Prices everywhere are dropping and price inflation is nowhere to be seen. In fact, according to some online indices, the United States is actually experiencing an 11% annual deflation rate as of January 2, 2015. But there are two major sectors of the economy where prices are still levitating high in the sky. Those are the stock market, and mining sector costs.

At first glance these two sectors have nothing to do with each other. But at bottom, they are both essentially the capital goods sector. Mining is the first step in creating capital goods, and stock prices reflect the value of capital goods in general. With consumer prices falling by as much as 11% annually at this point, prices are being bid up almost exclusively within the capital goods sector. What causes that, chiefly, are extremely low interest rates.

Low interest rates allow capitalists and entrepreneurs to borrow money at low cost to finance long term projects. Low interest payments reflect positively on balance sheets and earnings statements, causing the value of capital, and hence stock prices, to increase. But with that increase comes an increase in producers costs as well. If money flows into the capital goods sector as a whole, capital goods costs along with values inexorably rise.

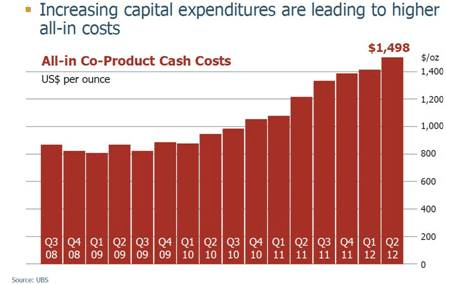

Those most affected on the cost side are the companies at the very top of production – the miners, where capital goods production begins. Since 2009, global all-in costs of gold mining, for example, have risen from $800 to $1500 in 2012.

They have since backed down slightly to $1200, but this fall is still paltry when compared with the rise in the cost of mining since the gold bull began in 2000. With gold prices still below $1200, the current average cost of production, average-to-marginal miners will go bankrupt. The Big Three in the mining sector by market cap – Barrick (NYSE:ABX), Newmont (NYSE:NEM), and Goldcorp (NYSE:GG), are all bleeding cash profusely. Altogether they lost a combined $16B in 2013, with numbers about to come out for 2014, and they won’t be pretty. Not to mention the other marginal juniors, nearly all of whom are unsustainable given current metals prices, gold silver and copper included.

It’s the same with oil drilling, though the situation is less dire. The cost per barrel for Exxon (NYSE:XOM), in 2013 for example was $15.42, which is still more than 50% higher than it was in 2009 at $10.25. So while the oil industry is in much better shape than the mining industry, the price inflation in production costs even in oil is still glaringly evident here. For oil to reach the dire straits that mining has reached, the price of oil would have to drop to $10 a barrel. As unfathomable as this sounds, $1200 gold for Barrick is the equivalent of $10 oil for Exxon in that sense.

Copper is only skirting its production price of around $2.60 per ounce, currently trading at $2.86, so it’s not only the precious metal miners that are in trouble, but industrial miners as well.

Taking an even broader look, the S&P is currently trading at 9 times the CRB Commodity Index. This is nearly twice as high as it was at the previous market high in October 2007.

The conclusion is simple. Either metals production prices have to come down drastically, or the price of metals has to go up drastically. Price deflation be as it may, the money supply is still increasing week by week according to Federal Reserve data, so it is very unlikely that production prices will drop for any sustained period of time.