We’re closing in on the end of the week in the biotechnology space and it’s been a week full of noteworthy action. Things at both ends of the sector have hit press as potentially market moving, and there have been numerous binary events served up from which traders and investors have been able to draw profit.

As the penultimate session of the week kicks off, here’s a look at some of the biggest movers, what’s moving each and where we expect things to go next for the companies in question.

The companies we’ve got in our sights this morning are Pieris Pharmaceuticals Inc (NASDAQ:PIRS), Nymox Pharmaceutical Corporation (NASDAQ:NYMX) and BioPharmX Corporation (NYSEMKT:BPMX).

First then, Pieris.

This one’s a classic biotech situational shift. The company is a young development stage biotechnology outfit based out of Boston that’s attempting to developed a group of drugs called anticalins – a sort of engineered protein that’s designed to be easier to administer (and potentially safer) than targeted biologics.

The lead asset is a drug called PRS-060, and Pieris just announced that it’s signed a collaboration deal with big pharma behemoth AstraZeneca plc (ADR) (NYSE:AZN). The deal will see the latter pay a $45 million upfront payment initially and then pay a further $12.5 million once Pieris kicks off a phase I study of the above-mentioned PRS-060.

Outside of the initial payment and the first milestone, there’s an additional $2.1 billion up for grabs in development and commercialization-related milestones. For a company with a current market capitalization of just $150 million, that’s a game changer.

As expected, then, the company is up more than 50% on the news and looks set to gain further strength as we close out the week.

Moving on, then, let’s look at Nymox.

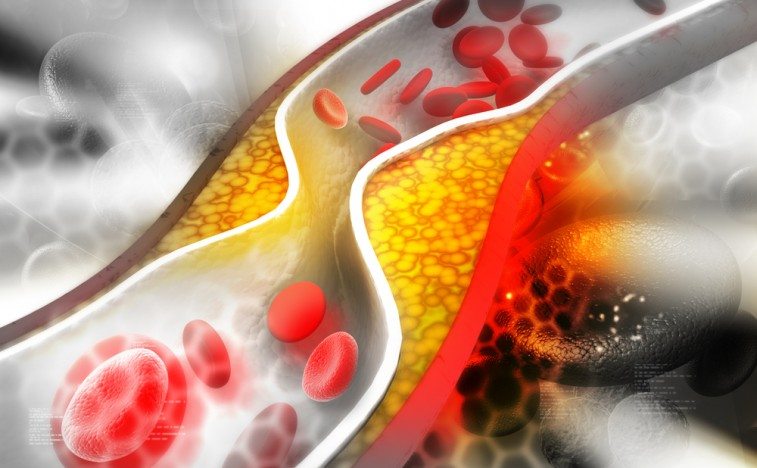

This one’s rooted in a filing for marketing approval by the company in Europe. Nymox is a New Jersey based company that’s working to develop a drug called Fexapotide for the indication of treatment of the symptoms of BPH (benign prostatic hyperplasia; prostate enlargement).

It’s a potentially novel way to treat a condition that desperately needs an upgraded therapy, and while Nymox has been the subject of much denouncement (especially as relates to this asset) over the last six months or so, it looks as though the company has shaken off the negative sentiment and is pushing forward with its rollout strategy.

As per the latest news, the company has filed to seek approval for marketing authorization for Fexapotide Triflutate in five European countries, comprising the Netherlands, the UK, Germany, France and Spain. These are big markets and could add up to considerable revenues if and when the company gets a regulatory green light from the European Medicines Agency (EMA) in Europe for the drug.

Markets have recognized this potential in their response to the news and Nymox currently trades for $4.17 ($4.10 at yesterday’s close, up several points after hours on Wednesday) – a more than 18% run on the pre-announcement price per share.

It’s all about the outcome in Europe and the concurrent pathway to approval in the US now for Nymox.

So, finally, BioPharmX.

Just as with Pieris, this one’s a classic biotech shift. The company has just announced data from its phase IIb trial of a drug called BPX-01 – the lead asset under investigation for the treatment of acne in moderate to severe sufferers.

The trial in question pitched two separate doses (one low, one high, 1% and 2% respectively) of the active drug against a vehicle arm, and graded the response against a primary endpoint of reductions in non-nodular inflammatory acne lesions.

The data was somewhat mixed.

The primary endpoint hit against both concentrations of the drug, both high and low, resulting in a reduction of 15.4 for the high dose and 15.3 for the low dose, compared to baseline. The vehicle arm saw a reduction of 11.3.

The secondary endpoint, which was defined as the proportion of subjects with at least a two-grade reduction in IGA to clear or almost clear, did not hit.

The bottom line on this one is that we’re going to see an advance into a pivotal trial, and that’s what’s important. Sure. A secondary hit would have been nice (as there’s a chance the FDA might require an IGA endpoint in the pivotal study) but a secondary miss is not terminal for the program.