RedHill Biopharma Ltd – ADR (NASDAQ:RDHL) just announced the initiation of the latest element of its Yeliva development program, and the company has teed up for a number of near term catalysts on the back of the study. It’s a phase II targeting hepatocellular carcinoma (HCC), which is the most common primary malignant cancer of the liver, with a mortality rate of 95%. If the company can replicate the data seen in the phase I on which this protocol for this phase II is based, then there’s plenty of potential upside for the company.

With this in mind, and ahead of any interim, here’s a look at the drug under investigation, and what we’re looking for when the numbers hit.

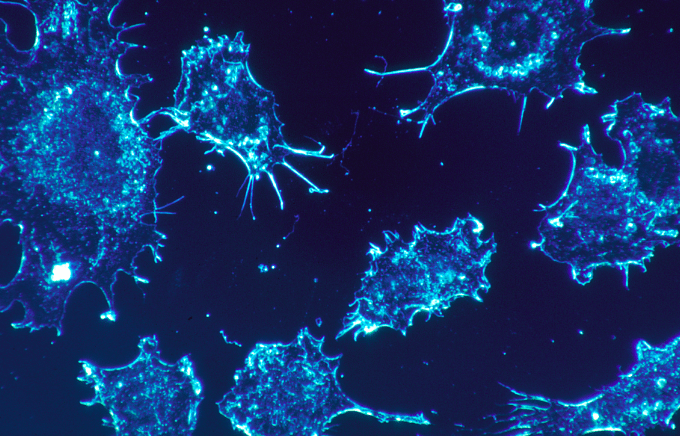

So, as mentioned, the drug is called Yeliva, and it’s under investigation for a whole host of inflammatory and oncology indications. The MOA for this one sounds pretty technical because of all the jargon, but it’s not too difficult once you get past the names of the elements. It’s part of a family of drugs called sphingosine kinase-2 (SK2) selective inhibitor’s. The SK2 enzyme is responsible for creating something called sphingosine 1-phosphate (S1P), which is what’s called a lysosphingolipid. In healthy cells, it works as a sort of vascularization agent, and immune regulator. In cancer cells, however, it promotes proliferation, and inhibits apoptosis (which is the programmed cell death by which normal cells die). Inhibition of the SK2 enzyme translates to a reduced synthesis of S1P, which in turn helps to avoid the inhibited apoptosic process and mediates proliferation.

As a quick side note, this sort of treatment was referenced once in the TV show The West Wing. The President (in the show) deliberated over whether to launch an equivalent of the Apollo Program with a goal of curing cancer after having heard sphingosine kinase described as “the enzyme believed to control all signal pathways to cancer growth.”

Anyway, back to the real world, the trial in question is investigating the efficacy of the drug in up to 39 patients with advanced HCC, each of which have experienced tumor progression following treatment with one of the standard of care first-line single-agents, sorafenib, a drug currently marketed as Nexavar by Bayer AG (ADR) (OTCMKTS:BAYRY).

The National Cancer Institute (NCI) awarded a $1.8 million grant to the Medical University of South Carolina Hollings Cancer Center (MUSC), and this is going towards the funding of the trial. RedHill is footing the bill.

So what are we looking for from the data, and what impact might it have on the company going forward if the numbers come out as positive?

Well, the phase I demonstrated safety and tolerability, so we’ll be looking for a replication of the safety profile seen previously. This said, in this sort of indication, where prognosis is very poor, then the FDA will generally accept a poorer safety profile if the drug can demonstrate some degree of benefit. Our primary focus is the efficacy readout, and this is going to be based on an endpoint rooted in tumor progression.

We don’t yet know the specifics of the endpoint, but the failure of the preceding treatment, the sorafenib treatment, is quantified by way of a tumor progression measurement. As such, it’s reasonable to assume some degree of response measurement will come in as the primary evaluation point – more likely than not a primary of progression free survival (PFS).

And what’s the market potential?

Total revenues for HSS in the US annually are $471 million, and globally, somewhere in the region of $895 million. Of course, this one will only account for a portion of these, but with such a poor prognosis, there’s plenty of potential for revenue streams from the scope of target indications under investigation.