Teva (NYSE:TEVA) has a new chairman. As of February 5 and after four and a half years at the helm of the largest generics manufacturer in the world, Dr. Phillip Frost has resigned his position. This was announced back in June and is no surprise, and wouldn’t be all that noteworthy if not for the fact that other companies that Dr. Frost is heavily involved and invested in are suddenly making rather large upside moves.

Two of Frost’s companies in particular have been on a tear. One, Opko Health (NYSE:OPK), has increased 73% since the middle of December. Frost is both Chairman and CEO of Opko. Another, Cocrystal Pharma, (OTCBB:COCP) has increased 54% over the last 5 trading days.

Opko’s Recent Run, Patience has Paid Off

While Opko’s appreciation is at least explainable in terms of fundamentals, there is no obvious reason why Cocrystal would rise so fast and to such an extent. The fact that its rise has been almost exactly correlated with Frost’s official resignation from Teva may be coincidence, or there may be something more to it.

Frost has been Chairman and CEO of Opko since March 2007. He took over the company right on the cusp of the financial crisis, and weathered the startup through an 80% decline over a two year period. Opko’s stock didn’t get back to even under Frost’s tenure until February 2011, just under 4 years since assuming leadership of the company. From that point, it took yet another two years for the stock to finally move to a new trading range. Now, six long years later, OPK is up over 570%.

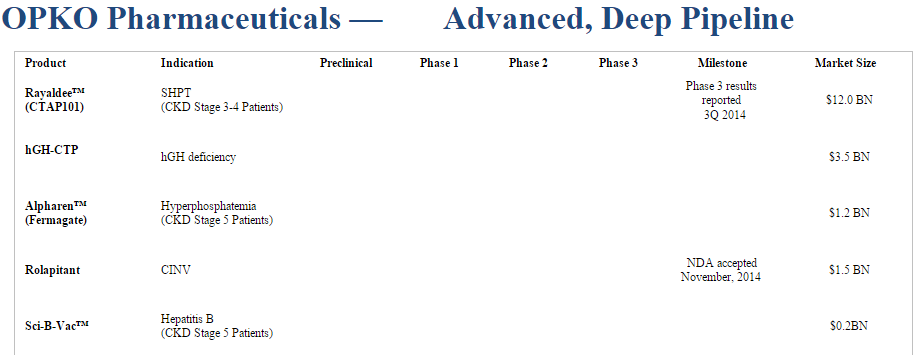

Opko is a bit of an enigma if you just look at its earnings statement. Annual losses have skyrocketed from $31M in 2012 to $114M in 2013, and look set to surpass $160M for 2014. However, the end of 2014 marked several critical milestones for the company that look to make 2015 a breakout year, with investors taking notice.

First of all, its lead product Rayaldee met endpoints in both of its Phase 3 trials reported late last year. Rayaldee is designed to treat vitamin D insufficiency in late stage chronic kidney disease (CKD) patients. These patients constitute a $12B market, and could transform Opko into a blockbuster company.

Ironically, this very success is what is causing Opko, at this point at least, to bleed cash even faster. In March 2013, Opko acquired Cytochroma, and with it the rights to Rayaldee. With primary endpoints being met in both Phase 3 trials, the milestone payments to Cytochroma have gone up, significantly increasing Opko’s operating expenses. In other words, Opko is a victim of its own success, that is, until the point in time where Rayaldee begins break into its $12B addressable market.

As for the results themselves, Rayaldee corrected vitamin D insufficiency in 97% of treated patients versus 6% with placebo. Safety and tolerability data were comparable in both treatment groups. The reason Opko has risen so sharply of late could be a combination of these results in addition to the fact that Opko’s management, including Frost, is intimately familiar with pharmaceutical marketing channels and how to get a new product to patients by targeting physicians.

Though Opko is a startup biotech, it is not headed by a rookie executive staff by any means. It took 6 years and almost $622M in capital to get where it is, but chances look good that patience will pay off in this case.

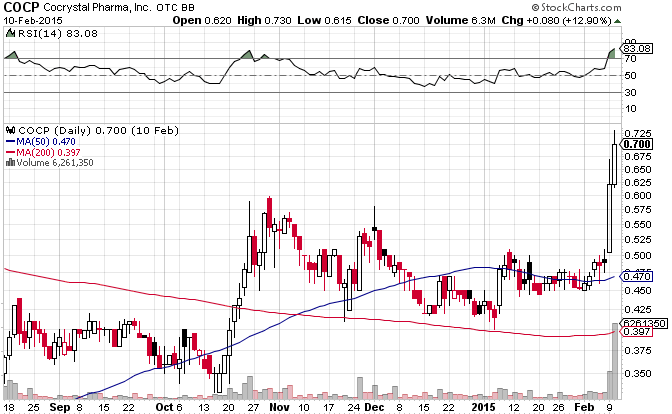

Cocrystal Jumps 54% in a Week

Cocrystal Pharma, also one of Frost’s pet projects, is 22% owned by Frost which includes a 7.8% stake by Opko and a 14.3% holding by Frost Investments. Though Frost does not chair Cocrystal, he is a director, and is part of a team of insiders that hold approximately 72% of shares outstanding. Cocrystal is currently focusing on Hepatitis C antivirals among others, and is headed by a team that includes the founder of Pharmasset, which was acquired by Gilead (NASDAQ:GILD) for $11B in a deal that was catalyzed by – you guessed it – a hepatitis C antiviral.

Cocrystal is still in the early stages of development, but has for some reason jumped from $0.50 to $0.70 in two days. While there is a chance the move could be temporary, patience and a 6-year wait did turne out well for Opko shareholders. Not to mention the precedent of an $11B acquisition of Pharmasset for a hepatitis C treatment. Having the founder of Pharmasset on your board certainly can’t hurt either.

Pershing Gold

There is yet another company that Frost is heavily invested in, but is getting much less attention, possibly because it is not in the pharmaceutical industry where Frost’s name has more influence. It is in fact a gold miner called Pershing Gold (OTCMKTS:PGLC). When people mention the name Dr. Phillip Frost, gold mining is not usually the first thing that comes to mind, and therefore his 15% ownership of the company tends to go relatively unnoticed. Neither does Frost’s name appear on the Pershing board of directors.

But unlike Cocrystal which just jumped seemingly for no reason other than possibly Frost’s resignation from Teva to concentrate on Cocrystal and Opko, Pershing does have some recent developments that could cause its stock, bouncing between $0.20 and $0.40 a share for three and a half years now, to break out of this range.

According to a February 4th press release, Pershing announced the discovery of a 2.24 ounces per ton intercept at its Relief Canyon mine in Nevada, considered extremely high grade. High grade is anything above one tenth of an ounce per ton. Nevertheless, the stock has yet to respond to the news.

Up until now, Pershing has burned through $111M in capital as a development stage gold miner. While comparing a gold miner to a startup biotech may be apples to oranges, $111M is less than 20% of what Opko spent to get to its current point. Could patience finally pay off for Pershing shareholders as well after over three years of the stock going nowhere?

Market Exclusive Is a financial portal geared to engaging discussion on current financial topics. Market Exclusive is not an investment advisor. Please read our full disclaimer at http://marketexclusive.com/about-us/disclaimer/