BR Brands LLC, a consumer-packaged-goods company within the global legal cannabis industry, reported the first closing of its Series A capital raise backed by its strategic capital partner Rose Capital.

In conjunction with the closing, BR Brands acquired the remaining capitalization and out-right control of Mary’s Brands, the creator of such brands as Mary’s Medicinals, Mary’s Methods, Mary’s Nutritionals and Mary’s Tails. The acquisition is one of the largest private CPG acquisitions to date within the U.S. cannabis sector.

“BR Brands has proven to be a valued operational and strategic capital partner. They have helped us grow in the short-term and secure the infrastructure necessary to take advantage of the growth opportunities they bring to the table for Mary’s Brands,” stated Lynn Honderd, CEO and co-founder of Mary’s.

Financial terms were not disclosed.

BR Is Hungry for Cannabis Bands

By employing a “buy and build” strategy, BR Brands combines cannabis brands and operators under the common BR Brands umbrella. Presently, the company represents one of the largest consortiums of cannabis brands/IP and possesses manufacturing and production capabilities.

“BR Brands was established to provide emerging, premium cannabis brands with access to best-in-class operating talent and capital expertise,” stated BR Brands Chairman Andrew Schweibold stated.

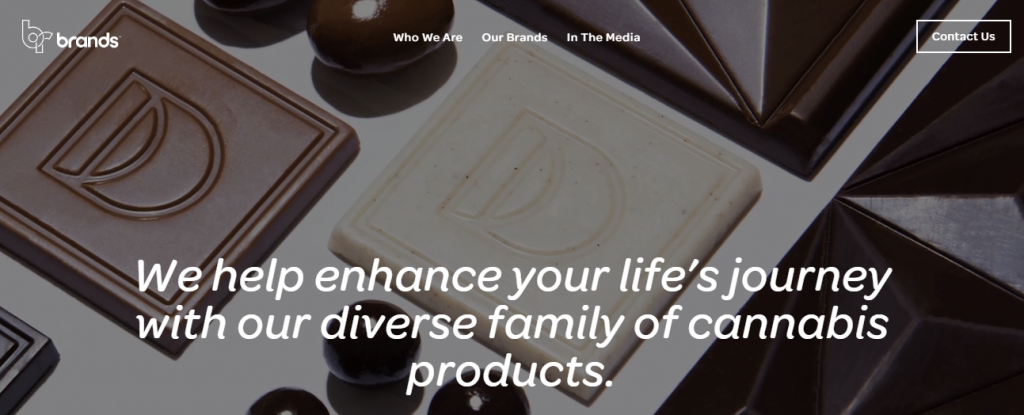

In addition to Mary’s, BR Brands has partnered with and invested in Beezle, a manufacturer of concentrates, Défoncé, a manufacturer of high-end cannabis-infused confectionary products, and Rebel Coast, a manufacturer of alcohol-free beverages infused with THC.

In the next 12-18 months, BR Brands expects to deploy more than $100 million of acquisition and growth capital to support operators in the U.S. and globally.