Rumors were circulating last week that JP Morgan Chase (NYSE:JPM), currently the largest bank in the US with over $2.5T in assets, may be splitting. JP Morgan CEO Jaime Dimon begs to differ, and with the force of his leadership he may soon put the rumors to rest, for now. In any case, Wall Street is now discussing the bank’s earnings with interest, pun intended, concerned over signs of lack of growth. Revenue is down 1% from last quarter. Net income is down 17%.

These are the numbers that the main stream media is focusing on, but they are not really the most worrisome numbers. The ominous numbers are in fact JP Morgan’s debt numbers. The nation’s largest megabank now has $723.6B in debt on its “fortress balance sheet” as Jamie Dimon likes to call it. He even labels it that name on the bank’s official SEC filings.

Scarier than the number itself, which is more than half-way to $1T in debt, is that the number has gone up 187% since 2008. This is to be expected, because exceedingly low interest rates pretty much force banks to take on debt in order to stay ahead of competing banks. JP Morgan’s interest expense as of the middle of 2013 was just over $2B. If interest rates were to reach 3% or 4%, that interest expense would eat into its entire net income. If they got any higher sustainably, the entire bank would be in serious danger in a relatively short time, fortress and all.

Defenders would say that the bank is almost indestructible because if interest rates do go higher, JP Morgan would wind up making even more money on its loans on the creditor side, which would compensate for its higher interest expense on the debtor side. While that sounds good on paper, in reality, the megabank would have a hard time staying “fully loaned up” if interest rates do go up, and even if it did, it would have an even harder time collecting its money from delinquent borrowers. It would probably end up having to pay the higher interest expense from the huge debt on its fortress balance sheet, while not being able to fully compensate on for that increase with higher interest income.

In one sentence, if interest rates rise and JP Morgan’s debtors begin defaulting on their bank loans, the bank will be in serious trouble.

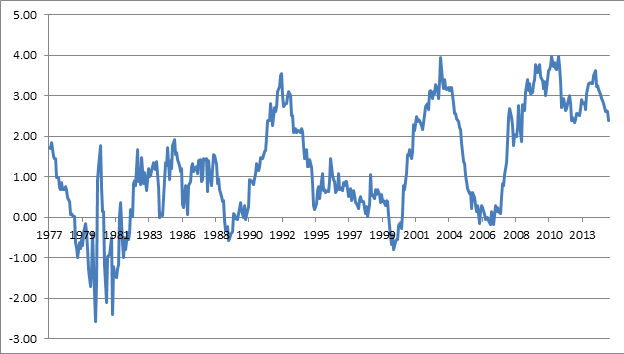

On top of that, the foundation stone of any bank’s business is to borrow short and lend long, profiting on the difference between long term and short term interest rates. This is the famous yield curve. The yield curve usually slopes positive, meaning that long term rates are usually higher than short term rates, enabling the bank to profit on the difference. But on the rare occasions that the yield curve inverts and long term rates are actually lower than short term rates, the bank can no longer borrow short and lend long without losing money.

Below is the yield curve plotted from 1977 until today – the 10-year yield minus the 2-year yield plotted continuously. Above zero means positive, and the higher above zero, the bigger the gap between short and long term rates, meaning the higher the profit for banks like JP Morgan. The last three times that the yield curve sloped negative were in 1989, 1999, and 2007, preceding the 1990, 2000, and 2008 recessions. Those recessions happened, in part, because the banks – the credit machines of the economy – could not profit on providing credit anymore, and that puts them in danger, starting a chain reaction of bankruptcies.

The yield curve is still positive, but it has been heading lower since early 2013.

More important than any talk about JP Morgan being split or having not-so-stellar earnings now for whatever happenstance reason (in this case it is higher legal fees), is what happens to JP Morgan, given its exploding debt since 2008, if the yield curve continues trekking downward and goes negative?