It’s Thanksgiving in the US today and the markets are closed for the session. This means there’s a good chance we’ll see a lull in any real activity (from a fresh input perspective – news, data, that sort of thing) until next Monday.

With that said, we still saw some movement during the session on Tuesday and those companies that moved are probably going to carry on in terms of directional sentiment when things get back underway next week.

With this in mind, here’s what happened in the biotechnology space on Tuesday with a discussion of what moved the companies in question and where we expect things to move when the markets reopen next week.

The two companies in focus for the session today are CHF Solutions, Inc. (NASDAQ:CHFS) and Ampio Pharmaceuticals, Inc. (NYSEMKT:AMPE).

First up, then, CHF.

This one is a classic move in the biotechnology space and – unfortunately for the company and its shareholders – the move hasn’t come in the direction either would have hoped. CHF announced on Tuesday that it had arranged terms on the pricing of an underwritten public offering of convertible preferred stock, together with warrants. The offering, stock and warrants are expected to bring in somewhere in the region of $18 million on completion and, according to the report, preferred stock is convertible into shares at a conversion price of $4.50 per share.

On the back of the news, CHF shares have taken a real hit and closed out on Wednesday’s session for a close to 45% discount to the price at which it opened at the bell. The closing price was $4.35, which is just below the price at which the convertibles are being offered for conversion, and the company was trading in and around $7.80 pre-announcement.

So why this response?

The problem with biotechnology companies is that – especially at the smaller end of the market – they generally don’t generate any substantial revenues. At the same time, however, they’ve got to fund the development programs that they hope will carry them through to revenue generation at some point farther down the line.

In order to fill this deficit, these companies issue shares and raise cash. However, when a public company issues shares, the extra shares add to the base of outstanding shares and dilute those shares that are already in place.

It’s the dilution that causes the dip in sentiment and that – in turn – causes the stock to decline.

It’s not all bad, however. If the company that issues shares can use the capital it raises to push toward a value-add catalyst, the dip can be an opportunity to pick up some cheap shares ahead of a longer-term recovery.

With this in mind, we expect something of a bounce to hit the tape as things reopen on Monday.

Moving on, let’s look at Ampio.

This one’s a much more wishy-washy move but it’s substantial enough to qualify the company for a position on this list, whatever the reason for the action.

On Wednesday, Ampio opened play in and around $1.38 a share. By the time the session closed out, the company’s shares went for $1.75, having reached intraday highs of $1.90. That’s a close to 27% increase from open to close and – for anyone that pulled out of an intraday position at the right time – a more than 37% run from open to highs.

So what’s driving the action?

Well, here’s where things get a little bit flaky.

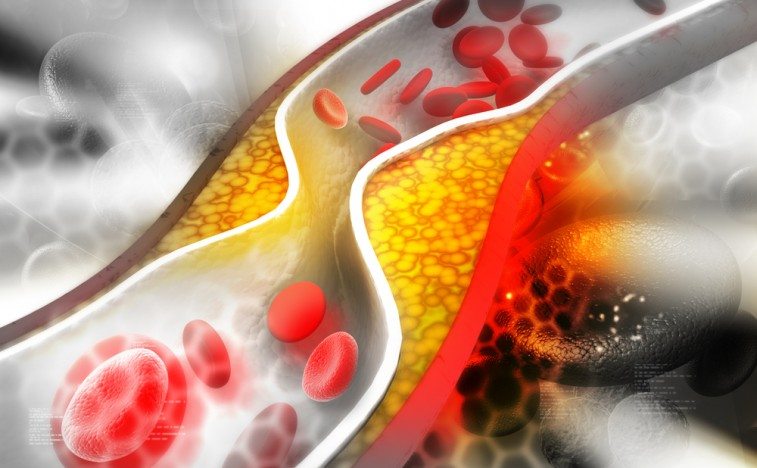

The company is trying to get a drug to market in the US called Ampion and it’s trying to do so as a potential treatment for patients with severe osteoarthritis of the knee. This is a tricky condition to treat and it’s one that, outside of development type assets and surgery, is generally just treated with pain management medication.

Ampion is an attempt to bring a much needed alternative option to this patient population and, so far, Ampio has managed to put together a pretty solid batch of data supportive of efficacy for the drug.

So why the latest run?

The company just announced a journal called Orthopedics, which is a peer-reviewed journal that offers clinically valuable research covering all aspects of orthopedics, has published an article outlining the efficacy of Ampion in the above-discussed target indication.

Again, this isn’t really a substantiated move and there’s a good chance we’ll see some degree of correction come next week.