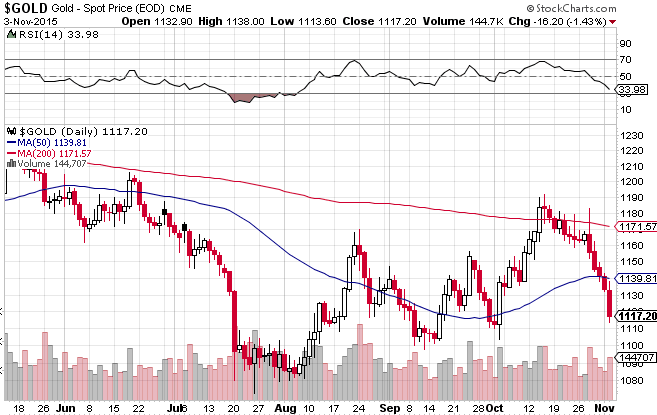

The gold market has been rough ever since the Federal Reserve for all intents and purposes forced itself to raise interest rates by 25 basis points come December. That was on October 28. The language of that meeting included the phrase “by next meeting,” when discussing raising rates, and the Fed is almost never that specific. That language caught gold bulls by surprise and tore the metal down.

Since then, gold (NYSEARCA:GLD) has fallen 4.2%, which by itself does not look good. However, two things indicate an imminent short term bottom. First, silver (NYSEARCA:SLV) is outperforming gold since the decline, only down 3.6%. In bear markets, silver typically doubles gold’s decline. Second, the gold mining stocks (NYSEARCA:GDX) are only down 6.9%. If the last rally were only a bear market rally and this decline a continuation of the bear market, then we’d see gold stocks getting hammered by much more than 10%. Less than 7% during a 4.2% decline for the metal itself is hardly a rout.

In fact, the last two trading days have been even more pronounced in terms of outperformance by the miners. While gold has fallen over 2% in the last two days, the miners remain unchanged. This indicates an imminent bottom for gold, and once that is reached, the miners should spring higher and top their recent high at $17 over the next run.

As for gold itself, holding above $1103 would be a good sign, as it would indicate the pattern of higher lows remains intact. Right now we are trading at $1120 an ounce. That gives us $17 of breathing space before gold needs to reverse to keep the pattern of higher lows intact.

Disclosure: The author was long gold stocks at time of writing.