It was a short-lived recovery in oil prices, which have again jumped back in sub-30 per barrel territory. A slew of factors are responsible for driving oil prices to lower levels. However, the reluctance of the OPEC (Organisation of the Petroleum Exporting Countries) to address oversupplies combined with the massive output from Iraq are weighing on the commodity.

OPEC pleads co-operation

The global benchmark, Crude Oil Brent is seen trading at $30.52 as it shed nearly 6.3% on Monday while the U.S. Crude Futures (CLH6) for March delivery is hovering near $30.34.

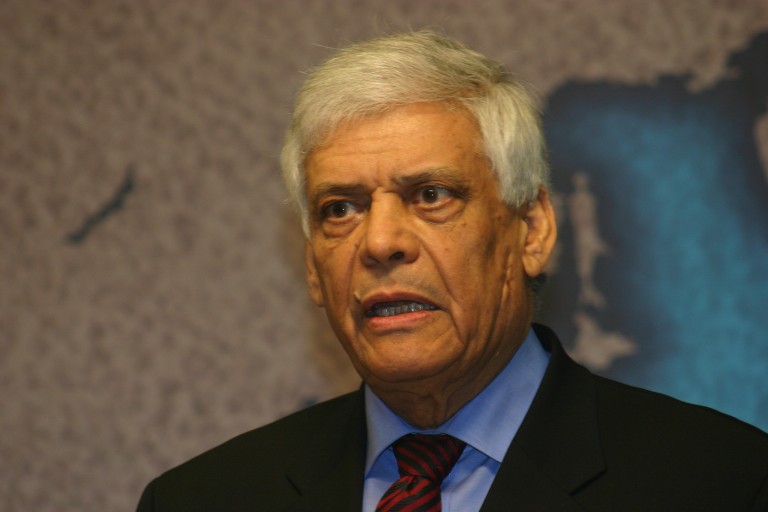

The sentiment around oil has grown negative after the head of OPEC has asked oil-producing countries outside of OPEC to show co-operation. This signals that the OPEC is adamant on its stance to continue with existing oil output. Abdullah al-Badri, head of OPEC, released a statement asking co-operation from non-OPEC members to help contain oil supplies. Al-Badri held non-Opec members responsible for the current oil rout, which has further dampened the expectations of an early resolution.

Reluctant to act on its own

So far, only one of the members of OPEC is willing to consider ways to boost oil prices, according to Indonesia’s OPEC representative. Meanwhile, Iraq is busy pumping out more oil, indifferent to the current oil glut, which has further fueled the concerns over increasing oil supplies. The Iraqi government has reported a record high oil production of 4.13 million barrels per day. Simultaneously, Iran is also keen on loading more oil tankers following the lift of Western sanctions.

Amid these developments, several analysts hold are of the opinion that the oil reserves will rise during the next few months and will start declining from thereon. Given the current oil stockpiles, HSBC has trimmed its price forecast for Brent crude to $45 per barrel from $60 per barrel for the year 2016. Another research firm, UniCredit has also slashed its crude price forecast to $37 per barrel from $52.50 per barrel, signalling more pain ahead for the commodity.