Sponsored Content:

Sometimes the allure of a new industry is too strong to resist. The legalization of medical and recreational cannabis has attracted entrepreneurs from across the spectrum to try their luck in the nascent pot industry. Without a doubt there will be some spectacular successes in this new and budding sector, but the fact remains that the vast majority of startup firms will fail.

This is true and has been true for all of economic history. On average, 90% of all startups fail. For the cannabis industry specifically, because so many actors are entering the market all at once, it is estimated that 97% of all pot startups will end in bankruptcy. While the market potential is there for anyone who wants to try to take it, like everything, it’s easier said than done.

Action Alert! Strong Buy Recommendation! Nabis Holdings (CSE: NAB) (OTC: NABIF)

The big question is, as an investor, how can you pick one of the 3% of cannabis firms that will survive and thrive? There are two common answers to this question.

- You can stick to the big names like Aurora Cannabis (NYSE:ACB), Canopy Growth (NYSE:CGC) or Aphria (NYSE:APHA).

- You can do your due diligence and speculate in a handful of risky startups, hoping that at least one of them succeeds in the end and you see spectacular returns.

As for the first option, there is logic to sticking to safe picks in a volatile industry in its infancy. Holding a percentage of any pot stock portfolio in these relatively safe companies is prudent and wise. However, it’s probably not going to get you anything close to the spectacular gains that are possible if you are able to pick the right startups.

The second option is always a possibility, but it is admittedly a dangerous one. No matter how talented of a researcher you may be and no matter how well you can intuit markets, read financial statements and divine the direction of a newborn sector, publicly available information can only get you so far as an outside investor. Again, the vast majority of cannabis startups are going to fail. If you’re not an industry insider with intimate knowledge of how exactly it is structured, the pitfalls involved, who the important people are and what pressure points and bottlenecks and regulatory traps are out there, the chances of you hitting the jackpot here are vanishingly small.

Action Alert! Strong Buy Recommendation! Nabis Holdings (CSE: NAB) (OTC: NABIF)

In fact, they may be even smaller now, because 70% of startup failures happen between years 2 and 5 after inception. The pot stock space really got going in 2016, so we are right in the thick of the cull.

But there is good news. There is a third option in the cannabis space for outsiders like us. One that really is the best of both worlds. It is an option that combines the safety of the big names with the enormous return potential of the riskier startups. This third option can help you avoid the inevitable die-off of the vast majority of cannabis startups and stick to the winners. What is that option?

Simply this: When it comes to cannabis startups, just let proven industry leaders – insiders with major past successes – do the picking for you. How exactly?

Nabis Holdings

If you’ve been paying attention to the cannabis space over the last two years, you may remember a company called MPX Bioceutical Corporation. This company was one of the largest in the cannabis space. It was acquired by iAnthus Capital Holdings (OTCMKTS:ITHUF) in a massive deal valued at $1.6 billion, a 30% premium over the closing price of MPX on the day the deal was signed late in 2018.

In fact, two of the founding partners of MPX recently decided to break off and form their own company. It’s called Nabis Holdings (CSE: NAB) (OTC: NABIF) and if history rhymes as it often does, it could end up being the next big deal in the cannabis space – this time even bigger than the MPX deal.

The most important resource for any company is its people, and Nabis is the brainchild of the very best in the entire industry. The company’s President and Chairman, Mark Krytiuk, was himself a founding partner of MPX before it was acquired for $1.6 billion, and served as Vice President of Grow Operations there for five years. He oversaw the production of medical and pharma-grade marijuana products across North America during his tenure.

Action Alert! Strong Buy Recommendation! Nabis Holdings (CSE: NAB) (OTC: NABIF)

Nabis’s CEO, Shay Shnet, was also a founding partner at MPX, in charge of building its portfolio of international cannabis assets. Together, these two helped build MPX into the powerhouse it became, which was instrumental in securing a business combination with iAnthus valued in the billions. Now they’re back to what they do best, indeed exactly what they did at MPX – building a company by handpicking a carefully selected portfolio of cannabis assets. This time, they’re focusing on three global cannabis hubs – the United States, Israel, and Canada.

The name of the company itself, Nabis, points to the ultimate goals of its leaders. “Na bis” means “repeat performance” or “encore”. And that is exactly what the company’s leaders are bent on accomplishing – an encore of the MPX valuation.

So how exactly are these industry leaders positioning Nabis to be the next big cannabis deal? Simple actually, but in order to understand it, let’s begin with an analogy particularly apt for the cannabis space. Let’s talk about planting a garden from seed.

In the cannabis industry you have an enormous amount of startups, all of whom know that if they stick it out long enough, there is an enormous market opportunity ahead. The problem is, because the industry was legalized all at once – on the state level in the US and on the federal level in Canada – everyone chases the market all at once, and so everyone tries to germinate their seeds and get them all growing simlutaneously.

Of course, some of the seeds will germinate, and others will not. Of the ones that germinate, some will take root, and others will not. Of the ones that take root, some will die, and others will not. Of the ones that survive, some will thrive, and others will be weak, eventually dying off to competition. And so on and so forth until you are left with a few strong plants or trees that bear fruit. It is the Darwinian principle of survival of the fittest, and it applies across the entire natural world, including the market economy itself.

In a brand new garden or industry that comes into existence all at once, there comes a point in the growth stage where it is evident that a plant has a decent chance of becoming a powerful plant or tree. You see a few green leaves that look healthy, and you may decide to put more effort into that particular plant. Train it, prune it, add better fertilizer, etc.

From the industry perspective, let’s say it’s at the point where a company first becomes cash flow positive. Now, that could be a sign of success, or it might not mean anything at all. It could be a fluke, some kink in the market that really has nothing to do with long term prospects. The thing is, you can’t just look at it and make a snap judgment from what you see on the surface. To really figure it out, it takes an experienced gardener with the right tools, the right chemistry set to discern whether the seedling really has a good shot at making it big or not, whether it is worth it to continue investing resources into it, to add more nutrients and care and time at the expense of other opportunities, or to look for another candidate.

This is exactly where a keen eye for the industry becomes absolutely crucial, and where personal expertise in the nuances of the space from every angle simply cannot be replaced strictly by dry financial data that is publicly available. The data of course is crucial and absolutely necessary as well, but it is not enough to be able to pick the true successes.

The long term Nabis business strategy is to identify the cannabis startups with the best chances of long term success, and give them the support they need to become powerhouses of the cannabis industry.

Action Alert! Strong Buy Recommendation! Nabis Holdings (CSE: NAB) (OTC: NABIF)

Rigorous Requirements

At this point you may ask the following legitimate question: Why would these companies choose to become part of Nabis as opposed to any other holding company looking to execute some profitable roll-up? A key point to keep in mind here is that the MPX-iAnthus merger was an all-stock deal. That means, as opposed to an outright cash transaction, the original owners of MPX maintain their ownership, only within a larger capital structure.

Understanding the advantages of these types of deals for both sides is key. From the perspective of Nabis, all-stock deals allow management to keep a large cash pile in reserve. In fact, Nabis’s cash hoard is enormous relative to the size of the company. Cash, short term investments and net receivables on its balance sheet total over CAD$31 million right now, about twice the size of its market cap. To say Nabis is undervalued right now is an understatement.

What are the advantages from the perspective of the firms Nabis acquires? Namely that they continue their ownership of the companies they founded, maintain their influence over operations, and benefit from an influx of capital to continue and expand the businesses they poured their hearts into. Plus, these owners know and understand the history behind Nabis’s management team. Outside investors are not the only ones who want to see the tantalizing possibility of a billion dollar deal like the one pulled off last year by these same people. Would you rather cash out for chump change, or hitch a ride with industry mavens who know how to employ your capital in the best way and also have a $1.6 billion deal under their belts?

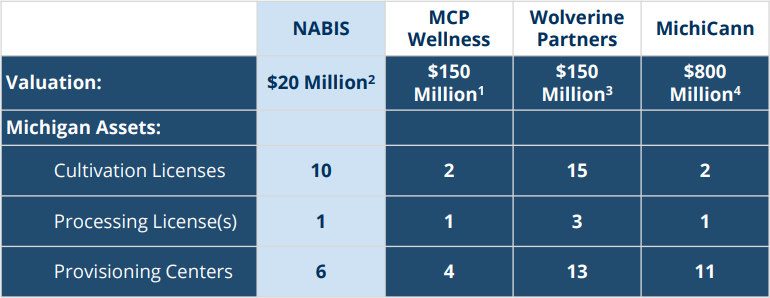

Using this approach and leveraging personal relationships, Nabis has already expanded into the key states of Michigan, Washington, Arizona, and California. Not only that, but with the specific acquisitions already made, the company has been able to rack up more licenses than even some competitors many times its size. For example, in Michigan it enjoys 10 cultivation licenses, compared to one competitor about 40x its size that only has 2.

The regulatory implications of this could be enormous as the state tightens its grip over the industry as it grows. As veterans of the cannabis space with intimate knowledge of how the industry works and its interrelationship with the regulatory environment, the leaders of Nabis are setting up for the long term. By keeping it all under one umbrella, Nabis is positioning itself in tune with the regulatory environment in order to minimize that burden on its future business.

In the words of Nabis’s Chairman and President:

“The existing regulations are complex, requiring businesses to follow detailed rules that govern every area of the industry from growing to packaging and selling to consumers. Even the smallest error can cost a cannabis business thousands, and incur harsh punishments such as losing their cannabis license.”

Nabis has a solution for this problem. In Krytiuk’s words:

“Artificial intelligence is one key technological advancement that could make a significant impact. By implementing this technology, cannabis retailers would be able to more easily track state-by-state regulations, and the constant changes that are being made. With this information, they would be able to properly package, ship, and sell products in a more compliant way that is less likely to be intercepted by government regulations.”

Beyond Michigan, in Arizona, Nabis has already entered into a definitive agreement to acquire 100% ownership of an asset serving 132,000 patients in the Phoenix area. The acquisition meets all of Nabis’s requirements with audited 2018 financials of $8.7 million in revenue, gross margins over 50%, and estimated $9.0 million in revenue for 2019.

The SodaStream of the Cannabis Industry

Starting to see a pattern here?

So do the firms already acquired by Nabis who have joined under its umbrella. If you see it, too, you simply cannot afford to miss out on Nabis Holdings.

Action Alert! Strong Buy Recommendation! Nabis Holdings (CSE: NAB) (OTC: NABIF)

***

Disclaimer:

Terms of Use/Legal Notice

ALL STOCKS INVOLVE RISKS AND THE POSSIBILITY OF LOSING ALL OF YOUR INVESTMENT. PLEASE CONSIDER ALL RISKS BEFORE INVESTING.

Release of Liability: Through use of this website viewing or using you agree to hold MarketExclusive.com, and or affiliates, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

MarketExclusive.com, is written and published by MarketExclusive.com, Inc. and or affiliates, employees. Readers are advised that this analysis report is issued solely for informational purposes. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a representation by the publisher nor a solicitation of the purchase or sale of any securities. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. The owner, publisher, editor and their associates are not responsible for errors and omissions. They may from time to time have a position in the securities mentioned herein and may increase or decrease such positions without notice. Any opinions expressed are subject to change without notice. MarketExclusive.com encourages readers and investors to supplement the information in these articles with independent research and other professional advice.

All information on featured companies is provided by the companies profiled, or is available from public sources and MarketExclusive.com makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Factual statements made by the profiled companies are made as of the date stated and are subject to change without notice. Investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. MarketExclusive.com, and or affiliates, makes no recommendation that the securities of the companies profiled should be purchased, sold or held by individuals or entities that learn of the profiled companies through MarketExclusive.com, and or affiliates. MarketExclusive.com, and or affiliates, may or may not hold positions in the companies that are profiled. Investing in securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled. MarketExclusive.com, and or affiliates may from time to time hold a position in any featured company and may trade on its own behalf at any time without prior notice.

The information contained herein contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of the company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect the company’s actual results of operation. Factors that could cause actual results to differ include the size and growth of the market for the company’s products, the company’s ability to fund its capital requirements in the near term and in the long term, pricing pressures, unforeseen and/or unexpected circumstances in happenings, pricing pressures, etc. Investing in securities is speculative and carries risk. Past performance does not guarantee future results. This report may be based on independent analysis or may rely on information supplied by sources believed to be reliable, but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. The opinions contained herein reflect our current judgment and are subject to change without notice. We accept no liability for any loss arising from an investor’s reliance on or use of this report. This report is for informational purposes only, and is neither a solicitation to buy nor an offer to sell securities.

Certain information included herein is forward-looking within the meaning of Private Securities Litigation Reform Act of 1999, including but not limited to, statements concerning manufacturing, marketing, growth, and expansion. Such forward-looking information involves important risks and uncertainties that could affect actual results and cause them to differ materially from expectations expressed herein.

Third Party Web Sites and Information

MarketExclusive.com, and or affiliates, and newsletter may provide hyperlinks to third party websites or access to third party content. MarketExclusive.com, and or affiliates, does not control, endorse, or guarantee content found in such sites. You agree that MarketExclusive.com, and or affiliates, is not responsible for any content, associated links, resources, or services associated with a third party site. You further agree that MarketExclusive.com, and or affiliates, , Inc. shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only.

Pursuant to SEC Regulation 17B, MarketExclusive.com, and or its affiliates have been paid $10,000 by ROK Marketing for a variety of media services which may include, corporate news distribution, Sponsored Company Series other investor relations services on behalf of Nabis Holdings Inc. (NAB.CN) (NABIF.OTC). We, and our associates may buy or sell shares of of Nabis Holdings Inc. (NAB.CN) (NABIF.OTC) in the open market at any time, including before, during or after the Website and Information, to provide public dissemination of favorable Information Nabis Holdings Inc. (NAB.CN) (NABIF.OTC).