It’s going to be a busy quarter for a few companies in the biotech space, with a number of catalysts slated for the next month or so. Presentation season is in full swing in the healthcare sector (a prime period for data driven catalysts) and earnings are soon about to start hitting the wires.

With this in mind, here are two companies in the junior biotechnology sector that have the potential to move on some near term catalysts, along side a look at what’s behind the catalysts and what our expectations for each is ahead of the release.

The two companies we are looking at are Anthera Pharmaceuticals Inc (NASDAQ:ANTH) and Theratechnologies Inc. (OTCMKTS:THERF).

We’ll kick things off with Anthera.

Anthera is set to put out data from a pivotal trial in its lead lupus candidate at some point during – and this is the best guidance we have – early fourth quarter 2016. The drug is called blisibimod, and it’s a selective peptibody antagonist of the B-cell activating factor (BAFF) cytokine, also known as B lymphocyte stimulator (BLyS). BAFF is stimulating factor of B cells such as the just mentioned B lymphocyte, and these B cells are associated with a flurry of different automimmune disease – one of which is the target in question, lupus. We won’t go into too much detail on the science here, but to simplify, BAFF upregulates B cell production, and overactive B cell activity initiates the immune action that causes the disease. Blisibimod binds to BAFF, which means it cannot activate the receptor that creates the B cell upregulation. No upregulation reduces the circulating B cell activity, which in turn (and in theory, at least) should limit the underlying disease cause.

Now, this one already failed to hit a primary endpoint of a phase IIb trial back at the end of 2012, but the company pushed forward with this phase III in the hope that a slightly altered protocol could alter the eventual outcome. Markets aren’t overly optimistic on its chances, but we’ve seen it happen many times before, and so we’re not writing the company off. A cautious approach into what is a negatively weighted binary event, which could serve up some sharp upside momentum for Anthera if the numbers come out indicative of efficacy.

Moving now to Theratechnologies.

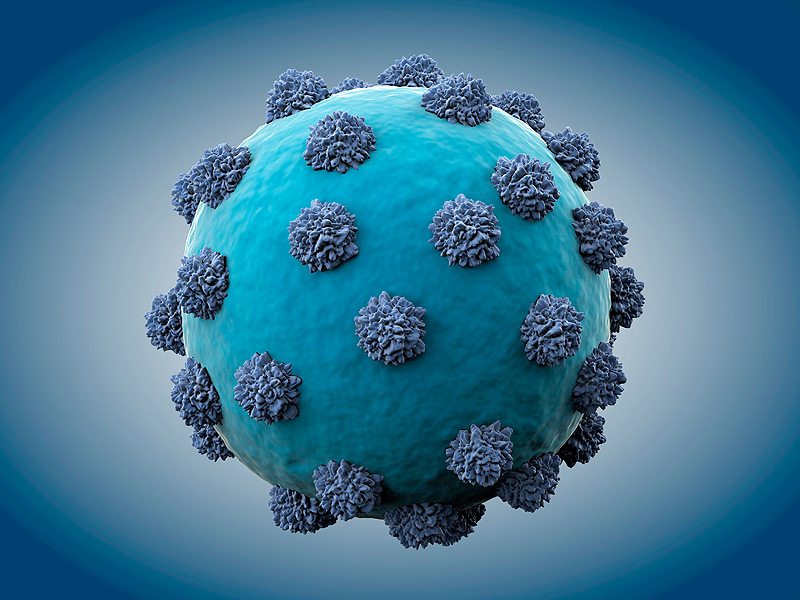

This company is developing a drug called ibalizumab, with which it is targeting patients infected with multi-drug resistant HIV-1. It’s intended as an adjuvant to standard of care (SOC) background therapy, and Theratechnologies just wrapped up a phase III trial investigating its safety and efficacy in its target population. The data from this trial is set to hit press at some point over the coming couple of weeks (we think it could be as early as next week) and an endpoint hit will be a major driver near term, and should dictate sentiment for at least the next couple of quarters.

HIV is a tough condition to treat, because after a certain period of time (this can vary from weeks, to months and at the outside a few years) a patient will become resistant to the currently available treatments. Physicians prescribe combinations of various antivirals in an attempt to overcome resistance, but again, this only lasts for a period, and then the patient must move on to something new.

Theratechnologies is hoping ibalizumab will be able to combine with current antivirals and – in doing so – both maximize their impact on viral load in HIV-1 and serve as a tool with which to extend the treatment (efficacy) life of the current options.

As mentioned, we’re looking at an unset timeframe for this one, but we expect the data to hit during the first week of November (next week). At the latest, look for a second week hit.