Vitae Pharmaceuticals, Inc. (NASDAQ:VTAE) just released topline data from the first part of its phase I clinical trial of VTP-43742 – an autoimmune therapy with an initial target indication of psoriasis. Autoimmune therapy is a real hot topic at the moment, and after a string of recent collaborations and buyouts from big pharma, early stage success has the potential to draw big name attention. While the recent data is only dose escalation, it paves the way for the second part of the trial – an efficacy endpoint in its lead indication. Ahead of the commencement of part two, let’s take a look at Vitae’s candidate and see where it fits into the AI therapy landscape.

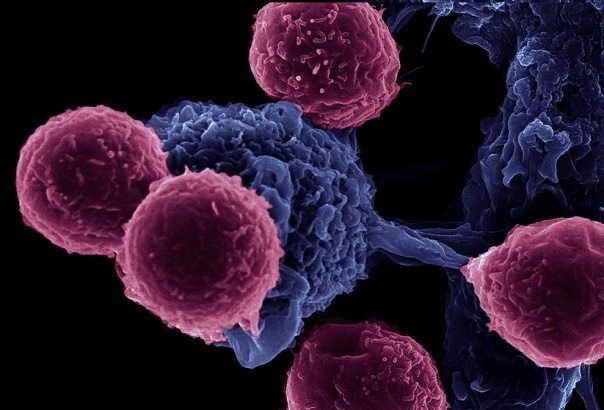

VTP-43742 is a biologic that works to inhibit what are called T helper 17 (Th17) cells. Th17 cells mediate a select number of cytokines called interleukins – specifically IL17A, IL17F, IL21 and IL22. All of these interleukins are responsible for a particular element of the human immune systems effect on cells – inflammation, for example, or in the case of psoriasis, excessive cell proliferation. VTP-43742 (hypothetically) stops, or at least reduces the rate of, interleukin production. In doing so, Vitae believes it can be an effective treatment across a range of autoimmune disorders. For those interested in this sort of therapy (as we’ve said, its hot right now) take a look at Roche Holding AG (OTCMKTS:RHHBY) new candidate (picked up as part of the $580 million Adheron deal) – SDP051.

In its latest announcement, Vitae reported that across a patient sample of 40 volunteers, its candidate demonstrated safety and tolerability across all dose levels, with all patients completing the full ten-day dosing schedule without adverse events. Its worth mentioning here that these are healthy volunteers – not psoriasis sufferers – but 40 is a relatively large sample size at this stage of development, so the chances of something revealing itself in psoriasis sufferers that doesn’t crop up across 40 healthy volunteers are minimal.

Perhaps more interestingly, the company conducted some ex-vivo tests to try and pick up a proof of concept. Ex vivo basically involves taking a blood sample from a patient, introducing the treatment to the sample, and recording the response. Vitae was looking for reduced IL17A levels, as this would suggest that its candidate is successfully inhibiting the production of this interleukin. Ex vivo, the company saw a 90% suppression for 24 hours post dosing, across all doses except the lowest. That the suppression didn’t show up in the lowest dose isn’t necessarily a bad thing – it demonstrates dose dependence, something that can be a great leading indicator of efficacy.

So what’s next? Well, as mentioned, this is the first part of the trial. We’ve got an ex vivo proof of concept, but in order to carry the treatment through to phase II, Vitae will need an in vivo POC. This is where part two comes in. The company is kicking off a POC phase I continuation in psoriasis sufferers, and expects top line during the first quarter of next year. If we get a replication of ex vivo in vivo, topline release could be a real upside catalyst for Vitae’s market cap.

The company has had a pretty tough year. VTP-43742 is its secondary pipeline candidate; VTP-34072, a biologic in colab development with Boehringer Ingelheim is its primary. However, in a phase II that completed earlier this year, the drug missed its primary endpoint in a diabetes indication. It remains to be seen whether the psoriasis indication can reverse Vitae’s fortunes, but if we get POC early next year, we should definitely see some strength – purely based on the market potential that would come with commercialization. Psoriasis affects close to 8 million individuals in the US alone, and a biologic such as this would qualify (assuming efficacy and safety can be proven) for both single and combination administration. Looking at the other side of the coin, cost could come into play on approval. Biologics such as these (i.e. those that target select immuno-functions) are expensive to produce. Current therapies such as corticosteroids are far cheaper – meaning we will need to see a considerable efficacy advantage over the currently available treatments to warrant the high price that will inevitably filter through to end users. The takeaway? That autoimmune buyouts are closing left and right, and the vast majority seem to be on the back of phase I data. With top line from its psoriasis trial due early next year, Vitae is definitely one to watch as we head into 2016.