Uniqure NV (NASDAQ:QURE) just put out data from its lead hemophilia trial, and the company has taken a hit on the release. The data was positive, and reinforced previously held efficacy theses, but the company is stuck on something of an odd position right now, and it’s weighing on sentiment.

Specifically, Uniqure’s lead hemophilia asset has underperformed on a key endpoint versus that of another company in the space, Spark Therapeutics Inc (NASDAQ:ONCE)’s SPK-9001, and there is a widely held belief that this underperformance writes off any potential market for Uniqure’s asset.

We think that this belief is misinformed, however.

In turn, we think that there’s an opportunity to pick up a heavily discounted exposure to a company with what looks to be a promising lead, in s severely underserved market. Here’s what underpins our opinions.

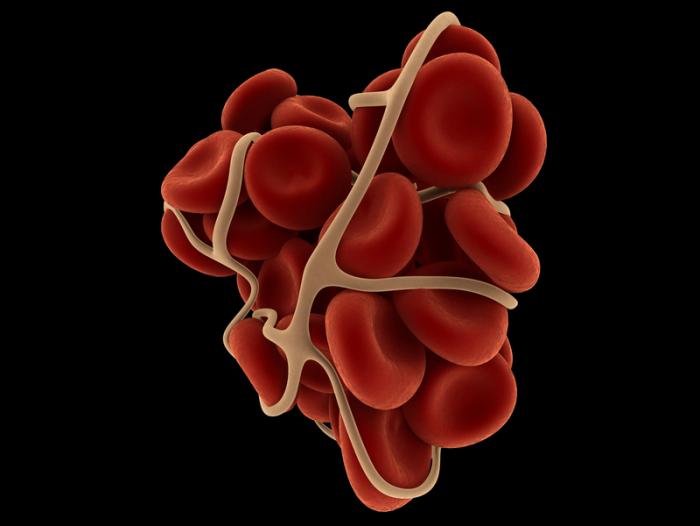

So, first, a look at the latest data. The drug in question is called AMT-060, and it’s currently under investigation in a phase I/II targeting the treatment of the above mentioned hemophilia B. For those not familiar with this indication, it’s a hereditary bleeding disorder caused by a lack of blood clotting factor IX.

AMT-060 is a gene that codes for factor IX, encased in a capsid viral vector. It’s designed to kickstart the production of the factor, with the goal of increasing a patient’s factor IX load and – and this is important – shifting the phenotype of the patient’s condition. We’ll get back to this shortly.

The data that hit focused on three important things. The first, the above mentioned shift in factor IX activity. Nine of the ten patients going in to the trial had severe phenotype hemophilia, meaning their factor IX activity was below 1%. The tenth patient had moderate to severe, with 1.5% activity. The goal then, was to boost this activity by 3% or more, and shift phenotype from severe to moderate in the more severe patients, and moderate to mild in the moderate patient. And the drug met this goal. Across two cohorts (five patients in each) the mean IX activity was 5.2% in cohort one, and 6.9% in cohort two. In nine of the ten patients in the study, the shift translated to a resulting shift in phenotype.

The second focal point was bleeding episodes. Basically, how frequent, and how severe, were the bleeding episodes per patient post-administration, as opposed to pre-administration. Again, across both cohorts, annualized bleed rate was dramatically reduced, post treatment.

Finally, safety was of key importance. Spark’s treatment has associated with it some safety concerns, rooted in the potential for autoimmune responses. This trial resulted in no such responses, and this nudges Uniqure ahead of its competitor, at least on that side of the equation.

We can sum all this up like this:

Spark’s candidate improves IX activity to a higher degree than Uniqure’s, but there’s continued debate as to just how much improvement is necessary for clinical benefit. Spark thinks a minimum threshold of 12% activity should be in place. Uniqure thinks the number is 5%. We think that a clean safety profile, combined with the ability to shift a patient to mild phenotype hemophilia, will be enough for the FDA, assuming Uniqure can replicate the numbers in a pivotal study. If this proves to be the case, then the company is going to beat Spark to market by a considerable period, and could quickly carve out a nice base of revenues for itself ahead of Spark entering the fray. At that point, prescribing physicians will be faced with a choice – stick with AMT-060, or shift to SPK-9001. There’s a potential efficacy benefit in switching, but there’s also an added risk (based on the data we’ve seen to date) and we think this risk might be enough to offset the rewards on offer for the patients in question.

So what’s next?

The company is going to sit down with the FDA, and put together a protocol for the implementation of a pivotal trial. We should also some some expanded data from the current ongoing. We’d like to see a reinforcing of the current efficacy readouts, coupled with a clean safety profile, as reinforcing our bias.