Wednesday was a big day in the biotechnology space for a number of companies. Here’s a look at some of the biggest movers, with an analysis of what drove the action in each. The two companies in our crosshairs for possession today are Gemphire Therapeutics Inc. (NASDAQ:GEMP) and Moleculin Biotech, Inc., (NASDAQ:MBRX).

Let’s kick things off with Moleculin

Moleculin has had an incredible few days. During the middle of last week, the company traded for in and around $0.80 a share. At the session close on Wednesday, its shares went for $3.28.

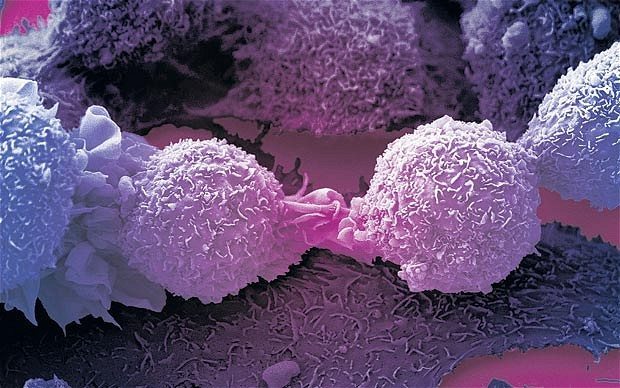

The upside run is rooted in a recently announced discovery based on the company’s existing lead asset, a drug called WP 1122, which is currently under investigation as a potential treatment for a type of brain cancer called glioblastoma multiforme (GBM), which is the most common and an extremely deadly form of the disease. Alongside this development program, Moleculin has also been running some exploratory investigations in collaboration with various universities and research entities, one of which is the M.D. Anderson Cancer Center. As per the latest announcement, this collaboration with the M.D. Anderson Cancer Center has just brought about an alternative version of the above-noted WP 1122, which the company is calling WP 1234. It’s basically the same type of drug (it inhibits the process of glycolysis, which is the process through which cancer cells generate the energy required for replication) but it is altered slightly in the sense that it circulates systemically for a slightly longer period than its predecessor. This extended circulation time should theoretically allow for an increased efficacy in a target cancer, which in this case, is pancreatic cancer. Pancreatic cancer is a notoriously tough form of the disease to treat and is normally deadly regardless of the stage at which it is caught. If Moleculin can capitalize on this discovery and get the drug into clinical trials, there’s a good chance the company will pick up strength on the back of any developments that point to clinical benefit.

As a secondary bonus, the fact that the company is now trading above one dollar a share means it is unlikely to effect a reverse split, something that has been on the cards for the past six months or so, as rooted in the necessity to maintain a share price above the one dollar threshold in order to fall in line with NASDAQ listing requirements. A fresh discovery in a cancer with a strong unmet need, coupled with some capital structure risk being lifted, is translating to considerable strength, and we expect this strength to continue near term.

Next up, Gemphire Therapeutics Inc. (NASDAQ:GEMP)

This one is a clinical development driven move.

The company is working to bring a drug to market called gemcabene in a target indication of a condition called homozygous familial hypercholesterolemia (HoFH) and, specifically, for patients in this population that are on stable maximally tolerated lipid-lowering therapies.

A phase 2B trial just completed and Gemphire put out topline from the study during the session on Wednesday.

And as it turns out, the drug seems to work pretty well.

The trial was set up to assess the efficacy, safety, and tolerability of multiple rising doses of gemcabene in the patient population in question, with the end game of informing dosing in a pivotal investigation in the same indication. As per the latest release, the drug at 300 mg lowered LDL-C by a mean of 25% (p=0.0063; range -55% to +1%), while the 600mg and 900mg doses lowered LDL-C by a mean of 30% (p=0.0047) and 29% (p=0.0035), respectively.

There was no major safety or tolerability issues reported, suggesting both that the drug works and can be administered without any real tolerability concerns across this population – a population that is crying out for fresh treatment alternatives based on the drawbacks and limitations of the current standard of care options in space.

At the end of the session on Wednesday, Gemphire traded at $13.50 a share, which represents a 10% appreciation in market capitalization on its preannouncement valuation.

Chances are we will see a near-term correction as the shorter-term operators pull profits off the table, but don’t expect any such correction to last too long, as markets will likely load up on the dip ahead of a pivotal initiation and – in turn – a registration application for the drug with the FDA in the US.