• Introduction

• The Ebola Virus

• The Latest Outbreak

• Trial Design

• The Drugs

• Phase 1 Clinical Trial Data

o RVSV-ZEBOV

o ChAd3-EBO-Z

• Conclusion

Introduction

Back on May 12, 2015, the Food and Drug Administration’s (FDA) Vaccines and Related Biological Products Advisory Committee released a briefing document detailing the process for licensure of Ebola vaccines and the required demonstration of effectiveness. This Market Exclusive Inside the FDA report aims to go inside this briefing document, break it down, and from there extrapolate based on the companies furthest along in developing an effective vaccine, according to the guidelines set out by the FDA itself.

Ebola is one of the world’s deadliest viruses in terms of mortality rate, though thankfully it is not a pandemic. It kills up to 90% of those who contract it, and there is no currently available cure or vaccination. The most recent outbreak began in 2013 in Guinea, West Africa. While it is now considered under control, the outbreak continues to hit certain populations in Africa, and there have been just shy of 30,000 reported cases of infection to date.

This has sparked a government-private industry scramble to develop and manufacture a vaccine that can be used to prevent further outbreaks. Two companies are at the forefront of this scramble, and their vaccine candidates have emerged as frontrunners in the race to commercialization. Here’s a look at the companies in question, and the drugs on which each is working, reflected through the perspective of the FDA panel.

The Ebola Virus

First, let’s take a look at the virus itself and the disease it causes. The image below is an electron micrograph of the Ebola virus virion, which is the form of the virus before it infects a host cell.

There are actually five currently identified and recognized types of Ebola virus, all categorized within the viral genus Ebolavirus. The five types (referred to as members in the scientific space) are each named after their original region of location:

- Bundibugyo ebolavirus

- Reston ebolavirus

- Sudan ebolavirus

- Taï Forest ebolavirus (originally Côte d’Ivoire ebolavirus)

- Zaire ebolavirus

The final one, the Zaire ebolavirus (here on in referred to as ZEBOV) is by far the deadliest, and is responsible for the most breakouts across the 40-year period for which we have known about the virus. It’s the one responsible for the latest outbreak.

The virus is thought to be carried by fruit bats, which don’t show any symptoms, and it is believed these are the main natural vector for the virus into humans.

From a scientific perspective, the virus inhibits type I and II interferon (IFN) signaling. The processes that ensue are beyond the scope of this report, but to simplify, this inhibition results in the concurrent inhibition of something called phospho-STAT1 nuclear import. When a macromolecule or big molecule (say, RNA, for example) needs to enter the nucleus of a cell, it binds to a protein called an importin, so called because they help import material into the nucleus. Importins are a kind of tag that signals to grant permission into the nucleus in a cell. If the macromolecule has an importin attached, it gets through to the nucleus. If it doesn’t, it doesn’t. The Ebola virus stops the tagging, and in turn, stops the importation.

This causes the commonly associated symptoms – vomiting, diarrhea, headache, confusion etc. – and eventually, in many patients, death.

The Latest Outbreak

The 2013 ZEBOV outbreak was far deadlier, relatively speaking, than many people realize. Before this outbreak, the most cases associated with a specific outbreak was 318, with 280 deaths. This means the 2013-16 outbreak was 100 times bigger than any other in history going back to the 1976 first-identification. It started in Guinea, as mentioned, and within a week or so of first identification had spread to Liberia. It subsequently spread to Guinea, Sierra Leone, Nigeria, Spain, the US, the UK, France and Germany over a period of about ten months.

The outbreak officially ended in January 2016, when on January 14 the WHO declared West Africa Ebola-free. However, isolated cases remain, and many are still recovering from infection. At outbreak end, the WHO reported 28,657 cases and 11,325 deaths. The vast majority of these cases (28,611) occurred in Liberia, Sierra Leone and Guinea, coming in at 10,675, 14,122 and 3,814 respectively.

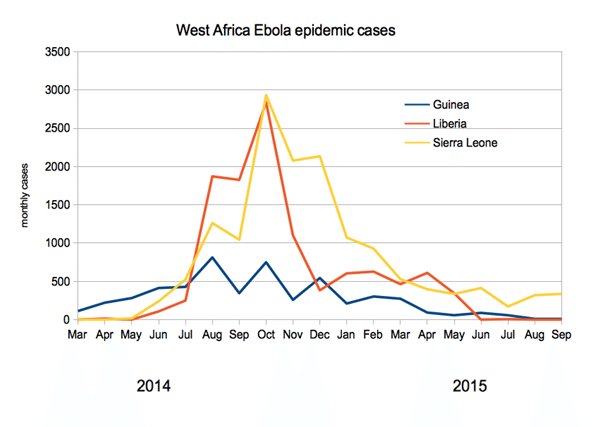

The chart below shows the number of monthly cases in the three most severely affected regions:

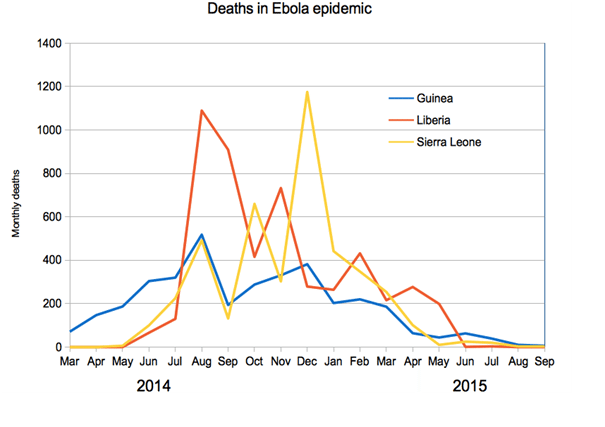

The next chart shows the number of monthly deaths in each of the three affected regions across the period generally regarded as active:

Trial Design

Before we get into the individual vaccines, it’s worth sidetracking for a brief discussion of trial design and approval requirements. In a standard drug approval process, a company would pitch its drug against various predefined endpoints and conduct the trial based on these endpoints. Because of the decline in Ebola infections over the last six months however, there aren’t going to be enough infected individuals to conduct a trial to the scale that an agency like the FDA would generally require. Plus, there is something a tad disturbing about giving an Ebola patient a placebo in the midst of hemmorhagic fever if any trial were to be placebo-controlled. As such, a number of alternate methods are going to be required. There are two primary methods through which an Ebola vaccine developer can demonstrate to global health authorities that its candidate is effective.

The first is through the use of a surrogate endpoint. The way this would work is that the trial would use healthy volunteers, and the endpoint would be something that is indicative of efficacy – most likely an immune response.

The second is via what’s called the Animal Rule. This one is pretty much exactly what its name suggests. A company would conduct trials in animals, and then present data to the authorities based on these trials. If the data shows efficacy in the animals in question (most likely primates in this instance) and the agency thinks that the data suggests that this benefit would transmit to humans that undergo the same treatment, it will approve the vaccine conditional on strict post-marketing studies.

Data presented as part of a government-sponsored workshop in the US suggested that immune response was similar in both healthy humans and non human primates (NHP). This points to the potential for a combination of the two above methods being used to garner an approval, and is the most probable path going forward.

The Drugs

There are currently three frontrunners in development of a vaccine, two of which will be covered here. These are:

1. rVSV-ZEBOV

2. ChAd3-EBO-Z

3. Ad26.ZEBOV

As the names of each suggest, they all target the Zaire member subtype, ZEBOV. To date, all have been put through phase I trials, and all have demonstrated some level of efficacy, as measured by immunogenicity, basically the proliferation of immune cells in response to the vaccine, which doesn’t prove that the immune response will actually prevent infection however. The first two candidates on the list, rVSV-ZEBOV and ChAd3-EBO-Z, have published trial data available. The third, Ad26.ZEBOV, does not. As such, for the purposes of this report, we will focus on the two with trial data available going forward.

Phase I Clinical Trial Data

This section of the report will focus on the two vaccines for which there is available phase I data – rVSV-ZEBOV and ChAd3-EBO-Z.

rVSV-ZEBOV

rVSV-ZEBOV was initially developed as part of a program by the Public Health Agency of Canada (PHOC), and then licensed to NewLink Genetics Corp (NASDAQ:NLNK). Subsequent to this licensing, NewLink entered into a collaboration deal with Merck & Co., Inc. (NYSE:MRK), which saw the latter granted exclusive rights to the rVSV-ZEBOV vaccine candidate as well as any follow-on products.

The letters in the name stand for Ebola Virus Recombinant Vesicular Stomatitis Virus-Vectored vaccine, quite a mouthful. It is a vaccine based on a genetically modified vesicular stomatitis virus (VSV) that expresses the envelope glycoprotein (GP) from the ZEBOV strain. So basically they take a different virus, cover it with glycoproteins from Ebola, and it masquerades around as a sort of fake Ebola for the immune system to train on.

Data from a phase I study showed median GP ELISA antibody responses of 1:2,000 at day 28 at a vaccine dose of 106 pfu. ELISA here refers to an enzyme-linked immunosorbent assay. Essentially, these assays measure how much of an antigen is present in a patient’s system post administration. The 1:2,000 number is a pretty robust response, a good sign but not necessarily effective against actual Ebola. The important thing is what’s called seroconversion. Seroconversion is the point at which the body develops antibodies to a level that they are detectable in the blood. Data from two phase I trials conducted at WRAIR and NIH showed a 100% seroconversion rate in 40 patients that received the vaccine.

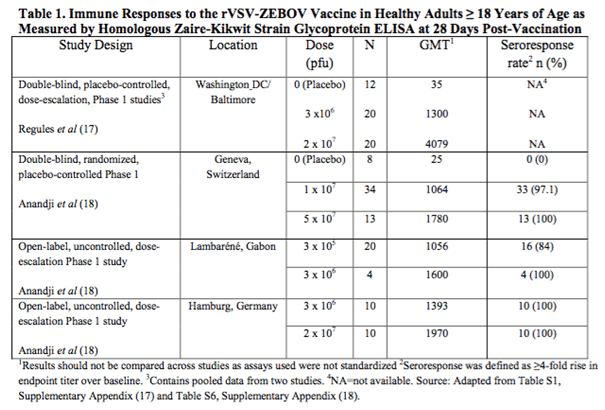

The chart below taken from the FDA briefing document details the data from four different studies of the rVSV-ZEBOV vaccine across the US, Europe and Africa.

An important note relating to this data – the assays used across the trials were not standardized. This means we can only compare the data across the dosing in each trial, and not the data from one trial to another. To put this another way, a GMT of 1064 in the Geneva trial doesn’t necessarily suggest an improved response over the GMT of 1300 in the Washington trial.

Bottom line here is that this one looks good from an efficacy perspective, but only insofar as it was trying to prove that an immune response could be generated, not necessarily that that immune response would be effective against live Ebola virus.

Aside from Phase 1 trials, there are two primary ongoing phase 3 studies sponsored by Merck in West Africa. Interim data published last year suggested a 100% efficacy rate – i.e. all individuals that received the vaccine achieved immunity to the “fake Ebola” within 6-10 days. The p value on the data was 0.0036, which is great from a statistical significance perspective. The FDA generally requires a p value of .05 or less. In other words, it seems this vaccine works well, at least for what it was trying to prove.

ChAd3-EBO-Z

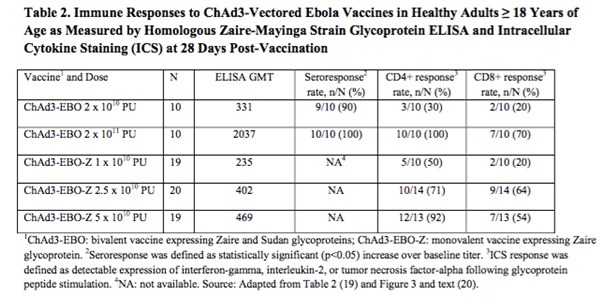

ChAd3 vaccines are currently under investigation across a range of glycoprotein expressions, with the two primary being the Zaire glycoprotein and the Sudan glycoprotein. The one we are interested in here is the Zaire GP, as this is the most sought after approach. The vaccine was developed by the Vaccine Research Center of the National Institute of Allergy and Infectious Diseases, and picked up by GlaxoSmithKline plc (ADR)(NYSE:GSK) back in May, 2013. The data from a completed Phase I trial is illustrated in the table below. The table also includes data from a completed Phase I in a vaccine that is bivalent – that is, it contains both the Zaire and the Sudan GPs. The mono vaccine, the one listed in the table as EBO-Z also taken from the FDA briefing document, is the vaccine that GSK is developing.

Note that the immunogenicity is not as robust at the highest mono dose (GMT = 469) as it is in the highest bivalent dose (GMT = 2037). Unlike the previously discussed trial, these are comparable, and this indicates that the bivalent is probably more effective than the mono. This, again, weakens the GSK candidate a little. In the interest of balance, however, these results were taken at the 28-day post administration point. If GSK can demonstrate that the GMT increases after this point, or extends beyond the bivalent vaccine in terms of how long the immune response maintains, it would strengthen the bid for commercialization.

A GSK study is currently ongoing for this vaccine, and if it completes successfully the vaccine will be fast-tracked for approval and shipped to West Africa. The company has reportedly already prepared and is storing ten thousand doses in anticipation of an approval.

Conclusion

To bring all this together, there are five types of Ebola, and each requires a different vaccine (bivalent vaccines aside). The two lead development candidates right now both target the Zaire type, which is by far and away the leading cause of deaths in Ebola history, primarily based on the latest West African breakout. The two vaccines are rVSV-ZEBOV and ChAd3-EBO-Z. The former is currently in a Merck-sponsored Phase III trial, having been licensed from NewLink, and is performing exceptionally well for what it is trying to prove. The latter is being developed by GSK and is in a Phase I extension trial that, if successful, will result in GSK shipping ten thousand doses for commercial application in West Africa.

We don’t expect either vaccine to be blockbuster or a significant money maker in the near future, but an approval and shipment would give either company some very positive press and could give stocks an extra, brief 5-10% jump over what would otherwise be, though this is just a rough estimate. In the event that Ebola truly becomes a pandemic issue, something that would indeed be terrifying, then we’re looking at much bigger gains on global panic alone.

Ebola investments should be considered tail-risk investments for worst case scenarios. Having some GSK or Merck stock in your portfolio is not particularly risky, so holding them for the unlikely event that Ebola becomes a global pandemic is not a particularly bad idea for any portfolio. These are the companies that will be turned to in such an event by governments all over the world, and in the event of a true pandemic, you better believe that regulatory precautions will be thrown out the window. In case they are and one or both of these pharma giants prove to carry effective vaccines, we’re looking at serious panic gains for shareholders, though hopefully, for the sake of humanity, this will not actually happen. And if it doesn’t, that’s good for all of us, and owning GSK or Merck is not particularly risky anyway.

As for what happens from here, the Merck Phase III trial being conducted in Africa may be enough for the FDA based on the surrogate endpoint of immunogenicity, or it may not be and they may require animal studies to prove that the immunogenicity generated is actually effective against the virus itself. Our guess is that in the meantime, while Ebola is not a serious issue, the FDA will require animal testing after Merck’s Phase III is completed. If the Animal Rule proves efficacy in primates, then we probably do have an effective vaccine. In that case, Merck could make some extra cash through government stockpiling, which has been the case for the smallpox vaccine, but as big of a spender that the US government is, it shouldn’t have much of a material effect on Merck as long as Ebola is on the back burner.

So in the end, Ebola programs are basically a bonus card that has little to no downside impact on either Merck or GSK. If they pan out in the event of disaster, shareholders will benefit. If they don’t, downside is limited, and humanity is in better shape.

Image 3 source

Image 3 source