Clovis Oncology Inc (NASDAQ:CLVS) – a billion dollar biotech with no approved products and zero revenues. The company has had a rough twelve months, and its shareholders have run for the door in droves. There are still some hanging on, however, and it looks as though the patience may be about to pay off. Clovis just reported an update on its now-lead candidate, an ovarian cancer drug, and it looks as though the update may point to better than first thought chances of approval.

Here’s how, and why, this matters for the company.

Let’s quickly look back to the end of last year, by way of a brief reintroduction for those not familiar with Clovis.

The company’s lead candidate, prior to last November, was a lung cancer treatment called rociletinib. All looked pretty promising until, in November last year, an advisory panel essentially tore the drug apart. The panel came out of the meeting have concluded that the drug was ineffective, and had a poor safety profile, and that follow up data would be necessary before it could get anywhere close to a recommendation of approval. Of course, the FDA doesn’t have to follow its advisory panel’s advice, but in this instance, it seemed it had no choice. The agency issued a CRL in line with the panel’s recommendations, and Clovis tanked, from more than $100 a share to less than $30, basically overnight.

Since this tanking, the company has traded pretty much sideways between a $13-$17 range, until early last month when buyers started to flock to the company in anticipation of a ruling on the now lead, rucaparib. The drug picked up fast track designation last month, and the FDA set a PDUFA of February 23, 2017.

So what’s the latest update?

Well, by way of a pretty stealthy 8-K submitted by Clovis to the SEC, we learnt that the FDA isn’t going to require an advisory panel meeting pre-PDUFA. It’s this non-requirement that has caused the latest boost, with markets interpreting the action as positive for the drug’s chances come decision day.

Of course, this interpretation may be unfounded. The FDA doesn’t always pull in a review panel to aid it with its decisions. However, given the history of Clovis, and its relationship with the review panel in its lung cancer drug (read: the importance of the panel in the FDA’s final decision), that the agency has decided a second opinion might not be necessary seems like a positive implication.

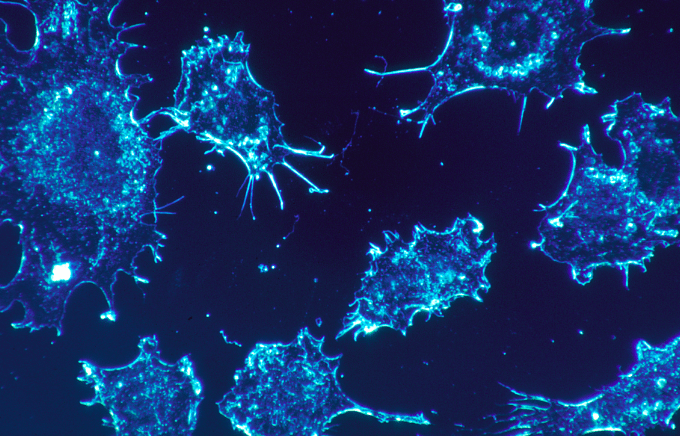

So how does the drug work? Rucaparib is what’s called a PARP inhibitor. The MOA of these types of drugs is pretty interesting. When cells divide and replicate, their DNA is damaged. If this damage isn’t repaired, the cells are unable to replicate further – at least, that is, without serious issue or mutation. PARP is an enzyme that helps to repair this damage. Because cancer cells replicate so much, and so quickly, they are heavily dependent on the PARP enzyme for repair. Rucaparib inhibits the action of the enzyme, meaning the damaged DNA of the cancerous cells doesn’t get repaired. No repair translates to the inability to replicate, which in turn translates to the inability to proliferate. No proliferation stops the spread.

Data from the phase III on which the NDA rests is pretty solid, and tolerability didn’t seem to be an issue when submitted as part of the application.

There’s also a kicker. In a recent conference presentation, Gilead Sciences, Inc. (NASDAQ:GILD) expressed its intentions to buy a PARP inhibitor if and when the right one hit markets. With Clovis’ rucaparib looking by far the most likely to hit commercialization soon, the company is very much in line for consideration when Gilead heads to market. Analysts estimate peak sales for Rucaparib at more than $1 billion annually in the US, and so the upfront cash infusion from Gilead for Clovis would be considerable if any such deal comes to the fore.

Maybe that billion-dollar valuation isn’t too optimistic after all.