Shortly after the markets closed in the US on Thursday, we got news that private entity Guardant Health had closed a series D financing that saw the company pick up just shy of $100 million from a host of big name participants. The financing round, led and managed by OrbiMed, a household name in the biotech funding space, brings the company’s total capital raise to date to close to $200 million, and should give the company the capital required to take its proprietary technology to the next level in the industry. What it also does, is paints the company as a potential buyout target – or at least one with which big pharma may look closely at collaborating with. This, in turn, makes it interesting to us. So, let’s have a look at what the company does, and see if we can earmark some potential big pharma suitors.

So, the technology. Before we look at Guardant’s technology, it’s best that we address what it replaces, as this gives us some idea of its potential. Despite what many people think, when a physician diagnosis a patient with cancer there are lots of different treatment options – some of which will work and some of which wont. The difference between those that do and don’t is rooted in genetic mutations in cancer cells, and the impact these mutations have on the efficacy of the treatment in question. As a result, physicians perform a biopsy on the cancerous tissue, or tumor, in an attempt to profile the DNA of the cancer. Through this profiling, the physician can make an informed decision as to which of the available treatment options (i.e. which chemotherapy drug, etc.) is least likely to be susceptible to the resistance imposed by genetic mutation. The problem is, biopsies are risky, expensive and – sometimes – impossible to perform. Further, if a patient has a difficult to reach tumor, say in the liver, then the risk (and pain) associated with the biopsy is amplified.

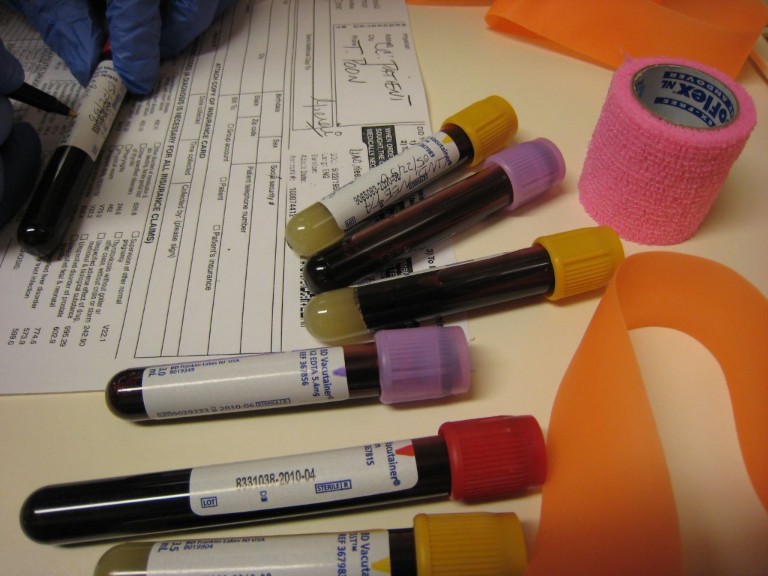

Way back in the early 1990’s scientists recognized that tumors expressed their DNA in the bloodstream, but only in very very small amounts. The small amount made it impossible to accurately profile the DNA, and so we stuck with the biopsy route. Enter Guardant. The company has developed what it calls Guardant360. Its technology allows for DNA profiling that is more than 1000X more accurate than the current technology. This allows for profiling using a small sample of the patient’s blood – two vials to be specific. The sample provides results that are 99.999% accurate, and offer a tailored approach to oncology diagnostics that isn’t otherwise possible with the current technology. It also provides far faster results than a biopsy.

Essentially, then, this could be a game changer. Anything that reduces the cost and risk of a current procedure – so long as it can maintain efficacy comparable efficacy – is generally quickly snapped up in biotech, and by the healthcare sector as a whole.

So who could be in line to acquire Guardant? Well, the list is pretty extensive, but if we are looking at big pharma, we can throw forward a few potential suitors. The criteria we are looking for is a healthy cash position and an established oncology portfolio and pipeline. Straight off the bat, Amgen Inc. (NASDAQ:AMGN) comes to mind. Amgen had about $3.2 billion cash and equivalents at last count (quarter end Sep 30, 2015) and has a diverse portfolio of drugs with indications ranging from melanoma to blood cancer. It also has some late stage clinical candidates, and an NDA with the FDA for an extension of its blockbuster myeloma drug.

Another potential candidate is Pfizer Inc. (NYSE:PFE). Pfizer has just shy of $3.1 billion cash on hand, and also has a robust oncology division, but perhaps sets itself as a frontrunner through its diagnostics arm. The company is well established in its approach to cutting edge diagnostics, and makes a compelling case for a buyout suitor.

Of course, it’s still early days. The company has developed it’s tech, and is in the process of pushing it to oncology centers throughout the US. Big name investors such as Sequoia Capital and Lightspeed Venture Partners are on board, so for those looking for an early exposure, these funds make a compelling allocation. Longer term, however, expect big pharma to muscle in, and from an equity market perspective, there’s your opportunity.