In one of the most exciting biotech announcements so far this year, Inovio Pharmaceuticals Inc. (NASDAQ:INO) on May 24th reported that its HIV vaccine, PENNVAX®-GP, combined with immune activator IL-12, produced some of the highest levels of immune response rates ever demonstrated in an HIV vaccine study.

The vaccine combines four different HIV antigens together with Inovio’s INO-9012, which carries the DNA code for immune activator IL-12. 93% of patients showed a cellular immune response to at least one antigen, versus zero placebo. The antibody response rate was 100% or close to 100% for several of the antigens tested in the assay, according to Dr. Stephen De Rosa, cochair of the study. The study enrolled 94 patients, 85 vaccine and 9 placebo.

The hopeful news has, unsurprisingly, caused Inovio shares to skyrocket 40%.

Most commentary covering this news will go into the details of the trial and what it means for the HIV market, but here we’d like to focus on something a little bit different. That is, INO-9012, Inovio’s IL-12 product it combined with PENNVAX-GP. IL-12 is being combined with other drugs in other indications as well, and its preliminary success with HIV may help give investors a hint as to where the next big stock move may come from.

While each case is different, if the approach can work for HIV (so far at least), then it might work for cancer as well, and Inovio is working to find that out. Though still in the very early stages, on May 8, Regeneron Pharmaceuticals Inc (NASDAQ:REGN) announced that it had entered into a clinical study agreement with Inovio that will see the two companies team up on a cancer indication to investigate a combination of Regeneron’s immune checkpoint PD-1 inhibitor, with both Inovio’s T-cell activating immunotherapy and INO-9012, the IL-12 product used in the HIV vaccine.

This sort of combination approach to immunotherapy is a promising space for a large population of patients that are nonresponsive to monotherapies. Other companies have recognized the potential of combinations of this type and are also working to prove that these combinations can be beneficial in various populations of cancer patients.

Besides Inovio and Regeneron, the two companies furthest along the IL-12 PD-1 combo are OncoSec Medical Inc (NASDAQ:ONCS) and Merck & Co., Inc. (NYSE:MRK), which are taking a similar approach to Regeneron and Inovio, but are much closer to an FDA approval for the combination in question than are the other two.

The OncoSec/Merck combination therapy unofficially began its clinical pathway when OncoSec conducted a Phase II trial investigating the impact of its lead asset, a therapy called ImmunoPulse IL-12, when combined with Merck’s anti-PD1 asset Keytruda, in melanoma patients.

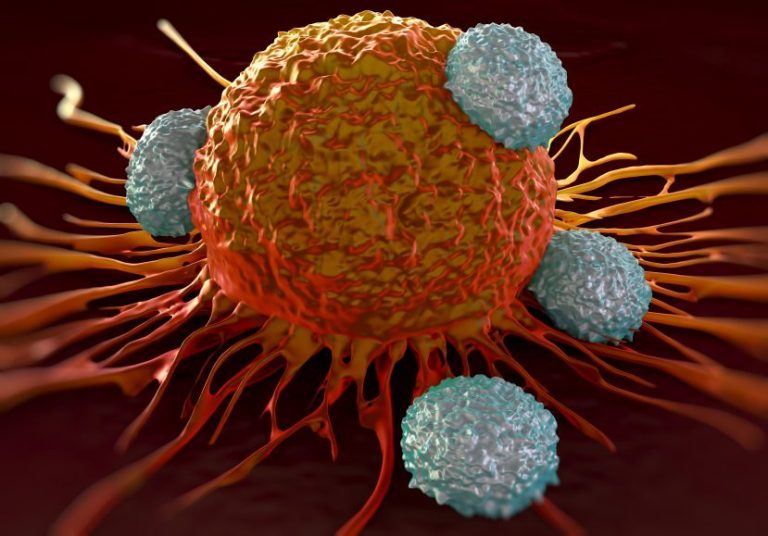

Anti PD-1 assets like Merck’s Keytruda are a type of immunotherapy treatment that released the breaks on the immune system. Cancer cells have the ability to turn off our immune system by hiding. They do this through the production of proteins that bind to a receptor called PD-1 that is located on lymphocytes. It is this receptor that is responsible for programmed cell death, and by binding to it, the protein stops the lymphocytes from being able to activate the cell death switch in cancer cells.

Keytruda binds to and blocks the receptors, meaning they can’t be activated by the protein that the cancer cell creates. This stops the cancer cells from turning off the ability of the lymphocytes to attack them, and programmed cell death carries out as normal in the cancer cells. This process, outside of the oncology space, is in place to stop the immune system attacking its own cells. As such, turning it off, or perhaps it’s more accurate to say inhibiting it, can have some pretty severe side effects. With that said, in these sorts of target oncology indications, the side effects are generally well worth accepting when stacked up against the benefits of therapy.

Unfortunately, however, this treatment only works in a relatively low portion of treated patients (as low as 20% in melanoma). Further, there seems to be a correlation between the efficacy of the treatment and the density of what are called tumor-infiltrating lymphocytes (TIL) present in the patient.

OncoSec has taken the implications of this correlation and hypothesized that by increasing the number of TILs in a patient, you can increase the chances of said patient becoming a responder to a PD-1 therapy like Keytruda. It’s ImmunoPulse IL-12 is designed to induce this increase. The treatment involves the injecting of IL-12 directly into a tumor and the parallel treatment of the tumor cells with electric signals. The signals, or electroporation, open up the cancer cells temporarily so that the IL-12 gets in. Once inside it gets to work highlighting the cells to the immune system and increasing the TIL presence. When Keyruda is introduced, then, it’s got a far higher TIL count to work with, meaning the response rate should be better.

And there’s data to back this up, derived from the Phase II.

However, to confirm the effect beyond doubt, and to quantify its impact in the target population, OncoSec needs to conduct a registrational Phase II that looks at the efficacy of the drug in patients that haven’t responded to PD-1 therapy initially. In other words, try and show that the IL-12 therapy can turn a non responder into a responder.

And that’s what Merck’s and OncoSec’s clinical trial agreement is designed to achieve. The company is going to work with Merck to see if patients with Stage III/IV metastatic melanoma who are progressing, or have progressed, on previous treatment with an anti-PD-1 therapy, respond to the drug after they have been treated with a round of OncoSec’s ImmunoPulse therapy. It’s not a collaboration as such – Merck is only supplying the Keytruda, while OncoSec is paying for and conducting the trial – but if it hits on its primary endpoint, it could be a game changer for OncoSec just as PENNVAX and IL-12 looks like it may be one for Inovio.

The data, if positive, would be enough to justify an approval before Phase III in the US (with a Phase III being carried out as confirmatory post-approval) and also a good chance that OncoSec could bring in a big name partner (probably Merck) to help fund commercialization of the drug.

The timeline we’re looking at here, with the accelerated Phase II approval approach, is mid 2019 as a potential approval period, giving the company a jump on the likely 2022 projected approval if it went traditional and conducted a phase III before picking up a regulatory green light from the FDA.

For some perspective, the Inovio/Regeneron study is a phase 1b/2a proof of concept and still a long way from approval, though recent success with PENNVAX and IL-12 with HIV may push the Regeneron/Inovio collaboration up the proverbial depth chart.