellectual property (IP) will play in upcoming technology spaces such as Artificial Intelligence, Big Data or the Internet of Things and it is crucial to address how various approaches to IP strategy and policy can lead humanity to substantially different social and economic contexts.

The question of IP strategy and policy is particularly pronounced as the nature of wealth generation is radically changing. While at the end of the 19th century the richest man in the world, John D. Rockefeller, made his wealth in the petrol industry, one of the richest man of much of the 21st century, Bill Gates, possesses primarily one resource: intellectual property. This alone, seems reason enough to systematically identify economic approaches to IP and competition law. IP bears the potential to be the currency of the knowledge-based economy, but for this to happen, it is crucial that we start treating it as an economic asset and use it to foster inclusive growth and assure strategy and policy measures to achieve this.

.

[1] Data from the 2012 Economic Census, available at: http://factfinder2.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ECN_2012_US_53I3&prodType=table (last accessed August 11, 2014).

[2] Litan, Robert and Hal Singer. 2014. Unlocking Patents: Cost of Failure, Benefits of Success. Economists Incorporated.

Sponsored Content