If you’re a bottom picker in oil stocks, then like most commodities and the companies based on them, company valuations tend to lead the underlying commodity. If oil stocks can resist any more down moves in oil and spike strongly on small up moves, this is a strong signal that oil is at or near its bottom.

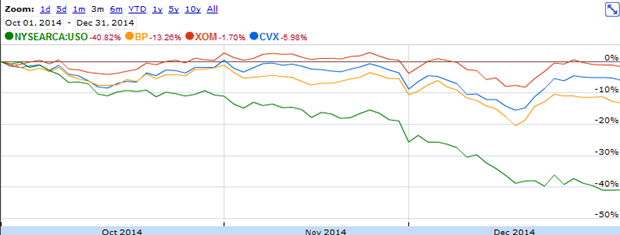

And this is indeed what is happening now. Looking at a 3-month chart below, British Petroleum (NYSE:BP) Exxon (NYSE:XOM) and Chevron (NYSE:CVX) have all been resisting oil’s hard December selloff, especially since December 15.

If we zoom in since December 15, we’ll find that oil stocks have actually risen – Chevron more than 10% – while oil has fallen another 7%. This is either a really nasty head fake, or oil stocks are signaling that the bottom in the oil market has been hit, and that we are now on our way back up.

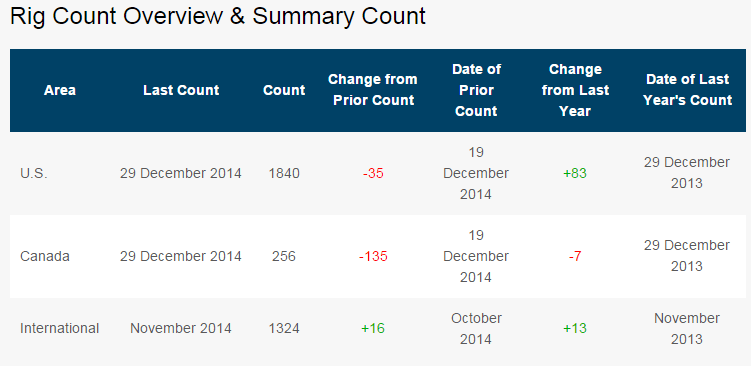

Adding to this is the fact that supply side, rigs are starting to be shut down. The US has lost 35 rigs in the past 10 days, and Canada 135. The longer oil stays in its current range, the more rigs will continue to be shut down, stabilizing and then pushing price back up.

With supply on one side being crimped, half of every oil transaction involves dollars, and the supply of this is going up fast. Money supply just broke through $11.7 trillion last week for the first time, with no signs of let up. The money supply is now growing, looking at the one week average, at a 12% annualized rate. A falling supply of oil with a rising supply of dollars eventually leads to more dollars per barrel of oil.

Given the similarities to what happened to the oil market at the end of 2008, BP, Chevron and Exxon look like good long term buys, as it will take some time for oil to trudge back to the $100 level. After the 2008 crash, to took two years for oil to get back to $100 a barrel for a low near $30. In the meantime the stocks pay decent dividends while patient holders can wait.